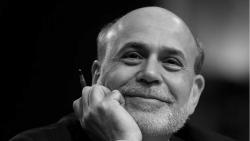

Jos. A. Bank and the Folly of Quantitative Easing

A few years back I wrote an article comparing buy-one-suit-get-three-free sales by Jos. A. Bank to the Federal Reserve’s quantitative easing program. Then Jos. A. Bank’s management did something absolutely brilliant: In March 2014 it sold the company for $1.8 billion to Men’s Wearhouse, its closest competitor (and twice its outfit’s size).