By EconMatters

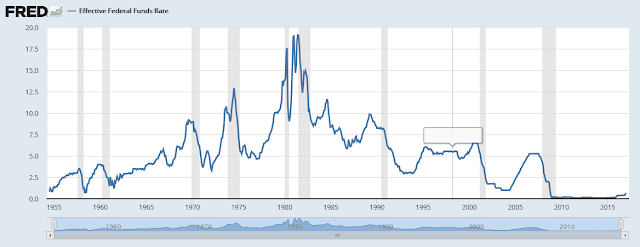

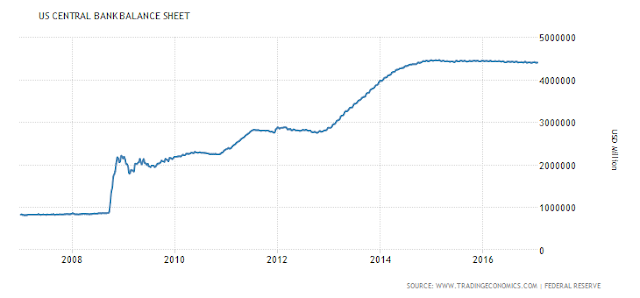

We discuss the fact that average investors are making very poor investment decisions right now in financial markets because of a Federal Reserve that refuses to normalize interest rates after a decade of ZIRP. We should have a Fed Funds Rate around 3% right now based upon even conservative Monetary Policy, and a case could be made for a 5% Fed Funds Rate based upon Asset Bubbles and the historical norms for economic data.

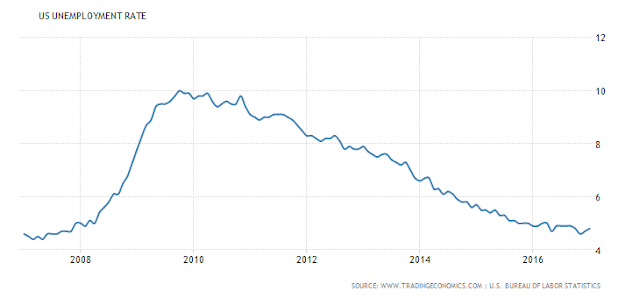

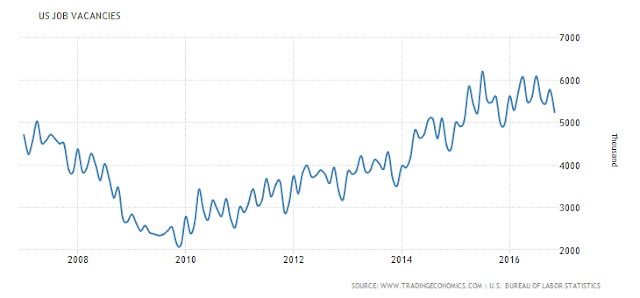

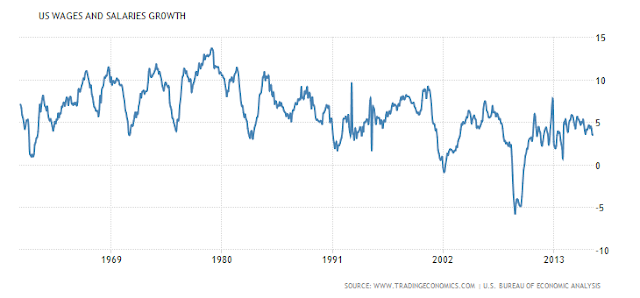

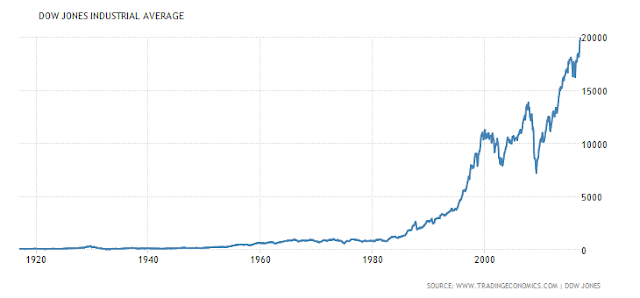

There are many parts of the economy that would actually benefit from higher interest rates. We have gotten all the benefits that can be gleaned from a low interest rate policy from this economy, and the elevated risks right now of financial asset bubbles that are systemic destabilizing the longer the excessive risk taking continues should be the Federal Reserve`s primary concern right now in raising interest rates.

Rates should be raised by a considerable margin from where they currently are now with an effective fed funds rate of 65 basis points, that is just way too low, and one of the reasons financial asset bubbles continue to grow each month!

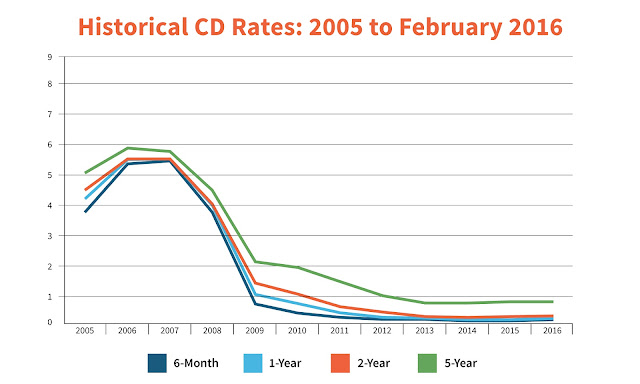

Investors don`t need to be investing in bubbles with their retirement money, how irresponsible of the Federal Reserve for incentivizing these poor investment choices. They need to be saving this money for the next downturn in the economy when they lose their job, or retire completely and need this money to live on, and not risk losing substantial principal chasing small dividends in overvalued dividend stocks or overpriced bonds.

They need to put this money in a safe CD or Money Market Cash Account and receive a fair interest rate for doing the smart thing with their retirement, safe money. What is wrong with you Janet Yellen, are you this uncaring, or just plain ignorant to the position your abnormal monetary policies are placing retired Americans, and everyday, average Americans trying to save for their future in a responsible manner.

These are not Hedge Funds who can dance with your free money, and hope they can get out before you stop playing the music. And Frankly, judging by past history, most of these risky speculators are going to lose lots of money trying to take advantage of this cheap money because they always over extend themselves getting greedy at the punchbowl. What is wrong with Central Banks are they this freaking corrupt or just this bloody stupid?

https://www.youtube.com/watch?v=zNUAdmC-cOs

© EconMatters All Rights Reserved | Facebook | Twitter | YouTube | Email Digest | Kindle