Central Banks Are Rapidly Running Out of Options

Central Bankers are flummoxed.

Having cut interest rates over 600 times since 2009 (and printed over $15 trillion), they’ve yet to generate the expected economic growth.

Central Bankers are flummoxed.

Having cut interest rates over 600 times since 2009 (and printed over $15 trillion), they’ve yet to generate the expected economic growth.

Hold your real assets outside of the banking system in a private international facility --> http://www.321gold.com/info/053015_sprott.html

The Fed Rate Hike: the Torpedo is Launched

Posted with permission and written by Bullion Bulls Canada, Jeff Nielson (CLICK FOR ORIGINAL)

By Peter Schiff of EuroPacific Capital

Mission Accomplished

Submitted by David Stockman via Contra Corner blog,

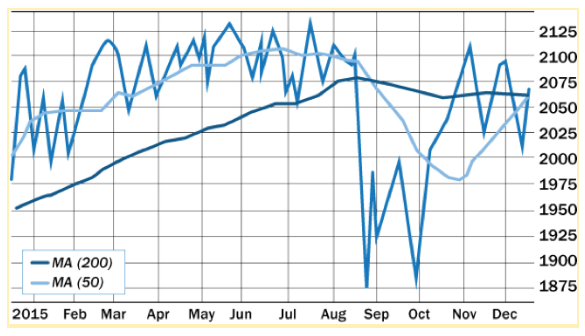

The Fed pricked the financial bubblethis week as expected. Janet Yellen’s press conference couldn’t have been more perfect for our investment thesis at my new research publication, Stockman’s Bubble Finance Trader. It confirmed that the money printers have come to a stark dead end.

Submitted by Lance Roberts via RealInvestmentAdvice.com,

Well... she did it. After eleven years of maintaining emergency rates in order to boost asset prices, valuations, speculative debt accumulation back to pre-financial crisis levels, Janet Yellen officially hiked rates this past week.