Bonds Versus Economists: Reality & The Echo Chamber

Authored by Jeffrey Snider via Alhambra Investment Partners,

Authored by Jeffrey Snider via Alhambra Investment Partners,

Authored by Daniel Nevins via FFWiley.com,

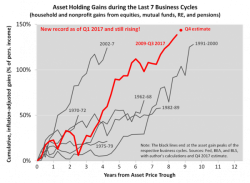

In September, we proposed a theory of the Fed and suggested that the FOMC will soon worry mostly about financial imbalances without much concern for recession risks. We reached that conclusion by simply weighing the reputational pitfalls faced by the economists on the committee, but now we’ll add more meat to our argument, using financial flows data released last week.

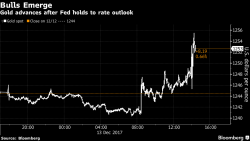

Year-end rate hike once again proves to be launchpad for gold price

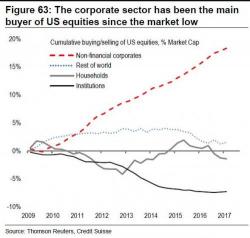

For at least half a decade now (How The Fed's Visible Hand Is Forcing Corporate Cash Mismanagement) we have warned about how the Fed’s flawed approach to monetary policy incentivizes corporations to fund share buybacks with massive amounts of debt...

…While the corporate sector has spent record sums on share buybacks...

Capex has experienced an unprecedented decline...

The Fed concludes its final FOMC meeting of the year today.

The entire financial world expects the Fed to raise rates a final time. This will mark the fifth rate hike since December 2015, and the fourth of the last 12 months.

Throughout this time period, the Fed has routinely stated that it is confused as to why inflation is “too low.”

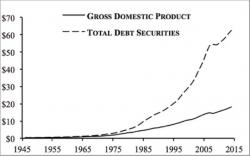

Inflation is not too low. The method the Fed uses to measure inflation is intentionally incorrect. As a result, the official inflation numbers reflect whatever the Fed wants, as opposed to reality.