Published

5 seconds ago

on

July 25, 2024

| 12 views

-->

By

Julia Wendling

Graphics & Design

- Athul Alexander

- Lebon Siu

The following content is sponsored by New York Life Investments

Magnificent Seven Mania: Why Diversification Still Matters

In 2023, the Magnificent Seven stocks outperformed the S&P 500, catching the attention of many investors. However, it’s crucial to remember that these stocks have underperformed previously as well, so having a balanced and diversified portfolio remains key.

In this graphic, Visual Capitalist partnered with New York Life Investments, to explore the importance of diversifying investments both in terms of security selection and geographic variability.

Magnificent Seven Stocks vs. the S&P 500: 2022–2024 (YTD)

Over the last couple of years, the price performance of the Magnificent Seven stocks has varied greatly.

In 2022, every single Magnificent Seven stock underperformed the S&P 500. Apple turned in the ‘highest’ performance of the group that year (-26.8% versus -19.4% for the S&P 500) and Tesla was the bottom performer (-65.0%).

| Stock | 2022 (%) | 2023 (%) | 2024, YTD (%) |

|---|---|---|---|

| Apple | -26.8 | +48.2 | +16.3 |

| Alphabet | -38.7 | +58.8 | +30.1 |

| Amazon | -49.6 | +80.9 | +20.1 |

| Meta | -64.2 | +194.1 | +37.7 |

| Microsoft | -28.7 | +56.8 | +17.8 |

| Nvidia | -50.3 | +238.9 | +149.5 |

| Tesla | -65.0 | +101.7 | +1.2 |

| S&P 500 | -19.4 | +24.2 | +16.7 |

Source: Yahoo Finance 07/22/2024.

In 2023, the trend flipped as each stock beat the benchmark. Despite being the worst performer of the Magnificent Seven, Apple still managed to nearly double the S&P 500—increasing by 48.2% versus 24.2% for the benchmark. Nvidia’s return was nearly 10 times the index as demand for its semiconductors gathered steam—up 238.9%.

Through May 2024, the price performance of the Magnificent Seven stocks has been mixed. This inconsistent trend shows the importance of maintaining a diverse portfolio.

The Dangers of Investing in a Handful of Stocks

Nearly three-quarters of individual stocks in the S&P 500 are underperforming the index so far this year (through July 22nd, 2024). Additionally, nearly a third of them have posted negative returns. As a result, “do-it-yourself” investing has had a higher probability of leading to underperformance.

| Performance | Count | Share (%) |

|---|---|---|

| Outperformed | 140 | 27.8 |

| Underperformed (with positive returns) | 206 | 41.0 |

| Underperformed (with negative returns) | 157 | 31.2 |

Source: Slick Charts 07/22/2024. Based on 2024 year-to-date price returns from December 31st, 2023 to July 22nd, 2024 of each stock in the S&P 500.

Investors can protect themselves from the potential underperformance of individual stocks by diversifying investments using either actively or passively managed pooled investments. But, there are also many other ways investors can further diversify their portfolios—whether by asset class, sector, market capitalization, or geography.

The Benefits of Geographical Diversification

Recessions, wars, natural disasters, and other phenomena impact stock market performance for any given country. So, having investment exposure across geographies can help investors avoid losses.

The MSCI index ranks various indices, including MSCI USA, MSCI Europe (excluding UK Index), MSCI Japan Index, and MSCI Emerging Markets, over the last decade, displaying significant variability.

| Year | USA (%) | Europe ex. UK (%) | Japan (%) | Emerging Markets (%) |

|---|---|---|---|---|

| 2023 | +27.1 | +22.7 | +20.8 | +9.8 |

| 2022 | -19.5 | -17.3 | -16.3 | -20.1 |

| 2021 | +27.0 | +16.5 | +2.0 | -2.5 |

| 2020 | +21.4 | +11.7 | +14.9 | +18.3 |

| 2019 | +31.6 | +25.9 | +20.1 | +18.4 |

| 2018 | -4.5 | -14.4 | -12.6 | -14.6 |

| 2017 | +21.9 | +27.8 | +24.4 | +37.3 |

| 2016 | +11.6 | +0.3 | +2.7 | +11.2 |

| 2015 | +1.3 | +0.1 | +9.9 | -14.9 |

| 2014 | +13.4 | -5.8 | -3.7 | -2.2 |

Source: MSCI 05/24/2024. Annual performances were calculated using the value of each index on December 31st relative to the prior year.

In 2023, for example, the U.S. index turned in a 27.1% performance while Emerging Markets gained 9.8%. Investors who only had exposure to Emerging Markets, in this case, would have missed out on the U.S. market’s stronger performance.

Stay Balanced

Though the Magnificent Seven stocks posted relatively strong returns in 2023, diversification remains incredibly important, both in terms of security selection and geographic variability. Pooled assets—whether actively or passively managed—can help investors get exposure across asset classes, sectors, market capitalizations, and geographies.

Explore more insights from New York Life Investments

Please enable JavaScript in your browser to complete this form.Enjoying the data visualization above? *Subscribe

Related Topics: #apple #google #tesla #amazon #s&p 500 #stocks #microsoft #diversification #alphabet #nvidia #msci #Meta #New York Life Investments #Magnificent Seven #magnificent 7

Click for Comments

var disqus_shortname = "visualcapitalist.disqus.com";

var disqus_title = "Magnificent 7 Mania: Why Diversification Still Matters";

var disqus_url = "https://www.visualcapitalist.com/sp/magnificent-7-mania-why-diversification-still-matters/";

var disqus_identifier = "visualcapitalist.disqus.com-168742";

You may also like

-

Markets2 days ago

Visualized: How U.S. Sports Leagues Make Money

We break down the five major U.S. sports leagues by revenue as billions are generated from ticket sales, sponsorships, and media deals.

-

Markets3 days ago

Mapped: The Price of a Big Mac Across the World

The price of a Big Mac varies substantially across the globe. The Big Mac Index uses these price variations to assess currency valuations.

-

Markets1 week ago

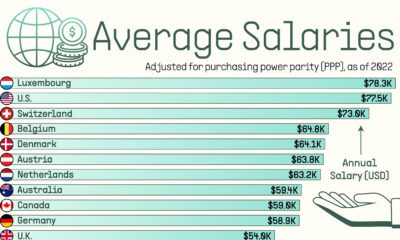

Ranked: Average Annual Salaries by Country

See how average annual salaries vary across 30 different countries, adjusted for purchasing power parity (PPP).

-

Markets1 week ago

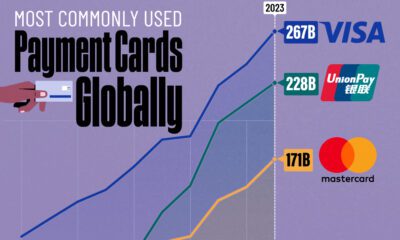

Charted: Visa, Mastercard, and UnionPay Transaction Volumes

Card services tend to be imagined as a duopoly between Visa and Mastercard. However, China’s UnionPay has all but caught up.

-

Markets1 week ago

Ranked: The Largest Sector ETFs, by AUM

This graphic lists the largest sector ETFs by AUM in 11 major stock sectors, including technology, energy, and healthcare.

-

Markets1 week ago

Charted: The G7’s Declining Share of Global GDP

The G7’s share of global GDP has been shrinking since the early 2000s. See the full story in this infographic.

Subscribe

Please enable JavaScript in your browser to complete this form.Join the 375,000+ subscribers who receive our daily email *Sign Up

The post Magnificent 7 Mania: Why Diversification Still Matters appeared first on Visual Capitalist.