You are here

US Federal Reserve

"I Don’t Want To Alarm Anyone But..." - David Rosenberg Flips Again, Thinks We Are Headed For A Recession

Back in 2013, when David Rosenberg infamously flip-flopped from bear to bull on the "thesis" that everyone's wages (not just his), are about to rise, and that a jump in wage inflation would be the catalyst to unleash a broad economic recovery in the process crushing bonds, we were decidedly skeptical.

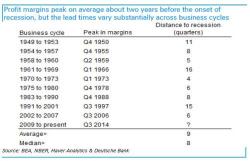

When Will The Recession Start: Deutsche Bank's Disturbing Answer

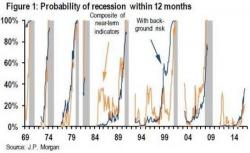

Just yesterday, when looking at the latest sudden drop in the US employment, JPM warned that as a result of the dramatic downshifting in the US economy, the bank's recession indicator had just hit a new cycle high of 36%.

Why The Fed Is Trapped: A 1% Increase In Rates Would Result In Up To $2.4 Trillion Of Losses

A funny thing happened as every central bank around the world rushed to stimulate their economy by devaluing their currency in a global FX war that is now 7 years old and getting more violent by the day: with bond yields plunging, and over $10 trillion in global debt now having a negative yield, every fixed income investor starved for yield was pushed into the long end of the bond curve where whatever yield is left in the world of "safe" bonds is to be found. As long as interest rates never go up, this strategy is relatively safe.

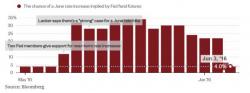

What Happens When The Fed Hikes During An Earnings Recession

At least until yesterday's abysmal jobs report, there was - just like last December - a renewed sense of optimism that just because the Fed had gotten surprisingly hawkish in recent weeks (just like it did in November) starting with the FOMC minutes, passing through the speeches of numerous Fed presidents, and culminating with last Friday's Janet Yellen appearance, that the US economy was once again set for a major rebound, leading to a substantial repricing higher in rate hike odds which was also coupled with a boost in risk sentiment.