"Grouchy" SocGen Analyst: "Fed Will Be Buying Again Long Before They Finish Normalizing"

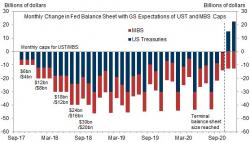

Over the weekend, One River's CIO Eric Peters said that last week's announcement by the Fed marked the "end of the QE era." At least one person, however, is not convinced: as the "increasingly grouchy" SocGen FX strategist Kit Juckes writes in his overnight note, slams calls that the Fed's announcement was a "hawkish hike", and says that "while we got more detail about the Fed's plans to run down its balance sheet, these amount to a pace so slow that they'll still have boatloads of bonds on board when the next recession strikes.