Published

2 hours ago

on

March 27, 2024

| 58 views

-->

By

Julia Wendling

Graphics & Design

- Alejandra Dander

The following content is sponsored by New York Life Investments

Beyond Big Names: The Case for Small- and Mid-Cap Stocks

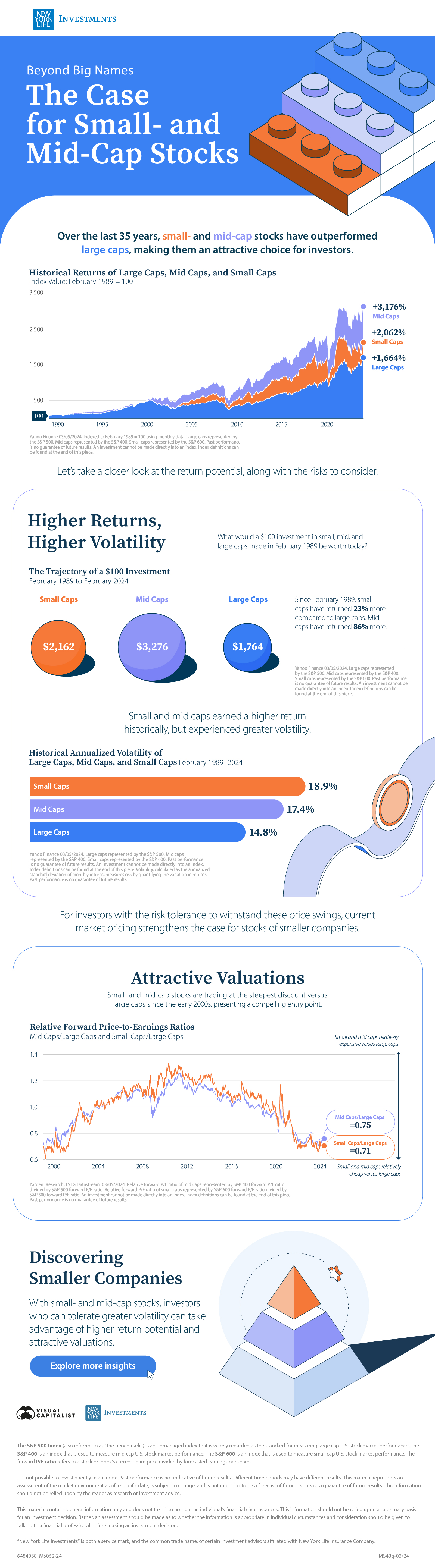

Over the last 35 years, small- and mid-cap stocks have outperformed large caps, making them an attractive choice for investors.

According to data from Yahoo Finance, from February 1989 to February 2024, large-cap stocks returned +1,664% versus +2,062% for small caps and +3,176% for mid caps.

This graphic, sponsored by New York Life Investments, explores their return potential along with the risks to consider.

Higher Historical Returns

If you made a $100 investment in baskets of small-, mid-, and large-cap stocks in February 1989, what would each grouping be worth today?

| Small Caps | Mid Caps | Large Caps | |

|---|---|---|---|

| Starting value (February 1989) | $100 | $100 | $100 |

| Ending value (February 2024) | $2,162 | $3,276 | $1,764 |

Source: Yahoo Finance (2024). Small caps, mid caps, and large caps are represented by the S&P 600, S&P 400, and S&P 500 respectively.

Mid caps delivered the strongest performance since 1989, generating 86% more than large caps.

This superior historical track record is likely the result of the unique position mid-cap companies find themselves in. Mid-cap firms have generally successfully navigated early stage growth and are typically well-funded relative to small caps. And yet they are more dynamic and nimble than large-cap companies, allowing them to respond quicker to the market cycle.

Small caps also outperformed over this timeframe. They earned 23% more than large caps.

Higher Volatility

However, higher historical returns of small- and mid-cap stocks came with increased risk. They both endured greater volatility than large caps.

| Small Caps | Mid Caps | Large Caps | |

|---|---|---|---|

| Total Volatility | 18.9% | 17.4% | 14.8% |

Source: Yahoo Finance (2024). Small caps, mid caps, and large caps are represented by the S&P 600, S&P 400, and S&P 500 respectively.

Small-cap companies are typically earlier in their life cycle and tend to have thinner financial cushions to withstand periods of loss relative to large caps. As a result, they are usually the most volatile group followed by mid caps. Large-cap companies, as more mature and established players, exhibit the most stability in their stock prices.

Investing in small caps and mid caps requires a higher risk tolerance to withstand their price swings. For investors with longer time horizons who are capable of enduring higher risk, current market pricing strengthens the case for stocks of smaller companies.

Attractive Valuations

Large-cap stocks have historically high valuations, with their forward price-to-earnings ratio (P/E ratio) trading above their 10-year average, according to analysis conducted by FactSet.

Conversely, the forward P/E ratios of small- and mid-cap stocks seem to be presenting a compelling entry point.

| Small Caps/Large Caps | Mid Caps/Large Caps | |

|---|---|---|

| Relative Forward P/E Ratios | 0.71 | 0.75 |

| Discount | 29% | 25% |

Source: Yardeni Research (2024). Small caps, mid caps, and large caps are represented by the S&P 600, S&P 400, and S&P 500 respectively.

Looking at both groups’ relative forward P/E ratios (small-cap P/E ratio divided by large-cap P/E ratio, and mid-cap P/E ratio divided by large-cap P/E ratio), small and mid caps are trading at their steepest discounts versus large caps since the early 2000s.

Discovering Small- and Mid-Cap Stocks

Growth-oriented investors looking to add equity exposure could consider incorporating small and mid caps into their portfolios.

With superior historical returns and relatively attractive valuations, small- and mid-cap stocks present a compelling opportunity for investors capable of tolerating greater volatility.

Explore more insights from New York Life Investments

Please enable JavaScript in your browser to complete this form.Enjoying the data visualization above? *Subscribe

Related Topics: #volatility #s&p 500 #valuations #New York Life Investments #Small caps #Mid Caps #Large caps #historical return #S&P 600 #S&P 400

Click for Comments

var disqus_shortname = "visualcapitalist.disqus.com";

var disqus_title = "Beyond Big Names: The Case for Small- and Mid-Cap Stocks";

var disqus_url = "https://www.visualcapitalist.com/sp/beyond-big-names-the-case-for-small-and-mid-cap-stocks/";

var disqus_identifier = "visualcapitalist.disqus.com-165490";

You may also like

-

Markets2 days ago

Swiss Watches: Market Share by Brand in 2023

In this graphic we rank the top Swiss watch brands, based on their estimated 2023 market share.

-

Markets3 days ago

Charted: Luxury Goods Investments vs. S&P 500 in the Last 10 Years

How does investing in luxury goods like expensive watches and rare whisky compare to other goods, or to the S&P 500?

-

Markets5 days ago

Visualizing the World’s Largest Sovereign Wealth Fund

This graphic breaks down the portfolio of the world’s largest sovereign wealth fund, valued at $1.4 trillion.

-

Markets6 days ago

The 12 Worst Investment Funds Over the Past Decade

The 12 worst investment funds have destroyed $56 billion in shareholder wealth over the past decade, as of Dec. 2023.

-

Stocks1 week ago

Visualizing the Biggest Companies on Major Stock Exchanges

With trillion dollar valuations becoming more common, we’ve compared the five biggest companies by stock exchange.

-

Markets1 week ago

Will Tesla Lose Its Spot in the Magnificent Seven?

We visualize the recent performance of the Magnificent Seven stocks, uncovering a clear divergence between the group’s top and bottom names.

Subscribe

Please enable JavaScript in your browser to complete this form.Join the 375,000+ subscribers who receive our daily email *Sign Up

The post Beyond Big Names: The Case for Small- and Mid-Cap Stocks appeared first on Visual Capitalist.