Why A Bitcoin ETF May Not Be Coming Any Time Soon

When it comes to the future of bitcoin, the "holy grail" has emerged as becoming the first to have a bitcoin ETF approved by the SEC.

When it comes to the future of bitcoin, the "holy grail" has emerged as becoming the first to have a bitcoin ETF approved by the SEC.

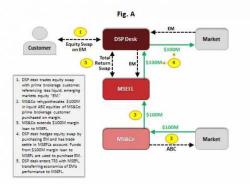

On Tuesday, the SEC announced that Morgan Stanley will be fined $7.5 million to settle civil charges that it violated customer protection rules, when it used trades involving customer cash to lower its borrowing costs. The SEC said MS will settle the case without admitting or denying the charges, effectively letting slide a violation which, in an exaggerated format, was exposed as a quasi-criminal offense engaged in by Jon Corzine's now defunct MF Global.

Submitted by Probes Reporter

Alibaba’s SEC Probe: What’s Missing From This Disclosure?

The SEC is taking a new approach to uncovering nefarious dealings within the financial markets: bar hopping.

In its new strategy to root out any underhanded dealings, the SEC is making an effort to attend more Wall Street conferences. The overall plan: catch Wall Streeters with their guard down at the bar in hopes that after a few drinks everyone will begin to ramble on about just how much screwing of the general public they are doing. Of course, nobody from the SEC is drinking at these conferences, that's against policy.

Back in December the topic of insider trading by prominent members of Congress hit new highs when as we reported at the time a "Prominent Tennessee Senator Fails To Disclose Millions In Hedge Fund, Real Estate Investments." The politician in question, Tennessee republican Senator Bob Corker, who according to Roll Call was recently the 23rd richest member of Congress...

... and the company under focus: a Tennessee-based REIT, CBL & Associates.