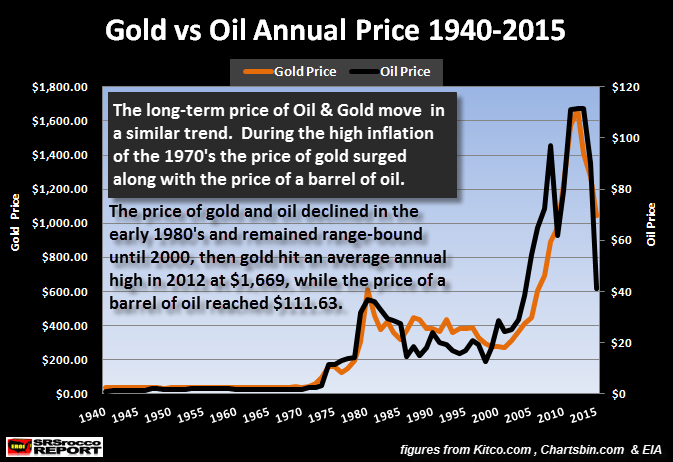

Gold & Silver Prices Will Surge On Fundamentals Not Technical Analysis

Hold your real assets outside of the banking system in a private international facility --> https://www.321gold.com/info/053015_sprott.html

Gold & Silver Prices Will Surge On Fundamentals Not Technical Analysis

Posted with permission and written by Steve St. Angelo, SRSrocco Report (CLICK FOR ORIGINAL)