Citi Asks: "Are Investors Beginning To Price In QE4?"

While many investors and analysts are asking when the Federal Reserve will decide to hike rates again, Citi's Global Head of FX Strategy Steven Englander asks a rather different question: Are investors beginning to price in QE4?

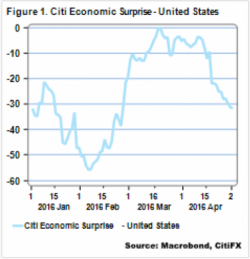

He points out that economic data in the U.S. hasn't been very good (sans unemployment headline data), and that for every one positive data release, a series of disappointments follow. He points to the fact that Citi's economic surprise indicator has been dropping since mid-April as reflecting that reality.