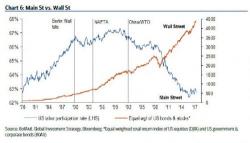

Albert Edwards: "Something Smells Different This Time"

In his latest note, SocGen's permaskeptic Albert Edwards looks back 20 years in time to the Asian Crisis, and makes an interesting observations: nothing has really changed. In fact, as he explains, the events over the past 2 decades have been a "linear progression of the monetary madness that followed the 1997 Asian", and all thanks to central bankers who used the crisis as a springboard for ever more drastic monetary interventions, resulting in one bubble after another, culminating with the current state of the world, to wit: