Written By Jenna Ross

Graphics & Design

- Miranda Smith

Published February 21, 2023

•

Updated February 21, 2023

•

TweetShareShareRedditEmail

The following content is sponsored by MSCI

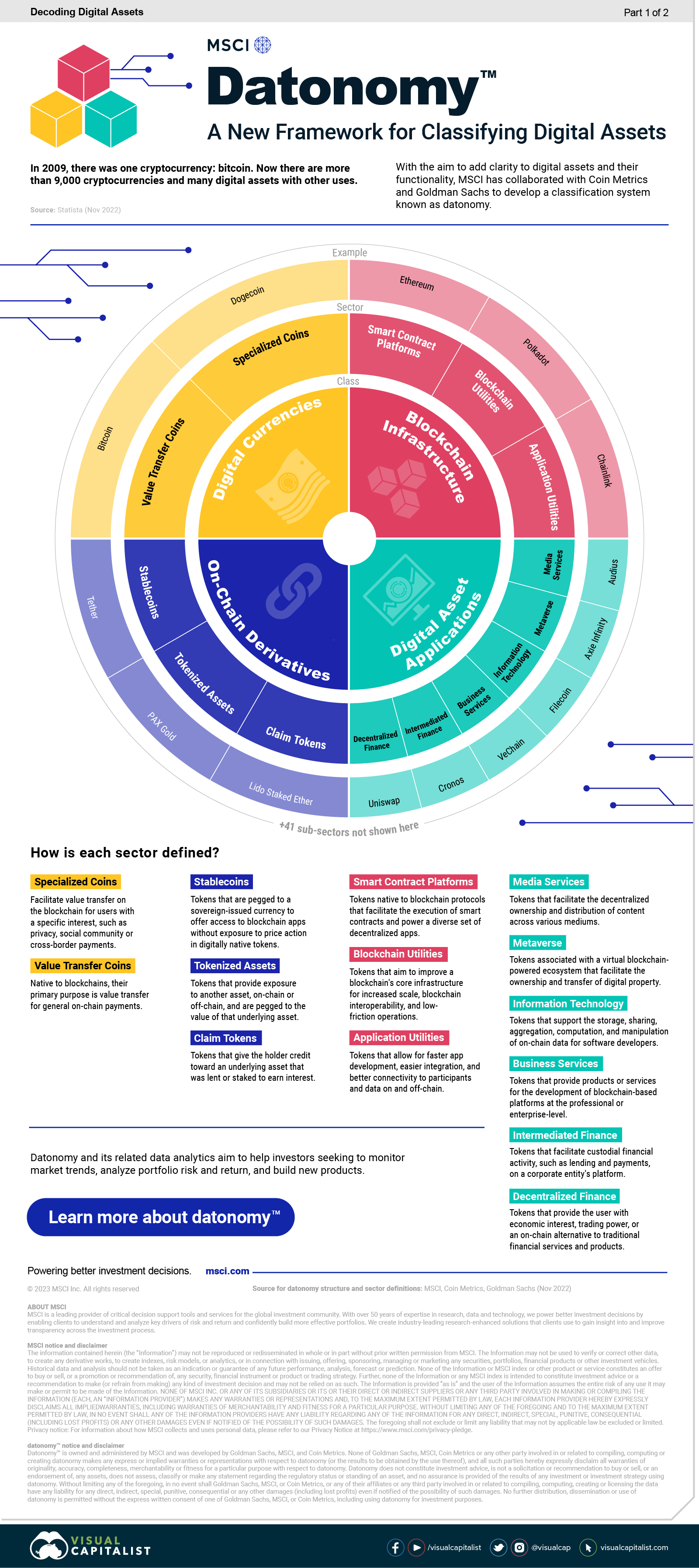

Classifying Digital Assets With a New Framework: Datonomy

In 2009, there was one cryptocurrency: bitcoin. Now there are more than 9,000 cryptocurrencies and many digital assets with other uses.

As the ecosystem becomes more complex, investors need more structure and clarity to make sense of how assets relate. In this graphic from MSCI, we introduce a new classification framework known as Datonomy. It is the first in a two-part series on decoding digital assets.

The Main Uses of Digital Assets

MSCI collaborated with Coin Metrics and Goldman Sachs to develop the framework, which classifies digital assets according to what they are primarily used for. It is hierarchical with three levels of classifications: classes, sectors, and subsectors.

We show the first two levels in the table below, along with examples of each sector.

| Class | Sector | Example |

|---|---|---|

| Digital Currencies | Value Transfer Coins | Bitcoin |

| Specialized Coins | Dogecoin | |

| Blockchain Infrastructure | Smart Contract Platforms | Ethereum |

| Blockchain Utilities | Polkadot | |

| Application Utilities | Chainlink | |

| Digital Asset Applications | Decentralized Finance | Uniswap |

| Intermediated Finance | Cronos | |

| Business Services | VeChain | |

| Information Technology | Filecoin | |

| Metaverse | Axie Infinity | |

| Media Services | Audius | |

| On-Chain Derivatives | Stablecoins | Tether |

| Tokenized Assets | PAX Gold | |

| Claim Tokens | Lido Staked Ether |

Let’s take a closer look at one sector within each class.

Specialized Coins facilitate value transfer on the blockchain for users with a specific interest, such as privacy, social community, or cross-border payments. Meme coins like Dogecoin fall under this sector, as do cryptocurrencies like Monero where every user is anonymous by default.

Smart Contract Platforms are tokens native to blockchain protocols that facilitate the execution of smart contracts and power a diverse set of decentralized applications. Following an “if this, then that” structure, smart contracts are essentially digital agreements that automatically execute when the terms are met. Ethereum is an example of a smart contract platform.

Decentralized Finance tokens provide the user with economic interest, trading power, or an on-chain alternative to traditional financial services and products. The sector includes things like exchanges (such as Uniswap), peer-to-peer loans, prediction markets for betting, and asset management.

Stablecoin tokens are pegged to a sovereign-issued currency to offer access to blockchain apps without exposure to price action in digitally native tokens. An example of a stablecoin is Tether, which has a 1-to-1 peg with a matching fiat currency such as the U.S. dollar.

A Structural Lens for Investors

As the digital assets universe continues to expand and evolve, investors need a consistent way to analyze the market.

Datonomy and its related data analytics aim to help investors seeking to monitor market trends, analyze portfolio risk and return, and build new products. Get insight on digital assets with MSCI’s data service, datonomy.

The second part of this series will explore how institutional investors can approach digital assets.

Please enable JavaScript in your browser to complete this form.Subscribe to our free newsletter and get your mind blown on a daily basis: *Sign up

Related Topics: #bitcoin #cryptocurrency #blockchain #crypto #smart contracts #decentralized finance #msci #digital assets #Metaverse #defi #stablecoin

Click for Comments

var disqus_shortname = "visualcapitalist.disqus.com";

var disqus_title = "Classifying Digital Assets With a New Framework: Datonomy";

var disqus_url = "https://www.visualcapitalist.com/sp/classifying-digital-assets-with-a-new-framework-datonomy/";

var disqus_identifier = "visualcapitalist.disqus.com-155408";

You may also like

-

Markets45 mins ago

Mapped: Unemployment Forecasts, by Country in 2023

Unemployment is forecast to tick higher in 2023, but so far red-hot labor markets are resisting this trend on a global scale.

-

Green4 days ago

Chart: Automakers’ Adoption of Fuel-Saving Technologies

See how 14 major automakers have adopted various fuel-saving technologies in this infographic based on EPA data.

-

Green4 days ago

Explainer: What to Know About the Ohio Train Derailment

A train transporting a number of potentially dangerous chemicals derailed near the Ohio–Pennsylvania border. This infographic explains what happened

-

Markets1 week ago

Ranked: America’s Best Places to Work in 2023

According to employee reviews on Glassdoor, here’s how the ranking of top-rated employers in the U.S. has changed over the last five years

-

Politics1 week ago

Ranked: The World’s Most and Least Powerful Passports in 2023

How strong is your passport? This ranking showcases the most and least powerful passports based on their ease of access to countries globally.

-

VC+2 weeks ago

What’s New on VC+ in February?

This month’s VC+ special dispatches feature an in depth look at the IMF’s country report on China and the February edition of Markets this Month.

Subscribe

Please enable JavaScript in your browser to complete this form.Join the 380,000+ subscribers who receive our daily email *Sign Up

The post Classifying Digital Assets With a New Framework: Datonomy appeared first on Visual Capitalist.