What Fresh Horror Awaits The Economy After Fed Rate Hike?

Submitted by Brandon Smith via Alt-Market.com,

Submitted by Brandon Smith via Alt-Market.com,

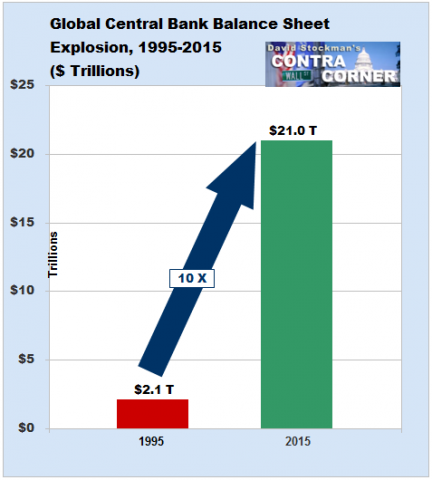

Submitted by David Stockman via Contra Corner,

Our point yesterday was that the Fed and its Wall Street fellow travelers are about to get mugged by the oncoming battering rams of global deflation and domestic recession.

With memories of last week's high-volume, post-Fed, quad-witching selloff fading fast, overnight the Santa rally defined as no volume, no breadth levitation, has continued for a third day and moments ago European stocks rose to their best level of the day, with the Stoxx Europe 600 Index headed for its biggest advance in a week, while US equity futures ramped on the European open as they traditionally do, and then again hit session highs minutes ago, as holiday volumes are in meltdown mode, and oddlots can move the E-mini by 1 point.

If the presidential candidates have not incorporated the Fed's reactions into their economic plans, then they really don't know what they are talking about. They will have no hope of boosting growth if they have a Fed determined to prevent the economy from creating more jobs.

Submitted by Lance Roberts via RealInvestmentAdvice.com,

In this past weekend’s newsletter, I discussed the end of the mutual fund redemption period. (Charts updated through yesterday’s close.)

“Friday’s sell-off, combined with options expirations, pushed the markets back to short-term oversold conditions and at previous support.”