Goldman Finds Most Modern Recessions Were Caused By The Fed

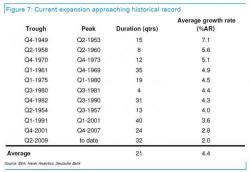

One week ago, Deutsche Bank issued a loud warning that as a result of the aging of the current economic expansion, now the third longest in history at 32 quarters, if with the lowest average growth rate of just 2%...

.... coupled with the collapse in the yield curve...

... and the risk that the Fed could fall behind the inflationary curve as a result of near record low unemployment (assuming the Phillips urve still works which it doesn't)...

... the risk is growing that the Fed could hike rates right into a recession that it itself causes: