Bonds, Futures, Global Stocks All Rise, Boosted By "Germany's Brexit Moment"; TSY Curve Collapse Continues

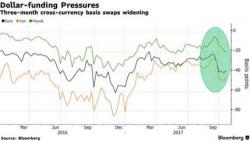

S&P 500 futures are higher, continuing on yesterday's momentum, after European and Asian shares also rose alongside a rebound in oil, as the year-end performance chase appears to be accelerating. There were several different moving parts in a mixed European session, in which early Euro strength gave way to weakness...

... which in turn pushed the Stoxx 600 and US index futures higher, rising above yesterday's session high on negligible volumes.