Art Market Bubble Bursting - Gauguin Collapses 74% To $22 Million

- Art Market Bubble Bursting?- Russian Billionaire Takes 74% Loss On "Investment"- $85 Million Gauguin Bought By Dmitry Rybolovlev in 2008- Christie’s auctioned the work at its evening sale in London- Global art sales plummet, but China rises as 'art superpower'- China soon to dominates global art and gold market- Art price volumes doubled since 2009- As currencies debase super rich seek out stores of value- Gold remains accessible store of value for all- Stocks, bonds and many assets at record prices- Gold half it's real price in 1980

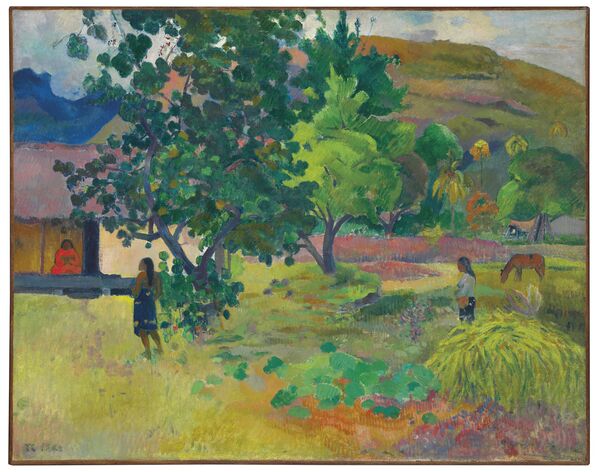

Te Fare by Paul Gauguin - Source: Christie’s

Russian billionaire Dmitry Rybolovlev paid €54 million or $85 million for a landscape by Paul Gauguin in a private transaction in June 2008. Yesterday, he incurred a whopping 74% loss on his store of value "investment" as reported by Bloomberg:

Gauguin’s 1892 landscape “Te Fare (La Maison)" fetched 20.3 million pounds ($25 million), including commission, at Tuesday evening’s sale of Impressionist and modern art at Christie’s in London. Rybolovlev will net about $22 million based on the hammer price. The auction house had estimated the value at $15 million to $22.4 million. The buyer was a client of Rebecca Wei, president of Christie’s Asia.

The Gauguin was one of four Rybolovlev pieces offered for sale on Tuesday. Another work, a Mark Rothko painting, will be auctioned March 7.

Rybolovlev -- with a fortune of about $9.8 billion according to the Bloomberg Billionaires Index -- invested about $2 billion in 38 works, from Leonardo da Vinci to Pablo Picasso. They were procured privately by Swiss art dealer Yves Bouvier, known for creating a network of tax-free art storage warehouses in Singapore and Luxembourg.

Two years ago, Rybolovlev sued Bouvier, alleging he was overcharged by as much as $1 billion, Bloomberg reported. Since then the Russian fertilizer magnate has been unloading works he acquired, some at record prices. He has already sold three for a loss totaling an estimated $100 million. The five works at Christie’s, all estimated below their purchase prices, were expected to deepen the loss.

The art industry is closely watching the London auctions running this week and next as the year’s first test of the global market following a significant contraction in 2016. Christie’s sales fell 17 percent to $4 billion pounds ($5.4 billion) last year, while Sotheby’s reported a 27 percent decline to $4.9 billion. Both houses saw steep declines in their two biggest categories: Impressionist and modern art, and postwar and contemporary art.

In May 2015, we warned about the bubble in the the fine art "investment market or indeed the Hyperinflation in Art Investment Market after a Picasso sold for $179 million.

[image]https://www.goldcore.com/ie/wp-content/uploads/sites/19/2015/05/goldcore_chart3_12-05-15.png[/image]William Banzai

At the time, we pointed out that ultra high net worth and family office buyers may be viewing the fine art market as a form of super safety deposit box and as a way to protect their wealth from market crashes, systemic risk and the risk of bail-ins and deposit confiscation today.

Since then global art sales plunged in 2016 as the number of high-value works of art sold dropped by half, while China regained its status as the world’s top market according to an annual report recently released by Artprice. Art auctions worldwide totalled $12.5 billion (11.8 billion euros) last year, down 22 percent from $16.1 billion in 2015, the report said.

The world’s biggest database for art prices and sales, working with Chinese partner Artron, attributed the drop to a plunge in the number of works worth more than $10 million each – from 160 in 2015 to just 80 last year. “On all continents, sellers are choosing a policy of ‘wait-and-see,'” Artprice CEO Thierry Ehrmann said.

In recent years, very wealthy art buyers may have believed art was less risky than holding increasingly debased digital currencies in banks that may be subject to deposit bail-ins.

As a diversification, art has some merit as it is not correlated with financial assets, but only as a very small part of an overall portfolio.

Given the scale of risks facing investors and savers today we are advising clients to increase allocations to gold from the standard 5% to 10% allocation to higher allocations of as much as 25% to 30%.

Most investors and savers cannot afford a Picasso or a Gauguin but the proven, timeless store of value that is physical gold remains accessible.

[image]https://www.goldcore.com/ie/wp-content/uploads/sites/19/2017/03/gold-inflation-adjusted-2017.jpg[/image]Gold in USD Adjusted for Inflation 1970-2017 - Macrotrends.net

Not only is it accessible but it remains relatively cheap from a long term perspective, at nearly less than half its real price high of $2,200 price in 1980 when adjusted for the considerable inflation of the last 37 years.

Gold is also relatively cheap compared to most stock, bond and property markets, many of which are at all time record highs. These highs are in large part due to quantitative easing (QE), zero and negative percent interest rates and global currency debasement on a scale never seen in history.

Access Breaking News and Research Here

Gold and Silver Bullion - News and Commentary

Gold down on hawkish comments by Fed officials, dollar pressure (Reuters)

U.S. Mint gold coin sales at 14-month low in February (Reuters)

Number of distressed U.S. retailers at highest level since Great Recession (Marketwatch)

Showdown in Indonesia brings world's biggest gold mine to standstill (CNBC)

Online channels shine with gold-backed financial products (China.org)

"We Will See Gold Go Higher For Sure" - Citigroup (Bloomberg)

FCStone Is Betting on Tech Transforming Physical Gold Market (Bloomberg)

Is Donald Trump extremely crafty or just plain thick? (Moneyweek)

Treasure hunters find earliest ever discovered gold in farmer's field (Telegraph)

Student Loan Debt In 2017: A $1.3 Trillion Crisis (Forbes)

Gold Prices (LBMA AM)

01 Mar: USD 1,246.05, GBP 1,007.18 & EUR 1,182.50 per ounce28 Feb: USD 1,251.90, GBP 1,006.90 & EUR 1,180.79 per ounce27 Feb: USD 1,256.25, GBP 1,011.16 & EUR 1,187.41 per ounce24 Feb: USD 1,255.35, GBP 1,000.89 & EUR 1,185.18 per ounce23 Feb: USD 1,237.35, GBP 992.97 & EUR 1,173.13 per ounce22 Feb: USD 1,237.50, GBP 994.21 & EUR 1,178.22 per ounce21 Feb: USD 1,228.70, GBP 988.86 & EUR 1,166.16 per ounce

Silver Prices (LBMA)

01 Mar: USD 18.33, GBP 14.89 & EUR 17.40 per ounce28 Feb: USD 18.28, GBP 14.70 & EUR 17.24 per ounce27 Feb: USD 18.34, GBP 14.77 & EUR 17.33 per ounce24 Feb: USD 18.27, GBP 14.56 & EUR 17.23 per ounce23 Feb: USD 18.00, GBP 14.42 & EUR 17.06 per ounce22 Feb: USD 18.00, GBP 14.47 & EUR 17.14 per ounce21 Feb: USD 17.89, GBP 14.41 & EUR 16.97 per ounce

Recent Market Updates

- Interview about Gold – Value, Weight, Beauty, Rarity, Peak Gold and Secure Storage- Oscars Debacle – Movies More Costly As Dollar Devalued- Gold Up 9% YTD – 4th Higher Weekly Close and Breaks Resistance At $1,250/oz- The Oscars – Worth Their Weight in Gold?- Gold To Benefit from Rising Inflation and Higher Than “Official” China Gold Demand- Russia Gold Buying Is Back – Buys One Million Ounces In January- Gold The “Ultimate Insurance Policy” as “Grave Concerns About Euro” – Greenspan- Sharia Standard May See Gold Surge- Gold Price To 2 Month High As Fiery Trump Declares World Order- Gold’s Gains 15% In Inauguration Years Since 1974- Turkey, ‘Axis of Gold’ and the End of US Dollar Hegemony- Gold Up 5.5% YTD – Hard Brexit Cometh and Weaker Dollar Under Trump- Bitcoin and Gold – Outlook and Safe Haven?

Interested in learning more about physical gold and silver?Call GoldCore and speak with a Gold and Silver Specialist today!