Authored by Paul Tustain via BullionVault.com,

Governments have abused and distorted our money. How about a 'Bitcoin standard'...?

THIS is a subsection of a book that's coming later.

It seemed worth publishing now, writes Paul Tustain, founder and chairman of BullionVault and co-founder of WhiskyInvestDirect.

What is money?

Strangely, for something with which we are all so familiar, not one person in a thousand could explain

- what money really is

- where it comes from

- the fundamentals of how it moves between businesses, banks and countries

To really understand this most of us need to discard some things we long thought we understood. But when you finally see what's going on it is extraordinarily satisfying.

Money – of a sort – arises naturally in the animal kingdom. Chimpanzees trade a variety of delayed and highly valued favours which it would be impolite to describe. South American vampire bats run a small economy which pays in blood. The little darlings have such a need for their daily dose that they lend, borrow and pay back amongst themselves rather than let a close relative go fatally bloodless for a whole night.

These animal transactions contain the seed of money in so far as a favour is performed, and the favour due back, the 'credit', which it generates, is stored up and repaid later.

The plastic cards we use are poorly named. They should be called credit-and-debt cards, because although you can spend the credit bit you may have noticed they leave the debt bit overhanging. To get just the spending power, without the debt which goes with it, we usually need to do some work, or possibly provide somebody with something in a sale. Either way, we too generate an unreturned favour, which we usually try to store up until we demand its return – probably from someone different to the person we first favoured.

Chimps and vampire bats show that these unreturned favours, and the obligations they create, occur naturally, as they did for the earliest humans who started to trade. They also show us that you don't actually need a formal system of money for keeping score, provided you can remember who owes what, and to whom.

But of course, beyond the smallest number of transactions between the smallest number of people it quickly becomes very difficult to maintain the score correctly, using just unaided memory.

That's why people invented money.

The Definition of Money

There are big flaws in the common definitions of money.

-

"Money is coins and notes exchanged in trade." This is a poor attempt at a definition, but a popular one. Yes, some money is in the form of coins and notes, but vastly more is in the form of records, in bank accounts for example.

-

"Money is a medium of exchange". Yes it is. This is a feature of money but this definition is inadequate because lots of things which are not money are also media of exchange. People often trade goods directly, so goods can be a medium of exchange, but they are not money. And besides, money is also a store of value. We don't define something by listing its attributes one by one. All that does is show us we can't put our finger on the essence of what we're talking about.

-

"Money is a store of value". Yes it is. But so are houses, land, oil and cheese (if you happen to be a cheese merchant). None of these are money.

-

"Money is wealth". No, it isn't. Lots of wealthy people have property but no money.

So what is it?

Money is a scorekeeping system for unreturned favours.

You may need a moment to think about this.

-

Yes, it works for cash, a scorekeeping system which uses portable tokens, as well as for bank accounts, a scorekeeping system which uses records.

-

Yes, you can see why you get money for working for someone, or perhaps for selling them something.

-

Yes, it excludes bartered goods, and property, but does not exclude both property and money forming part of wealth.

-

Yes, it allows for both storage and exchange, but can exist without either.

-

Yes, it might be based on any of the exotic things we know have been used as money. It allows for anything which can be used to keep score, some of which are good for the purpose, and some not so good. We know people have used cowrie shells, broken sticks, coins made of all sorts of metals, banknotes, credit cards, bank accounts, promissory notes, bills of exchange, computer records, Bitcoins and lots of other things. They're perfectly entitled to. They are all systems for keeping score of unreturned favours, and they have all been the basis of valid, if mostly temporary, monetary systems.

We do not need to go further than this just yet. It isn't necessary for you to completely accept this as the elusive definition of money. It'll probably take some getting used to. If you're coming at this from the viewpoint of a Bitcoin or gold 'miner' you might not like it much.

But bear with it, because you'll soon see that Bitcoin and gold both sit on the border between property and money, which is part of what makes them so interesting.

Moving money around

You can already see how all money can be moved around. Payments are just ways of changing the scores. With bank accounts you edit the scorecards, which usually means the accounting records. If you've ever wondered how money is transmitted down a wire, here is the answer. Money doesn't transmit down wires, instructions do, and if the people at both ends of the wire are playing by the same rules they can modify their own scorekeeping systems in a coherent and mutually consistent way.

Cash is the simplest scorekeeping system. It's based on tokens which pass from person to person, which makes payments easy to understand. Perhaps it's because cash is how we are introduced to money as children, or because it is tangible, or because it's the preferred monetary system for people who can't read, that it widely misleads people about what money is. Its physicality makes many people think credit must be an imaginary and conceptual thing derived from hard cash. But in fact that is the wrong way round.

Cash is a derivative device of credit; it's a physical token of unreturned favours, offering a simple way of keeping score which works just like chips or counters in a game. What you have in your hand is your score.

Even a solid gold coin is a token. It doesn't have a special place in the definition of money, and if it did it would mean there was something we hadn't properly understood, because clearly money can exist without gold, and often does. But yes, gold's reliable scarcity can help us build better and more reliable money systems which don't suffer from the biggest weaknesses that usually undermine them; namely cheating by duplication – either by governments or crooks, which are quite often one and the same.

Good. Now we will no longer be confused by what appear to be big differences between a privately remembered debt, money in a bank account, electrons flying across a bank's wire-payments system, gold in your pocket and Bitcoins. All types of money are scorekeeping systems for unreturned favours, and all payments are ways of modifying the scores.

What stimulates the creation of new types of money?

It already looks as though money could come from almost anywhere, because you don't necessarily have to be a genius to devise a new system for keeping score of unreturned favours. Indeed people who want to trade have spawned and will continue to spawn new types of money whenever a previous form has become too difficult to get hold of, or too expensive to use.

This is a reality that government has not been very aware of. They have been wrong to think that their own currencies, Dollars, Euros and Pounds, for example, were somehow above this truth. So they have steadily increased the load our monetary systems have to bear, forcing them to carry three large public burdens which are of very little interest to the buyer and seller in a simple transaction.

-

Over recent years government's main economic lever has been monetary policy, by which it seeks (not very efficiently) to direct the way our economies behave, primarily through the manipulation of interest rates.

-

Government operates a transparently simple policy when generating its own revenue. It looks for circumstances where our money changes hands, and it makes one side pay tax, and the other costlessly responsible for reporting and collecting it. That's why your income tax is paid by you and collected by your employer, why your VAT is paid by you and collected by your merchant, your Insurance Premium tax is paid by you and collected by your insurance company, and your travel tax paid by you and collected by your airline. The cost of money passing through private individuals' hands, as they earn it and spend it, is now frequently in excess of 60%.

-

Government now puts the monetary system at the heart of its law and order policy. Until 2004 there were no particular qualifying criteria for using Pounds, Dollars, or Euros. Since then, having introduced a range of new Anti-Money-Laundering laws, government has made normal financial services businesses responsible for detecting and reporting the unrelated criminal behaviour of their clients. The penalties for doing something entirely normal, but in the service of a criminal, are now very severe, which is why people now looking for a bank account will already rate the process as up there with a visit to the dentist. Meanwhile the sadder aspect of this legislation is that it forced businesses to act as jury and judge on their customers, without there being a trial. Thousands of innocents – for example, people with Arabic sounding names – are now obstructed in their use of bank accounts by formal institutional prejudice triggered by this law, and the citizens of 12 countries deemed pervasively corrupt are automatically tagged as 'Politically Exposed Persons', which gets them routinely barred. The cost to business of its new policing function has been high, and the benefits have been undetectable; it doesn't seem to have reduced crime at all. After all, there are plenty of other scorekeeping systems for criminals to use.

Each of these loads makes our currencies inherently less fit for their basic scorekeeping purpose, and paves the way for replacement currencies, like Bitcoin.

Where does money come from?

To really understand Bitcoin we first need to know where Dollars, Euros and Pounds come from.

By and large, units of our major currencies are created in the bookkeeping of banks' accounting systems. Many find this strange and think there must be something deeply wrong going on. But once you understand what is happening it's uncontroversial – and really quite sensible.

A bank account lets a prospective spender employ their bank's trusted status with merchants by becoming a member of the bank's own scorekeeping system. This is the effect of opening an account. It's much easier for a merchant to trust an established bank's scorekeeping system than to create a new one for every new, unknown customer.

A bank account offers some important functional benefits. For a start you can have a negative balance on a bank account, which you can't do with cash alone. And bank accounts automatically keep a transaction history, which makes it possible to see retrospectively if there has been a mistake, and correct it. That can be difficult with cash deals. On the other hand the fact that cash doesn't leave a trail is often considered a big advantage. People often trade in things they don't want anyone to know about.

In any event bank accounts live happily alongside cash. They let us easily transform our credit from account form into token form, and back again, by making withdrawals and deposits.

Where does the cash itself come from?

In the days of a gold standard, when everyone agreed what a monetary Pound represented in gold weight, cash used to come directly from private banks. Convertibility into a standard amount of gold made different banks' Pounds ordinarily interchangeable. Your bank would have been the terminal promissor, the final guarantor of the bank note, offering you gold if you wanted it, and its own name would have been printed on the note. It was perfectly free to make that promise to you, and you were free to accept it. Nobody else was involved; certainly not the government.

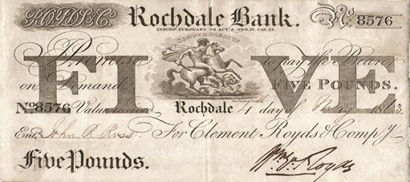

Here is some straightforward evidence of cash being a private extension of tokens by a private organisation – in this case the Rochdale Bank.

Nowadays there are no small town banks issuing cash. Banknotes and coins are bought by junior banks from a monopolistic Central bank, which isn't necessarily progress. Few monopolies are.

But we are where we are, and for the moment your bank tokenises its credit at Central in just the same way as you tokenise your credit at your bank. When it withdraws cash Central prints the notes and debits your bank in exactly the same way as your bank then debits you. The accounting records adjust the score as you opt out of a bank account and into tokens, and your token score – what's in your pocket – adjusts itself in the other direction.

In the days of the Rochdale Bank people could fairly easily see that even modest regional banks could create money – apparently out of thin air. To most people now, who are used to Central Bank issued notes and coins, that sounds a bit like alchemy. Is it true? Can banks really just create money?

Yes, they can. That Rochdale Bank five Pound note certainly suggests it. So how does this actually work?

How is money created?

Banks create money from collateralised private property. They don't need a deposit from one person to grant spending power to another. They just need a prospective spender to have some property. Then, with an appropriate collateral agreement between the property owner and the bank, money can be created.

Suppose a builder agrees to build a garden shed for a wealthy magnate who has a magnificent and un-mortgaged house, but no money. The magnate tells his bank to pay the builder and the bank keeps the score by recording the change, ie, by transferring some of the magnate's current monetary score to the builder.

But because the magnate started with a zero balance then, with the bank's help, the pair of them have just created money, because the builder now has brand new general purpose spending power where none previously existed, even if the magnate may now have an overdraft secured by a collateral agreement on his house.

This was just people going about the business of free trade, and they created this money out of an unreturned favour done by the builder – with a little help from the bank. They didn't need gold, or Bitcoins, or government permission. Was this creation of money some sort of financial skulduggery? No, it wasn't. The magnate's spending power has been created, indirectly, out of his house, and the bank has acted as an enabling credit agent, without which the shed building transaction couldn't happen.

Before the transaction our magnate owned a house which nobody could force him to sell, because he owned it outright and had no debts. It was un-mortgaged, so it was an asset without a liability – ie, it was owned and marketable property.

By signing something which permits the bank to grab his property and sell it if he fails to pay his debts, the magnate's house has become an asset with a liability – it is now collateral. In return he got the power to spend, ie, newly created money. His bank created two scorecards in his name for unreturned favours, one in credit (his current or 'checking' account, which allows him to spend) and a loan account next to it, which will be in debit.

In fact just as his shed building has here driven a creation of money, his magnificent house has probably caused a destruction of money for many years, as the credit he accumulated through his work was used to pay down his original mortgage. When he'd finally paid it down his house had solidified his previously earned money into outright property. But getting there involved the elimination of a lot of money which he'd earned, as the credit he received for his work met the longstanding debt on his mortgage account, and they mutually annihilated.

Now, with the bank's help, the wealth tied up in an un-mortgaged house has been partially re-monetised to build that shed. Our magnate's property wealth has again become liquid, and spendable. Doubtless in a short while the shed loan will be paid down, and the small amount of money created to get the job done will be eliminated again, as someone else's money passes through the magnate's hands and he uses it to pay down his shed loan and cancel his collateral agreement.

Then once again he'll be the outright owner of his house; and now a shed too.

It's perfectly natural for money to be created and destroyed all the time, in the normal course of business. Money creation by banks is constrained by the availability of collateral property, and overall, how much money is created, or destroyed, reflects the prevailing wishes of many people choosing to hold their wealth in spendable form (ie, money) or in property form.

Money is not like a commodity. It is not a tangible good which can only be shunted from one place to another, but whose supply is more or less fixed. Money is like love, or trust maybe. There can be as much of it as people want, or as little, depending on how much trust bankers place in the collateral value of their clients' private property, and also on how much the owners of that property choose to generate spending power from what they own.

So, this spendable money we are mostly familiar with is usually one half of a pair. Where that builder extracted his spending power, the magnate went into debt.

This debtor/creditor duality accounts for the huge majority of Dollars, Euros and Pounds that we come across – including the tokenised elements which move around as cash. Huge portfolios of collateral sit at the Central bank, having been put there by junior banks to support their demand for – among other things – cash.

But there are other ways to keep score which don't come from collateral, and don't have two sides.

'Naturally scarce' money

Gold is naturally scarce, and so is Bitcoin. Neither can easily expand in supply to accommodate the ordinary increase in demand for money required – for example – to build that shed.

Bitcoin

Even though it is quite likely that by the time the second (or possibly third) edition of this book is published Bitcoin will have shrunk to inconsequence amid a storm of recrimination it is nevertheless a case study in what happens when the available scorekeeping systems become too restrictive or too expensive to use.

Bitcoin is a 'cryptocurrency'. It is maintained independently of any government, so transactions in it are not subject to automatic deductions of income taxes and VAT. Also, because the system is anonymous and de-centralised, the state can't easily find anyone to persecute, or coerce into using it in any particular way. These are powerful advantages.

Bitcoins are solutions to a complex mathematical puzzle to which there are almost exactly 21 million possible answers. These solutions can only be found by trial and error repeated very many times to discover just one. The trial and error search is called 'mining' and involves entering a very long string of characters into a hashing algorithm the output of which is a very long number. Almost all the numbers produced by this process are worthless, but a tiny number of the possible inputs result in a rare pattern on the output (a number with 16 or 17 zeros at the front) and these become Bitcoins.

There will never be more than 21 million Bitcoins, although they can be subdivided, and there may well be other brands – say "Botcoins" – which are identical except for the name.

So far about 17 million solutions to the Bitcoin puzzle have been found, and bitcoin-mining computers are racing to find the remaining 4 million – in the process making people wealthy, and consuming ever more megawatt-hours of energy, usually paid for by their unwitting employer.

This puzzle's fixed number of solutions means the medium out of which the money is made (solutions to the puzzle) is naturally scarce. For its many adherents this is just one of several qualities which set Bitcoin on solid foundations for acting as money.

Upon its initial discovery each Bitcoin was first attributed to a 'wallet' owned by the electronic miner. A record of this ownership was entered on Bitcoin's register of owners, which is called the blockchain. Since its discovery subsequent changes in ownership have also been recorded there too, as the Bitcoin got split into fractions, and transferred in transactions. No matter how many times it has been spent or subdivided, the blockchain defines who owns it now.

Bitcoin's blockchain doesn't record a matching series of Bitcoin debts – or indeed any Bitcoin debts at all. There is no Bitcoin property collateral, and, unlike the major currencies, no duality of debtors and creditors, which means there are no Bitcoin debtors who owe you a return favour and might fail to pay you back. Unlike your Dollars, Pounds and Euros your Bitcoin is no-one's liability.

Most Bitcoin enthusiasts think this is very important, because it prevents them being disappointed by someone who owes them Bitcoin going bust. That can't happen with Bitcoin because their ability to spend a Bitcoin does not depend on the solvency of their scorekeeper. It depends only on the blockchain defining their ownership; and used properly, the blockchain is both independent of any controlling interest, and extraordinarily robust.

So unlike the money you are mostly used to, Bitcoin is an asset without an associated liability, which makes it a form of money very closely related to property.

In fact essentially the same system, without the electronics, used to operate with Trade Coins, which were made of naturally scarce bullion and passed as property (goods) in cross-border trade. They weren't legal tender on either side of a border, so they couldn't be used to pay a formal debt by right, but using them circumvented changing money across the historical equivalent of foreign currency exchanges, and avoided the government controls and charges which operated there.

Trade coins were barter bullion and Bitcoin is – in concept – strikingly similar, in so far as it eliminates the liabilities of debtor/creditor money systems and simply passes as property in settlement of transactions, outside of any government control or tax. Also Bitcoins remind us all that when governments or anyone else claim ever greater powers to control and tax trade then people will sidestep their official scorekeeping system and invent one which better suits their purpose.

Gold

Gold is scarce too, though not as rigidly scarce as Bitcoin. It's also easier for most people to understand. Nowadays it's sometimes used monetarily in a similar way to Bitcoin – ie, there are certain commercial services available (on the internet of course) which use computers to trade and pay in currency units each of which attributes direct ownership of physical gold stored in a vault.

But historically the much more significant monetary use of gold was the gold standard. This was not a system whereby every currency unit was underpinned by vaulted gold. It was a system where every monetary unit was convertible into a standard amount of gold. Gold was the unifying yardstick for money drawn from many different types of collateral – from houses, factories, land etc – all of which could be used to create money. Money created from wildly different collateral assets, and by completely different organisations, became interchangeable thanks to gold being used to solve the problem of defining what a unit of money actually was.

The gold standard still causes confusion. Because of the promise on a banknote to 'pay the bearer on demand' – in gold – many people continue to think that under it every Pound in every account needed to be backed by gold doing nothing but sitting in a bank's vault somewhere. They have tended to think that anything less was cheating. But that's neither what was intended nor how it worked. What mattered was that every Pound was underpinned by some marketable collateral – anything – which in a pinch could be sold on an open market, by the bank which held it, for at least the appropriate amount of gold.

The two main money systems

We have now reviewed the main forms of money. There's collateralised money, like Dollars and Pounds, and naturally scarce money like Bitcoin and gold. And there are hybrids too, like the gold standard. All offer different ways of keeping score. There are people who evangelise one approach or the other as if somehow they have a single answer to money. But nothing yet exists which perfectly solves the money problem.

The main problems with money created using collateral are:-

-

Falling collateral values can bust banks, losing depositors their money too. Multiple bank busts can spiral out of control into events like the Great Depression.

-

Governments (and sometimes businesses too) mess with the bookkeeping by finding somewhere to park a bad debt where it never gets written off. Writing off a debt inconveniently eliminates the credit associated with it, establishing a painful loss for someone somewhere. So it suits fraudsters to pretend that non-performing or non-existent assets are neither. Parking a bad debt transforms the credit side into true 'fiat' money –money with neither inherent scarcity nor a collateral base – and is very similar to just printing banknotes. A big extension of this type of behaviour has been how the western world has coped with the 2007-9 financial crisis, which is another reason people are looking for an alternative.

-

Forgery, which is essentially the same as the creation of fiat money, except that it's done by wicked criminals instead of governments.

On the other hand the problem for naturally scarce money like Bitcoin is that it buries its head in the sand on the issue of money being created and destroyed all the time, in the normal course of free trade.

Naturally scarce money can only address new demand by increasing its price. Only a small excess of demand sends Bitcoin prices shooting up, and an excess of supply sends it plummeting. This volatility is inevitable when demand for money cannot be met through perfectly safe, collateralised expansion, to satisfy people who want some new Bitcoin money to spend, and who have the property wealth to merit it.

Bitcoin's value volatility will remain a blessing to all who are involved with it while it (mostly) goes up. But, whatever its adherents hope and believe, it's unlikely to be capable of delivering rising values forever. There is something deeply unstable in any system where the optimal action is to anticipate what the majority is about to do, and then rush to do it quicker than everybody else.

The phase of sharply rising Bitcoin prices will definitely end in due course, and whether it collapses back like a typical bubble, or achieves dull stability will ultimately decide its genuinely widespread adoption. Dullness is desirable in money systems.

A second Bitcoin weakness is that having deliberately and perhaps justifiably set itself up to be independent of government control, its users enjoy anonymity and irreversibility. That way a receiver of Bitcoin isn't subjected to the risk that some pesky Court Order can require the Bitcoins to be given back. But experience suggests that most of us actually like our transactions to be subject to law. We like it that proper injustices, like fraudulent misrepresentation, can be reversed after due process. Bitcoin's strict anonymity and irreversibility are appealing for a minority at the extreme end of the spectrum where 'Caveat Emptor' always applies. But it caters only to them, and until it accepts that due legal process should render it reversible it probably restricts itself to a fringe role.

A 'Bitcoin standard'

The gold standard illustrates the possibility of hybridising the two main types of money. Doing something similar with Bitcoin would certainly make it duller in price terms, and we've already seen how it might work.

Our magnate, shed-builder and bank can do exactly what they previously did with Pounds, but on this occasion they denominate the overdraft and the spending in promises to pay in Bitcoin. You could call it 'the Bitcoin Standard'.

The bank can safely facilitate all this from its capital even if it has no Bitcoins itself. As we can now see, it doesn't need any. It is made safe by a Bitcoin denominated asset – a promise to pay in Bitcoin due to the bank from the magnate, and collateralised by something sufficiently valuable (the magnate's house) that it could be sold to redeem the outstanding Bitcoins, even if they had suddenly become a lot more expensive.

Should the builder cash in the bank's undertaking, and demand proper Bitcoins on the blockchain instead of mere 'promises to pay', the bank can expect to get hold of them. In a liquid marketplace for them it could simply buy them using whatever capital it has to hand. Only in an illiquid market demanding very high Bitcoin prices would it demand repayment by the magnate, and in the worst case sell his collateral.

So as long as the bank is watching the collateral value, and ensuring it could be sold to cover the magnate's Bitcoin debt, the bank is safe to create Bitcoin denominated 'promises-to-pay' even while it has no Bitcoin. It has wisely balanced its Bitcoin assets (owed by the magnate, and secured on his house) and its Bitcoin liabilities – the promise of an ability to spend Bitcoins – which it gave to the shed-builder.

This is why the risk in all this is almost entirely the magnate's, not the bank's. If Bitcoins rise 100 fold in value (which they seem to have done, twice) his originally modest debt might require him to sell his magnificent house to find enough Bitcoins to pay back what he borrowed to build his shed. Rising currency values are brutal on those with a debit balance, which gives collateralised borrowers a very good reason for liking their money to be dull. No magnate is going to accept a Bitcoin debt while it carries within it the possibility of shipwrecking him through rising prices.

Meanwhile flexing Bitcoin to accommodate our shed trade is, in a sense, undermining its two cherished pillars: its reliable scarcity and its debtor-free, blockchain register. Both get sidestepped by the use of collateral and 'promises to pay'.

Conclusion

These are the issues at the heart of Bitcoin's monetary conundrum. For it to become usable as money its price must stabilise. For it to stabilise it must be able to expand and contract, under collateral agreements, according to ordinary monetary demand. But this drives a bus through its principles.

Moreover, those same collateral agreements demand that someone sits on the debt side of the scorekeeping system, which no-one wants to do while the price is going up. And if finally someone extremely brave decides to step in and take the debt then the price will stall, and encourage thousands of twitchy Bitcoiners to sell, all at once, automatically bursting its bubble. It's in a catch 22 of its own design. In the long term, as it is, Bitcoin can't truly work as a stable form of money.

Nevertheless it has done us all a very useful and overdue service. It shows us that while we have liberty we can make the choice to stop using whichever money government is seeking to over-tax and over-regulate, and find our own way of keeping score. And for so long as the Bitcoin music plays, anyone can mimic the old fashioned buccaneers and smugglers who exchanged goods and services in their occasionally illicit deals, tax-free and un-pestered, on the fringes of society.