U.S. Jobs Growth A Horrible Miss, Worst in Five Years

U.S. Jobs Growth A Horrible Miss, Worst in Five Years

Written by Nathan McDonald (CLICK FOR ORIGINAL)

All the FED's horses and all the FED's men couldn't put this fiat bubble back together again!

U.S. Jobs Growth A Horrible Miss, Worst in Five Years

Written by Nathan McDonald (CLICK FOR ORIGINAL)

All the FED's horses and all the FED's men couldn't put this fiat bubble back together again!

Firts, a few notes from FTN on today's report which the firm classified quite simply as "awesomely bad":

U.S. Jobs ’Awesomely Bad’, Particularly Poor Timing

In less than an hour, the BLS will report the latest, May, non-farm payrolls and unemployment data. Here is what consensus expects:

The NFP breakdown by bank is as follows:

After yesterday's two key events, the ECB and OPEC meetings, ended up being major duds, the market is looking at the week's final and perhaps most important event of the week: the May payrolls report to generate some upward volatility and help stocks finally break out of the range they have been caught in for over a year. However, even today's jobs number will likely be skewed as reported previously as a result of the Verizon strike which is said to trim some 35,000 jobs from the headline print, casting anything the BLS reports today in doubt.

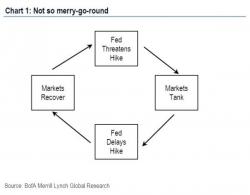

When we first presented the so-called "Nightmarish Merry Go Round", dubbed so by Bank of America because of the reflexive, recursive bond - and trap - that has formed between the Fed and markets...