Fed Notebook With "Classified Bank Info" Stolen In Chicago Robbery

Last week we learned courtesy of a Reuters FOIA that there over the past 6 years there has been a coordinated attack to hack the Fed.

Last week we learned courtesy of a Reuters FOIA that there over the past 6 years there has been a coordinated attack to hack the Fed.

As the economy struggles and wage growth stagnates, everyone can rest easy knowing that the Federal Reserve bank presidents are getting paid quite nicely for all of their efforts.

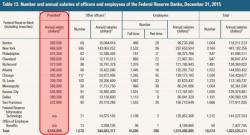

While wages grew 2.6% (at best) In 2015, Fed presidents saw a 4% average salary increase. And before anyone says that the presidents took one for the team, taking a pay freeze from 2011-2013, it was made up for in 2014 when a 6.6% increase was awarded.

Submitted by Lance Roberts via RealInvestmentAdvice.com,

Another week of going nowhere, really.

The good news is that this sideways pattern of market action over the last year will come to an end and likely very soon.

The only question investors have to get right is whether that resolution will be a continuation of the bull market that began in 2009 OR will it be the beginning of a more protracted bear market decline.

Who could have seen that coming?

closing above 2,100 > worst jobs report since 2010

— zerohedge (@zerohedge) June 3, 2016

Worst jobs print in 6 years and tumbling PMI, ISM, and Factory Orders - Did The Fed just lose it completely?

As regular readers know, one of our favorite chartpacks to show "Obama's recovery" is the one below, presented most recently just two days ago during Obama's now almost weekly televised sermon of how the economy is great and anyone who disagrees is "peddling fiction", which using simple Bloomerg data, summarize recent changes in key economic indicators including soaring federal debt and government dependency via food stamp use, surging healthcare costs and social inequality, plunging homeownership, income, and labor force participation, and - of course - driving it all, none of the presiden