![]()

See this visualization first on the Voronoi app.

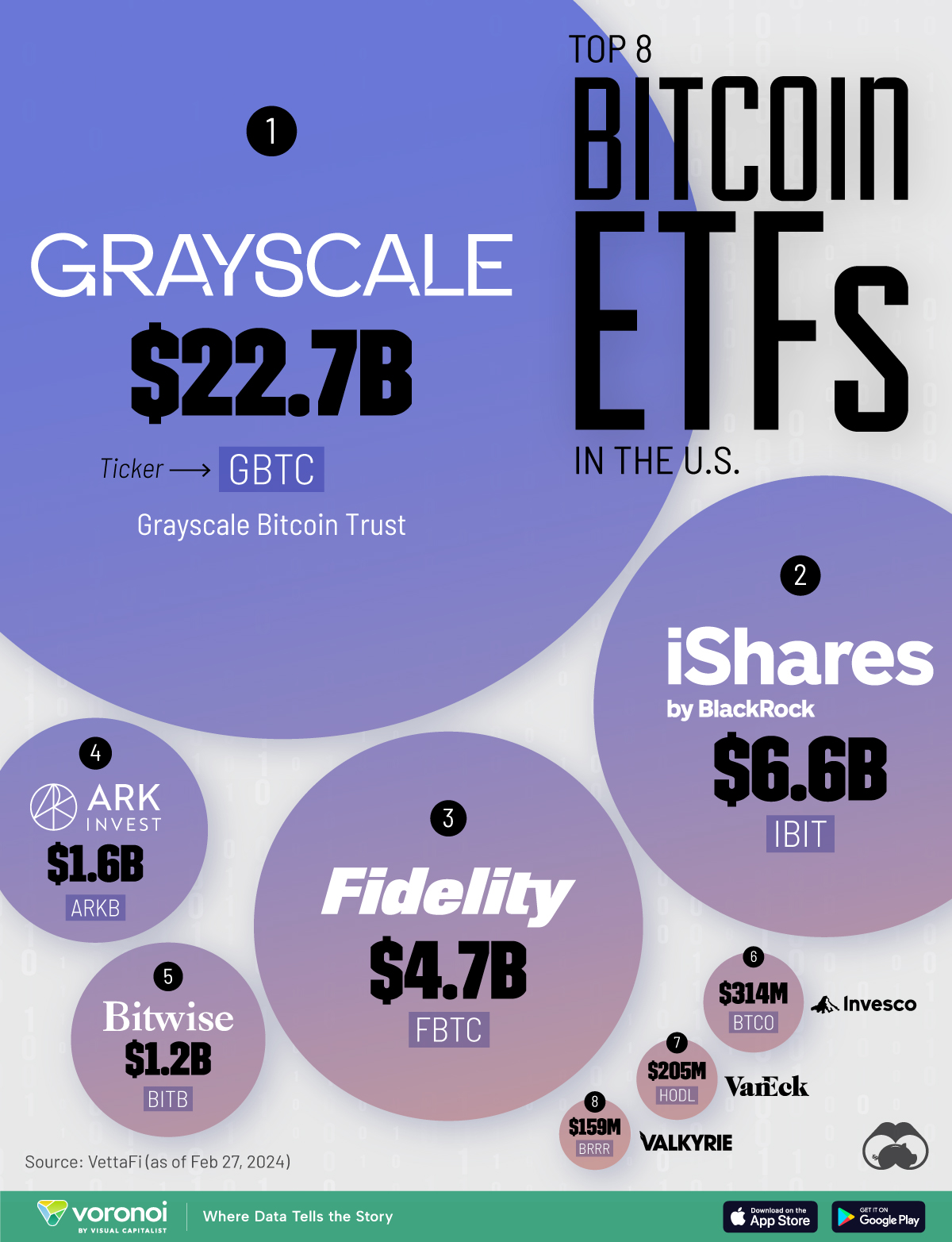

Ranking the Largest Bitcoin ETFs in the U.S.

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

In early January 2024, the U.S. Securities and Exchange Commission (U.S. SEC) gave its approval on exchange-traded funds (ETFs) to track Bitcoin, giving investors an alternative pathway to accessing the world’s biggest cryptocurrency.

In this graphic, we’ve shown the eight largest Bitcoin ETFs in the U.S. by assets under management (AUM), as of Feb. 27, 2024. To elaborate, these are ETFs that buy and hold actual Bitcoin, meaning their performance will generally follow that of Bitcoin itself.

The data used to create this graphic was sourced from VettaFi.

| ETF Name | Ticker | AUM |

|---|---|---|

| Grayscale Bitcoin Trust | GBTC | $22.7B |

| iShares Bitcoin Trust Registered | IBIT | $6.6B |

| Fidelity Wise Origin Bitcoin Fund | FBTC | $4.7B |

| ARK 21Shares Bitcoin ETF | ARKB | $1.6B |

| Bitwise Bitcoin ETF Trust | BITB | $1.2B |

| Invesco Galaxy Bitcoin ETF | BTCO | $314M |

| VanEck Bitcoin Trust | HODL | $205M |

| Valkyrie Bitcoin Fund | BRRR | $159M |

From these numbers we can see that Grayscale’s Bitcoin Trust (GBTC) is the largest by a wide margin. As its name implies, GBTC was originally structured as a trust, but was converted to an ETF on Jan. 11, 2024.

Why Buy a Bitcoin ETF?

Bitcoin ETFs simplify the process of buying and storing Bitcoin. This is because they can be purchased within a traditional brokerage account, just like any other ETF or stock.

Instead of having to think about creating a wallet, memorizing a 12-word seed phrase and holding their keys, this product scraps all of that and provides a well-known path: buy an ETF. This will open the digital asset space to a broader investor base.

Rita Martins, former Head of FinTech Partnerships, HSBC

Investors should be aware that these ETFs charge an expense ratio, which could eat into returns. Information on fees can be easily found on each asset manager’s relevant fund page.

For more visualizations related to Bitcoin, consider this graphic which shows how Bitcoin has performed relative to other major asset classes over the past 10 years.

The post Ranked: The Largest Bitcoin ETFs in the U.S. appeared first on Visual Capitalist.