Greenspan Warns Moving Into “Stagflation Not Seen Since the 1970s”

- Former Fed Chairman warns of bond bubble, stagflation- “Moving into a ... stagflation not seen since the 1970s"- This will not be "good for asset prices”- 10 Yr Gov bond yields fell from 15.8% in 1981 to 2.3%- Interest rates will not stay low, will rise ‘reasonably fast’- “Normal” interest rates in 4%-5% range- Inflation will not stay at historically low levels- Gold "protects savings" and is "store of value"- Gold is the "ultimate insurance policy" says Greenspan

Editor: Mark O'Byrne

Greenspan warns of Bond Bubble

‘We are experiencing a bubble, not in stock prices but in bond prices. This is not discounted in the marketplace.’

There are a lot of warnings on Bloomberg, CNBC and other financial media these days about a bubble in the stock market, particularly in FANG stocks and the tech sector.

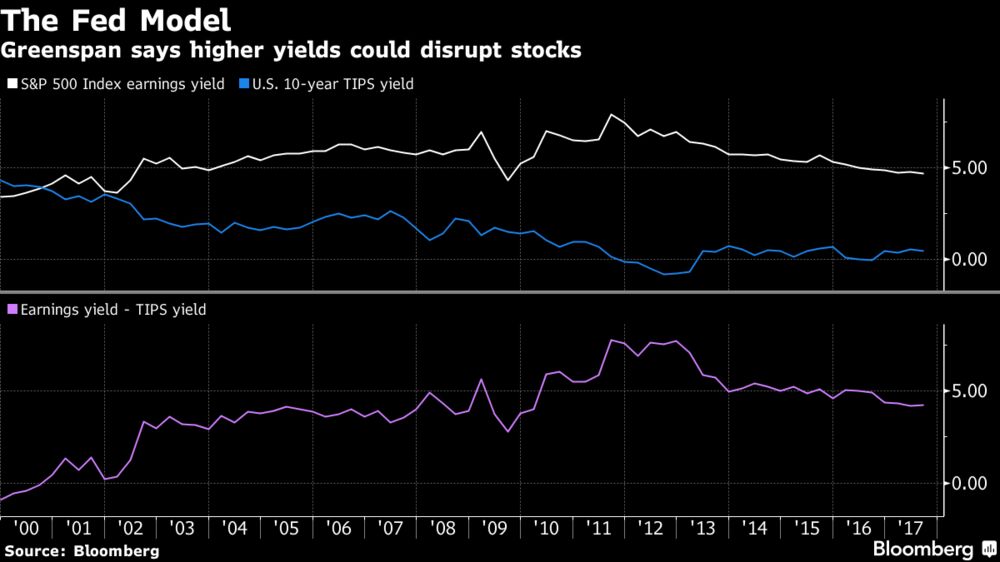

But former Fed Chair Alan Greenspan is not in agreement. He is continuing his message of the last two years, that there is a bond bubble and which is more dangerous than what is going on in the stock market.

He is not the only one, in recent months there has been a growing number of those who are concerned that real bond yields in the U.S., UK, EU and elsewhere are well below where growth and inflation rates seem to suggest they should be.

They correctly warn that it is only a matter of time before the inflationary pressures (that we are feeling) hit the bond market.

Stagflation on the horizon

Greenspan’s warning this week comes a little over a year after he last warned us that we were currently in the worst period he has seen since he began public service, including the financial crisis.

Things are so bad, he said that he wished he could “find something positive to say.”

At the time he pointed towards the problem of ‘entitlements’ (welfare / warfare spending of the 'welfare warfare state'). Something, he argued, is uneconomic and unsustainable. The main reason for its lack of sustainability is the low growth rates developed countries around the world are experiencing (around 2%).

Now, this lack of growth is prompting calls of concern from Greenspan regarding stagflation:

“We’ve been in a period of stagnation since 2008 as a consequence of the sharp decline of capital investment and productivity growth… We are moving into a different phase of the economy -- to a stagflation not seen since the 1970s. That is not good for asset prices.”

Felder Report via ZeroHedge

Asset prices obviously include the bond market, and this is where Mr Greenspan believes we should focus our concerns. Thanks to the unsustainable levels of low interest rates. Something which he has expressed concern about before.

Worried about interest rates

“By any measure, real long-term interest rates are much too low and therefore unsustainable,” the former Federal Reserve chairman, 91, said in this latest interview.

“When they move higher they are likely to move reasonably fast. We are experiencing a bubble, not in stock prices but in bond prices. This is not discounted in the marketplace.”

Two years ago Greenspan told Bloomberg that the bond market price-to-earnings ratio was in an ‘extraordinary position’ and that interest rates sitting below 4% was not normal.

“We have pressed the interest rates well below normal for a protracted period of time and the danger is they will come up to back up to where they have always been…There are two possibilities. Either we move slowly back to normal, or we do it in a fairly aggressive manner. History tells us it’s the latter which tends to be more prevalent than the former,” Greenspan said, the market impact, therefore, will be “not good.”

Yields on the US 10-year Treasury note have been below 4% since the summer of 2008 (see chart below).

[image]https://www.goldcore.com/ie/wp-content/uploads/sites/19/2017/08/Snip20170802_1-1-1024x553.png[/image]

No more air for the bubble

Currently around $1.5 trillion a year is created by central banks through money printing schemes. The major central banks (US Federal Reserve, the European Central Bank and the Bank of Japan) have collectively gathered around $13 trillion of government bonds on their balance sheets.

All of them, including others such as the Bank of England, are signalling that times are changing. For as long as money is being printed then bond prices have been going up. Great news for investors and pension owners, but those same investors would like to be able get out quickly.

This has been possible in recent years, thanks to what is basically a globally co-ordinated scheme of massive currency creation and bond buying.

However, we now appear to be heading into a period of co-ordinated global rate-hiking. This means that as interest rates start to climb then liquidity conditions will not work in investors’ favours.

There is little reason why we will not see a domino effect of increased interest rates, heightened volatility, falling bond prices and then perhaps even a crash in the stock and bond markets.

According to the 207 investment professionals surveyed by BAML last month, this would be disastrous for the market. They warned that a crash in the global bond market is the biggest tail risk for markets.

But so far these warning cries are little heeded in the mutual fund and wider market. According to Morningstar retail and high net worth investors alike are still ploughing cash into bonds.

Fixed-income products attracted $355bn in net new money between January to May 2017. Consider that next to the $375bn of net inflows for all of 2016. The figure also surpasses the entire year’s figures for 2013, 2014 and 2015.

Some of those who are buying believe that as inflation rates are low then it is unlikely to be a cause for concern to central banks, who are then less likely to raise rates rapidly. However, as we have covered here, the real rates of inflation really are a growing concern and are now on the radar of concerned central bankers.

At this point it is worth recalling another nugget of wisdom from Greenspan. He said back in 2014, ‘When bubbles emerge, they take on a life of their own. It is very difficult to stop them, short of a debilitating crunch in the marketplace.’

What does this mean for gold?

Mr Greenspan is a well-known gold-bug. Just earlier this year he said in an interview that investors were diversifying into gold and silver due to the deepening lack of trust in the financial system and currency markets.

Whilst interest rates are likely to rise, so is inflation which as Greenspan has previously argued, is good for gold:

“Significant increases in inflation will ultimately increase the price of gold. Investment in gold now is insurance.”

Gold is not only insurance against inflationary pressures but it is insurance against the unknown whether that be the outlook for the dollar or for the survival of the euro itself which Greenspan warned about earlier this year.

Earlier interviews with Greenspan have provided insight into how often bodies such as the Federal Reserve misjudge economic situations which then results in poor policy making. Of course, no one knows how the financial future will evolve, especially as each crisis comes with new financial strategies, technology and human behaviour.

Greenspan is unable to predict when the bond bubble will burst, and many disagree that it will happen, instead pointing to a stock market problem.

The bottom line is no one has a crystal ball. We simply don’t know now how this will pan out.

But we do know that the current situation is unsustainable. Most asset markets look overvalued and the value of major currencies are slowly being eroded.

Gold will hedge and insure against these real risks.

RelatedGreenspan Says Gold “Ultimate Insurance Policy” as has “Grave Concerns About Euro”

News and Commentary

Irish gold bullion broker GoldCore tops sales of $1bn (IrishTimes.com)

Gold edges away from 7-week high as dollar steadies (Reuters.com)

Gold settles at nearly 8-week high (MarketWatch.com)

Greenspan stresses ‘ominous’ worries about bond bubble (MarketWatch.com)

Fears rise on £200bn debt pile as Moody's warns Britons may be borrowing too much (CityAM.com)

- [image]https://www.goldcore.com/ie/wp-content/uploads/sites/19/2017/08/consumer-credit-outstanding-597f44452541f.png[/image]

- Source Bank of England via CityAm

Greenspan Sees No Stock Excess, Warns of Bond Market Bubble (Bloomberg.com)

Independent German Central Bank Responsible For Two Monetary Disasters (HandelsBlatt.com)

Importance of Rebalancing Portfolio - Now Good Time To Rebalance (StansBerryChurcHouse.com)

This Chart Might Make You Rethink the Adage “Stocks Always Come Back” (TheDailyCoin.org)

Popularity Rises For Precious Metals’ Initial Coin Offerings (ICOs) (Gold-Eagle.com)

Rickards: Scaramucci’s Chinese Operation May Have Pushed Him Out (DailyReckoning.com)

Gold Prices (LBMA AM)

02 Aug: USD 1,266.65, GBP 956.83 & EUR 1,069.56 per ounce01 Aug: USD 1,267.05, GBP 957.76 & EUR 1,072.30 per ounce31 Jul: USD 1,266.35, GBP 965.59 & EUR 1,079.06 per ounce28 Jul: USD 1,259.60, GBP 961.96 & EUR 1,075.45 per ounce27 Jul: USD 1,262.05, GBP 960.29 & EUR 1,076.53 per ounce26 Jul: USD 1,245.40, GBP 956.72 & EUR 1,071.29 per ounce25 Jul: USD 1,252.00, GBP 960.78 & EUR 1,074.59 per ounce

Silver Prices (LBMA)

02 Aug: USD 16.67, GBP 12.60 & EUR 14.09 per ounce01 Aug: USD 16.74, GBP 12.67 & EUR 14.17 per ounce31 Jul: USD 16.76, GBP 12.77 & EUR 14.29 per ounce28 Jul: USD 16.56, GBP 12.66 & EUR 14.15 per ounce27 Jul: USD 16.79, GBP 12.77 & EUR 14.34 per ounce26 Jul: USD 16.37, GBP 12.54 & EUR 14.06 per ounce25 Jul: USD 16.31, GBP 12.52 & EUR 14.00 per ounce

Recent Market Updates

- What Investors Can Learn From the Japanese Art of Kintsukuroi- Bitcoin, ICO Risk Versus Immutable Gold and Silver- This Is Why Shrinkflation Is Making You Poor- Gold A Good Store Of Value – Protect From $217 Trillion Global Debt Bubble- Why Surging UK Household Debt Will Cause The Next Crisis- Gold Seasonal Sweet Spot – August and September – Coming- Commercial Property Market In Dublin Is Inflated and May Burst Again- Gold Hedges Against Currency Devaluation and Cost Of Fuel, Food, Beer and Housing- Millennials Can Punt On Bitcoin, Own Gold and Silver For Long Term- “Time To Position In Gold Is Right Now” says Jim Rickards- Bloomberg Silver Price Survey – Median 12 Month Forecast Of $20- “Bigger Systemic Risk” Now Than 2008 – Bank of England- “Financial Crisis” Coming By End Of 2018 – Prepare Urgently

Important Guides

For your perusal, below are our most popular guides in 2017:

Essential Guide To Storing Gold In Switzerland

Essential Guide To Storing Gold In Singapore

Essential Guide to Tax Free Gold Sovereigns (UK)

Please share our research with family, friends and colleagues who you think would benefit from being informed by it.