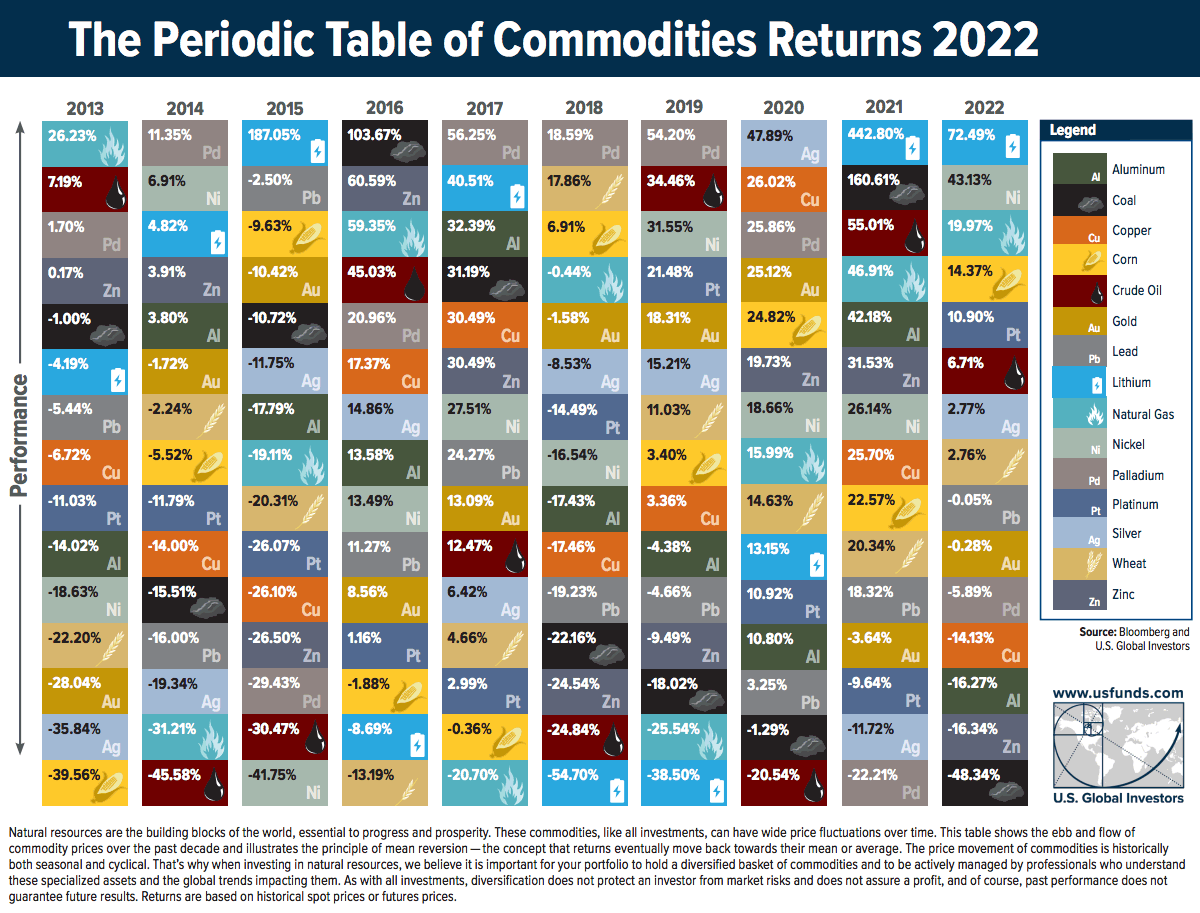

The Periodic Table of Commodity Returns (2013-2022)

Trying to predict which commodities will come out on top in any given year is tricky business—especially during this turbulent period in markets.

By looking back at previous years, investors can gain insights into long-term trends and patterns in commodity prices. To help better understand these trends, U.S. Global Investors releases a visualization called the Periodic Table of Commodity Returns at the outset of each year.

This year’s edition looks back over the past decade of returns between 2013 and 2022, and features an interactive design that allows users to sort returns by various categories including returns, volatility, and other groupings.

Editor’s note: Because of the Russia-Ukraine conflict, regional benchmarks for some commodities (coal, natural gas) had much bigger price divergences than is typical. In this case the graphic focuses in on U.S. regional benchmarks like Powder River Basin coal and Henry Hub natural gas prices. These prices may differ from price action seen around the world.

More Volatility, but Positive Returns

After 2021 saw an impressive surge in commodity prices as the world reopened post-pandemic, 2022 brought another year of positive returns for the asset class that were defined by high levels of volatility.

The broad-based S&P Goldman Sachs Commodity Index (GSCI) surged 52.1% in the first five months of 2022, as supply disruptions and fears across grains, metals, and energy fuels were spurred by Russia’s invasion of Ukraine.

The second half of the year saw prices cool as the U.S. continued to release crude oil from its strategic petroleum reserve while Russia and Ukraine established an agreement to enable grain and agricultural exports, quelling fears of extended supply disruptions.

The result? In the last seven months of the year the S&P GSCI nearly completed a return trip and only ended up rising 8.7% in 2022 overall.

| Commodity | 2022 Returns |

|---|---|

| Lithium | 72.49% |

| Nickel | 43.13% |

| Natural Gas (Henry Hub) | 19.97% |

| Corn | 14.37% |

| Platinum | 10.90% |

| S&P Goldman Sachs Commodity Index (GSCI) | 8.71% |

| Crude oil | 6.71% |

| Silver | 2.77% |

| Wheat | 2.76% |

| Lead | -0.05% |

| Gold | -0.28% |

| Palladium | -5.89% |

| Copper | -14.13% |

| Aluminum | -16.27% |

| Zinc | -16.34% |

| Coal (PRB) | -48.34% |

Another key factor that helped keep commodity prices cool in 2022 was China’s extended lockdowns which slowed down the country’s manufacturing and industrial capabilities. This helped reduce the demand of energy fuels in 2022, along with industrial metals like copper, aluminum, and zinc.

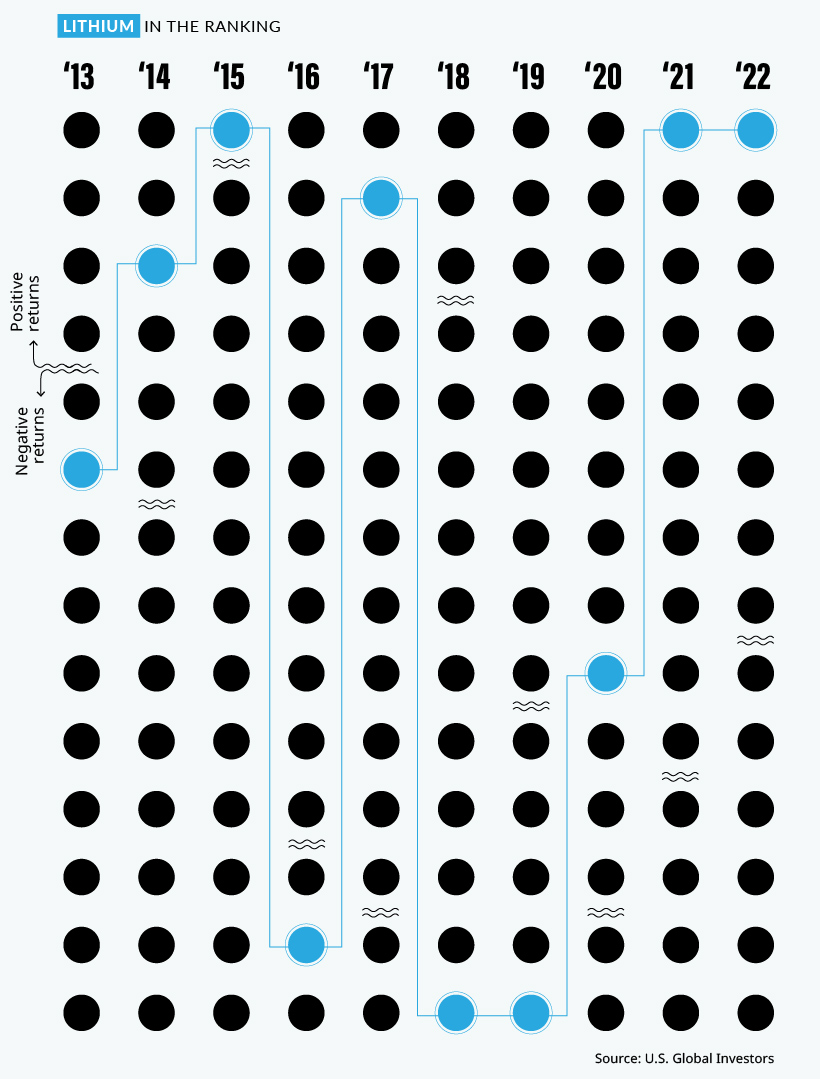

Lithium Continues to Top Commodity Returns

A metal that did shine brightly in 2022 was lithium, which has been newly added to the Periodic Table of Commodity Returns.

After topping the table in 2021 with an outsized price increase of 442.8%, lithium kept its top spot in 2022 with a more modest price increase of 72.5%.

The growing global push towards electric vehicles (EVs) has been a major contributor to the increase in demand for lithium and nickel, which was the second-best performing commodity in 2022 with a price increase of 43.1%. As more countries set targets to phase out gasoline and diesel vehicles, demand for key battery minerals like lithium and nickel is expected to continue to rise.

While the U.S. is working to strengthen its battery metals production and supply chains with $2.8 billion in grants for domestic lithium, graphite, and nickel projects, it will be years before more supply comes online as a result. In the meantime, robust demand for EVs in China has provided a constant need for these battery metals which are currently in short supply.

Energy Price Variance Fueled by Regional Uncertainty

After 2021 saw energy fuels dominate the top spots after lithium, energy fuel prices in 2022 were more volatile with more scattered returns. Natural gas was the only fuel which saw double-digit returns at a 19.9%, with crude oil returning 6.7% and coal at the bottom of the table at -48.3%.

It’s important to keep in mind how geopolitical events and supply disruptions last year affected the regional price differences for energy fuels. While WTI crude oil (North America’s benchmark) increased by 6.7% in 2022, Brent crude oil (Europe’s benchmark) was up 10.4% as Urals crude oil (Russia’s benchmark) fell by more than 26.5%.

| Type of Crude Oil | 2022 Returns | Price in U.S. dollars (Jan 17, 2023) |

|---|---|---|

| Brent Crude Oil (European benchmark) | 10.35% | $86.72 |

| WTI Crude Oil (North American benchmark) | 6.72% | $81.01 |

| Urals Crude Oil (Russian benchmark) | -26.53% | $55.60 |

As a result of the war and ensuing sanctions, the discount of Urals crude oil compared to Brent crude oil went from -$1.72 at the start of 2022 all the way to -$30.71 by the end of the year.

Thermal coal prices faced similar regional divergences, with Powder River Basin (PRB) coal (America’s benchmark for coal) falling by 48.3% this year while Newcastle coal, which is delivered out of the port of Newcastle, Australia primarily to various Asian nations, saw prices skyrocket up by 156.6% in 2022.

After such a wild year with huge variance in commodity prices, we’ll see if 2023 can bring some stability or if high volatility and growing regional price discrepancies will become the norm.

The post The Periodic Table of Commodity Returns (2013-2022) appeared first on Visual Capitalist.