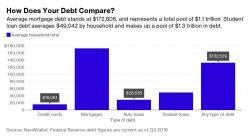

Americans Are Dying With An Average Of $61,500 In Debt

According to a recent study, the average total household debt in America is just over $132,500, broken down as per the chart below...

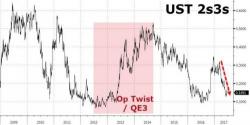

... and thanks to the Fed's recent and ongoing rate increases, the repayment of said debt will become increasingly more difficult. So difficult, in fact, that most Americans will be saddled with a sizable chunk of it at the time of their death.

Actually, most already are.