Subscribe to the Advisor Channel free mailing list for more like this

The Fastest Rising Asset Classes in 2023

This was originally posted on Advisor Channel. Sign up to the free mailing list to get beautiful visualizations on financial markets that help advisors and their clients.

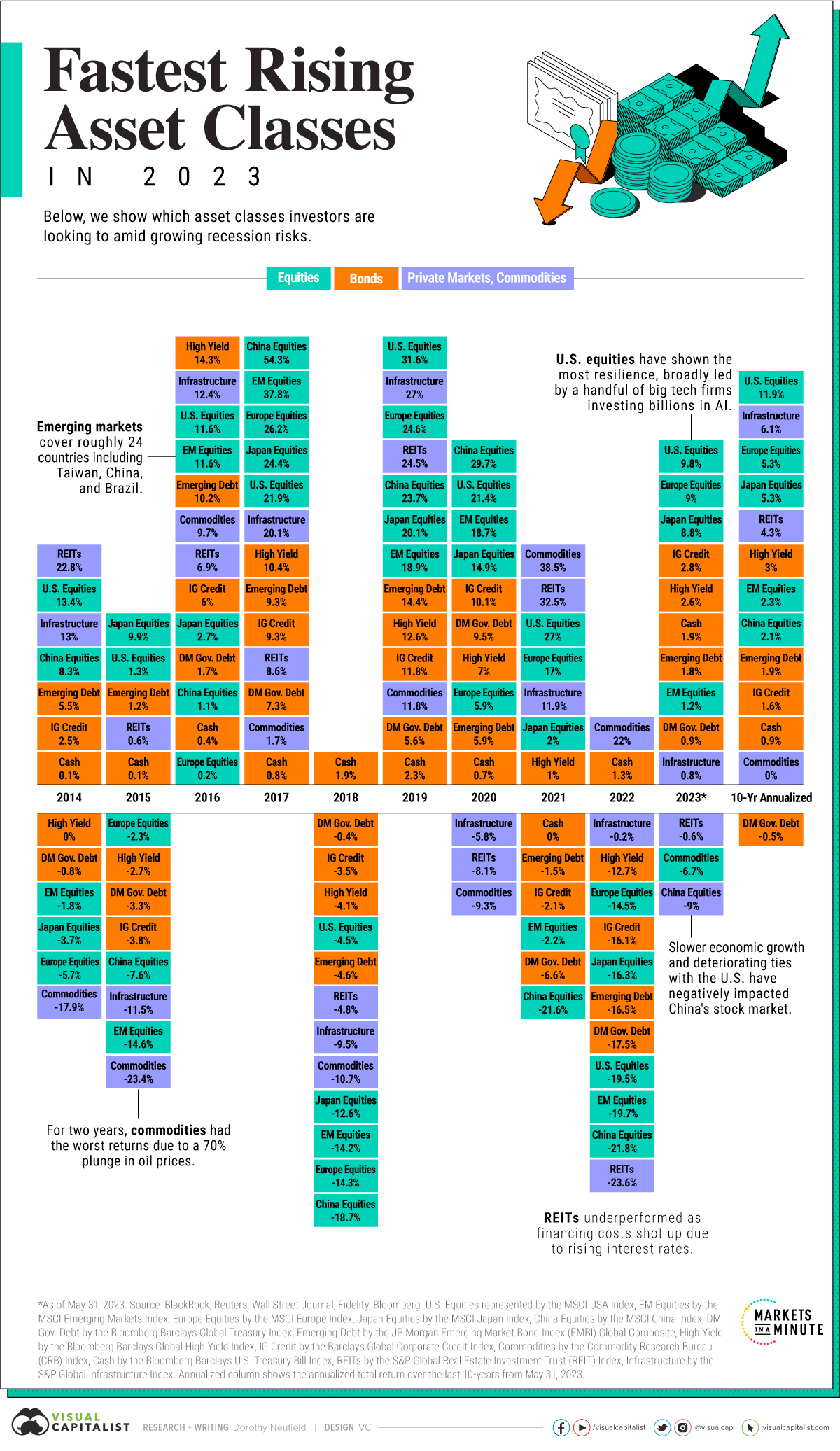

Many corners of the market have shown resilience despite persistent inflation and slowing economic growth in 2023. U.S. equities, international equities, and a variety of bonds have seen positive returns so far this year.

In the above graphic, we rank the top-performing asset classes to date with data from BlackRock.

Asset Class Performance, Ranked

Here’s how select asset classes have performed in 2023 as of May 31:

| Asset Type | 2023 Return (as of May 31) | 10-Year Annualized Return |

|---|---|---|

| U.S. Equities | 9.8% | 11.9% |

| Europe Equities | 9.0% | 5.3% |

| Japan Equities | 8.8% | 5.3% |

| Investment Grade Credit | 2.8% | 1.6% |

| High Yield Bonds | 2.6% | 3.0% |

| Cash | 1.9% | 0.9% |

| Emerging Market Debt | 1.8% | 1.9% |

| Emerging Market Equities | 1.2% | 2.3% |

| Developing Market Gov. Debt | 0.9% | -0.5% |

| Infrastructure | 0.8% | 6.1% |

| REITs | -0.6% | 4.3% |

| Commodities | -6.7% | 0.0% |

| China Equities | -9.0% | 2.1% |

After a troublesome 2022 for markets, you can see above that U.S. equities have rebounded the fastest in 2023. They are sitting at 9.8% returns year-to-date.

However, this has largely been a story of a few outperformers buoying the overall market. Nvidia with 159% returns, along with Meta (120%), Apple (36%), and Microsoft (37%) are among the companies with strong growth. Many of these companies are investing billions in artificial intelligence.

European equities, at 9% returns, have also seen steady performance. Investors have flocked to the market, given the tilt to value stocks during rising rates.

Globally, bonds fall roughly in the middle of the pack, while commodities have fallen 6.7% on the year so far. China’s equity market has faced headwinds amid strained economic ties with the U.S. and economic data falling under expectations.

Bull Market On the Horizon?

Tech funds saw a record $8.5 billion in weekly inflows as of May 31, 2023 driven by AI enthusiasm.

As investors pour into these megacap stocks, S&P 500 returns have rebounded almost 20% from their October lows, moving closer into bull market territory.

As it stands, investor optimism has increased across the broader market. The investor fear gauge hovered near its lowest point since February 2020. The CBOE Volatility Index (VIX) sank to 15, a significant drop from its average reading of 23 over the past year.

The post The Fastest Rising Asset Classes in 2023 appeared first on Visual Capitalist.