Never Mind Tea Leaves, Here's A Strong Signal from the Economic Dashboard

Authored by Daniel Nevins via FFWiley.com,

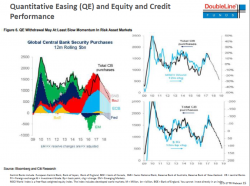

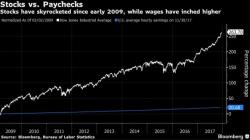

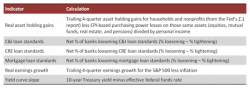

We’ve been seeing more and more commentaries discussing bad stuff that can happen when the Fed tightens policy and, as a result, the yield curve flattens. (See, for example, this piece from Citi Research and ZeroHedge.)

No doubt, the Fed’s rate hikes will lead to mishaps as they usually do—in both markets and the economy.