![]()

See this visualization first on the Voronoi app.

Use This Visualization

How Much Income Tax Americans Pay by Wealth Bracket

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

Key Takeaways

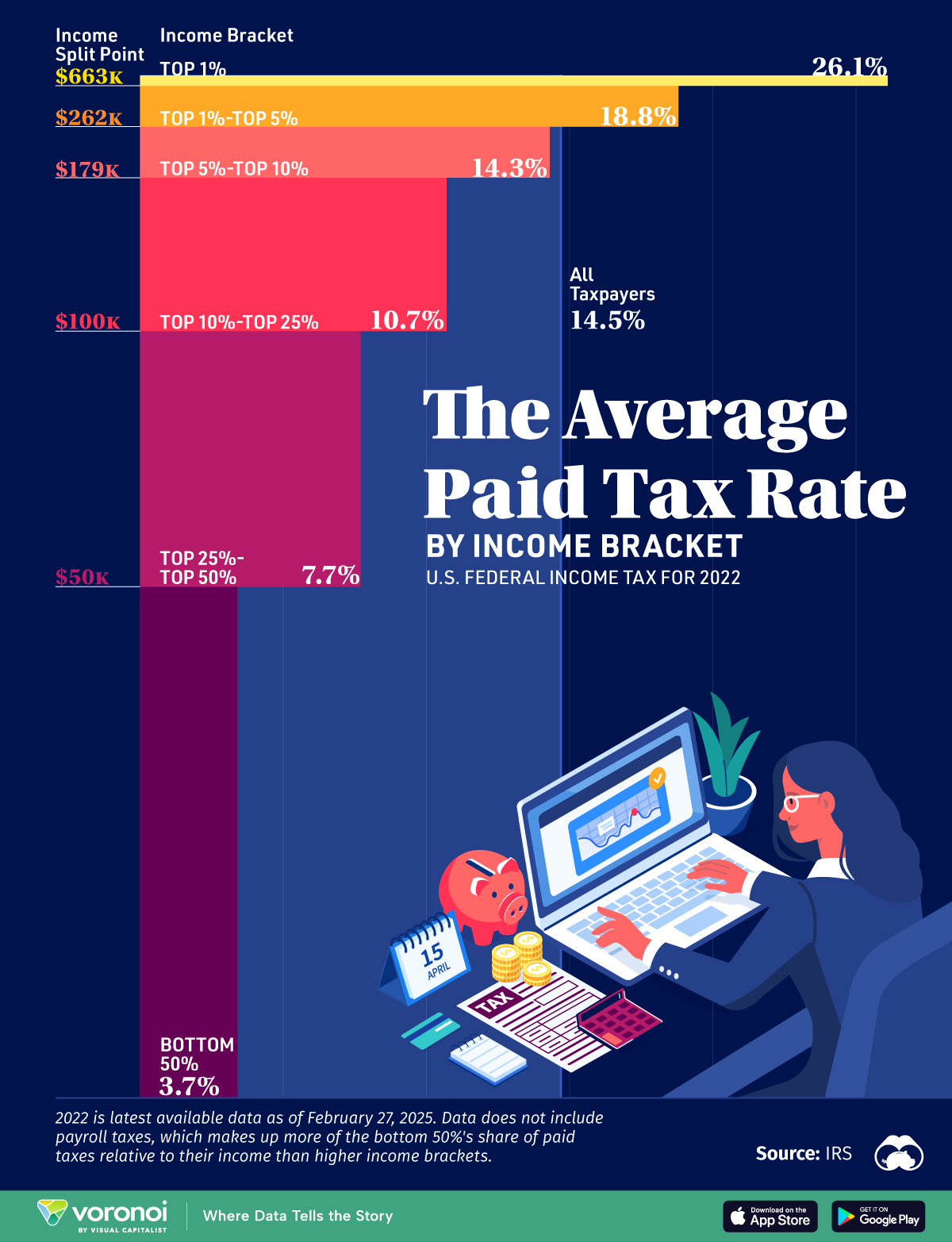

- Americans paid 14.5% on average in income tax in 2022, based on the latest available data from the IRS.

- For the top 1% of U.S. earners, the average income tax rate was 26.1%.

- Meanwhile, the bottom 50% of earners paid 3.7% on average in income tax. However, this figure does not include payroll taxes, which makes up a larger share of paid taxes compared to other income groups.

In America’s progressive tax system, income tax rates rise going up each tier of wealth.

Overall, the federal government collected 153.8 million tax receipts in 2022, generating $2.1 trillion in income tax revenue. The highest 1% of earners paid a total of $863.3 billion in taxes, averaging $561,523 each.

This graphic shows the average income tax rate Americans paid, based on data from the IRS.

Breaking Down Income Tax Rates by Wealth Tier

Below, we show the average tax rate paid in 2022 across different income groups:

| Income Bracket | Average Tax Rate |

|---|---|

| Top 1% | 26.1% |

| 5% to 1% | 18.8% |

| 10% to 5% | 14.3% |

| 25% to 10% | 10.7% |

| 50% to 25% | 7.7% |

| Bottom 50% | 3.7% |

| All Taxpayers | 14.5% |

At the very top, the highest-earning 1%—about 1.5 million taxpayers making at least $663,164 in 2022— saw an average income tax rate of 26.1%

Just below them, earners in the top 1-5% bracket paid 18.8% on average in income tax. Together, the top 5% of U.S. earners paid $1.3 trillion in income taxes, making up 61% of the federal total.

Meanwhile, those earning between $99,857 and $178,611—placing them in the top 10-25% of earners—paid an average rate of 10.7%. In total, the top 25% of earners were responsible for 87.2% of income taxes collected.

On the other end of the spectrum, the bottom 50% of U.S. earners paid an average of $822 in income tax, with a much lower average rate of 3.7%. Importantly, this does not include payroll taxes, which account for a bigger share of paid income taxes compared to others. Overall, these contributions made up 3% of total federal income tax revenue in 2022.

Learn More on the Voronoi App ![]()

To learn more about this topic from a global perspective, check out this graphic on personal income taxes around the world.