The Fed's Grinchmas Message To Markets: This Is As Good As It Gets, Mizuho Warns

The first Fed rate hike in seven years was supposed to trigger a powerful equity rally as the bulls expected money to pour out of bonds into stocks; especially into the cyclicals.

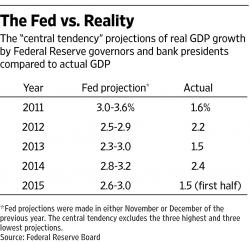

The logic behind this market call was simple and seductive. History shows that the economy and earnings keep on accelerating as the Fed initially shifts away from monetary policy accommodation and history was expected to repeat itself.