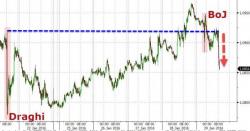

The Fed's Next Surprise Move

The Federal Reserve seems to have been caught off-guard by the recent turmoil on the markets. As the Chinese economic growth seems to be slowing down, all of the Western central banks need to re-think their plans, and the Federal Reserve will have to kneel in the dust.