Have Stocks Priced In A Recession? (Spolier Alert: Not Even Close)

Submitted by Lance Roberts via RealInvestmentAdvice.com,

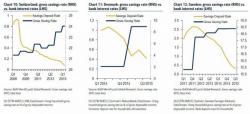

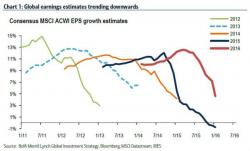

The Fed Is Behind The Curve…Again

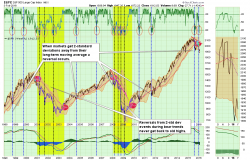

Over the last couple of months, I have been discussing the technical deterioration of the market that is occurring beneath the surface of the major indices. I have also suggested there is more than sufficient evidence to suggest we may be entering into a more protracted “bear market cycle.”