World's Largest Asset Manager Downgrades Global Equities To Neutral

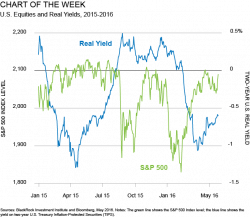

With one after another bank issuing downgrade reports on global stocks, including such stalwarts as JPM and, most recently, Goldman, overnight a far more important market entity - the world's largest asset manager - joined the club when BlackRock downgraded U.S. and European stocks to neutral, citing elevated U.S. valuations and the higher probability of a midyear interest-rate increase by the Federal Reserve.