"... A Recession Has Always Followed": Is This The Real Reason The Fed Is Suddenly Panicking

"Why is the Fed so desperate to raise rates and tighten financial conditions? Why has the Fed shifted from a dovish to a hawkish bias?"

"Why is the Fed so desperate to raise rates and tighten financial conditions? Why has the Fed shifted from a dovish to a hawkish bias?"

Shortly after Deutsche became the latest bank to warn that "markets seem to have entered frothy territory", going so far as to utter the dreaded "bubble" word, and suggesting that this time it will be different as "unlike 2016, the Fed does not appear to have enough patience anymore to postpone the rate hikes" and adding that "unfortunately, the Fed's resolution to raise rates this time seems to be firmer than in 2015 because of their assessment that US economy has almost reached full employment", one of the market's biggest bears actually scratch that, the market's biggest

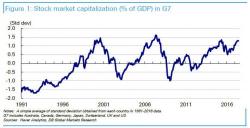

Another day, another warning of market froth, only this time not from the (widely ignored) Federal Reserve, but from Mikihiro Matsuoka, chief economist at Deutsche Bank who in a note released on Monday says that he believes that "the equity market in developed countries begins to show symptoms of ‘froth’. A simple average of the standard deviation of the stock market capitalization as percentage of GDP of seven major developed countries has been approaching very close to the previous peaks of 2000 and 2008.

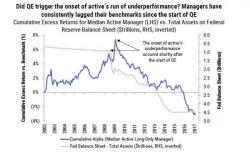

Over the past several years we have repeatedly stated that despite protests to the contrary, the single biggest factor explaining the underperformance of the active community in general, and hedge funds in particular, has been the ubiquitous influence of the Fed and other central banks over the capital markets, coupled with the prevasive presence of quantitative strategies, HFTs, algo trading and more recently, a surge in price-indescriminate purchases by passive, ETF managers.

The Fed keeps ringing bells to signal the top, but the markets aren’t listening.

Janet Yellen is set to present the Fed’s Monetary Report to Congress this week. Her remarks have already been posted online.

The results aren’t pretty.

Valuation pressures across a range of assets and several indicators of investor risk appetite have increased further since mid-February...