Published

1 hour ago

on

October 18, 2024

| 30 views

-->

By

Jenna Ross

Graphics & Design

- Athul Alexander

- Lebon Siu

The following content is sponsored by Empower

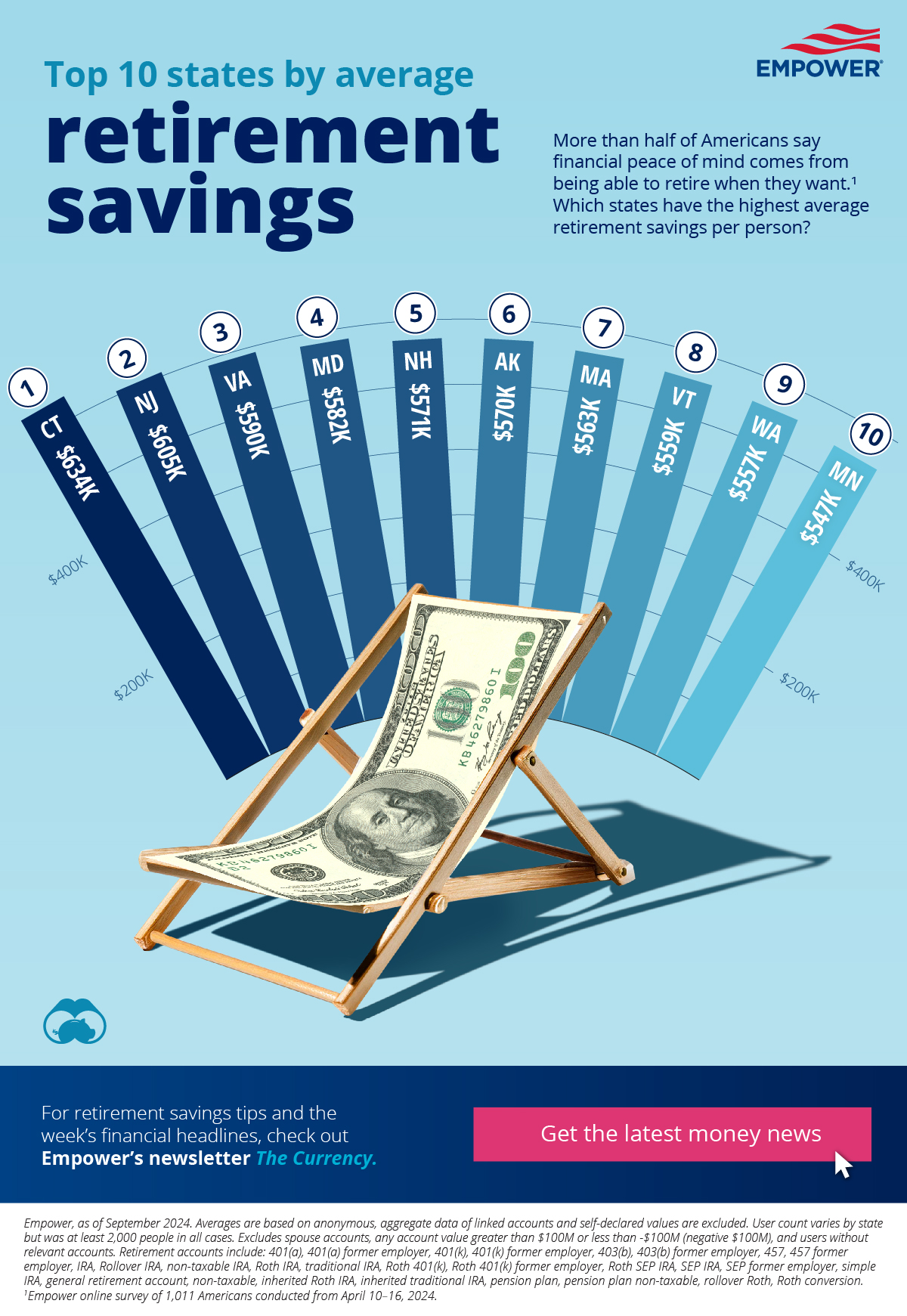

Ranked: The top 10 states by average retirement savings

Across all states, Americans have saved $498,000 on average for retirement. Which states have residents with the highest average retirement savings?

Using anonymized data from over two million Empower Personal Dashboard users, we explore these geographic trends.

States with the highest average retirement savings

Many Americans are racing against the clock when it comes to financial goals: half think they’re running out of time to save for retirement, even though 44% say they started putting money away early enough. Another 43% wish they could go back in time to start saving sooner.

People may be further along than they think. According to Empower Personal Dashboard data, the average 401(k) balance—one key measure of overall personal savings and investments—clocks in at $293,695. For people in their 50s approaching retirement age, the number jumps to $583,231.

In the graphic, we explore the states with the highest average retirement savings per person as of September 2024. These savings are across all types of retirement accounts, such as 401(k)s, IRAs, and pension plans.

| State | Average retirement savings |

|---|---|

| CT | $634,456 |

| NJ | $605,379 |

| VA | $589,965 |

| MD | $582,087 |

| NH | $570,511 |

| AK | $569,957 |

| MA | $563,353 |

| VT | $558,522 |

| WA | $557,139 |

| MN | $547,397 |

Northeast states make up half of the top ten states by average retirement savings. The remainder are spread across the Pacific (Alaska), South (Virginia and Maryland), West (Washington), and Midwest (Minnesota). Many of these states have a high cost of living, but also have higher average after-tax household incomes.

Taxes may play a role in how much people are able to save. For instance, Alaska (#6) does not have any state income tax or sales tax, and New Hampshire (#5) has a low overall tax burden.

The ideal retirement

In an Empower survey, 51% of people say retirement is their top savings goal.

When they reach retirement, what will it look like? More than 40% of Americans spend time “dreamscrolling” their retirement by picturing their ideal age, location, and monthly spending. Around two-thirds of Americans are interested in relocating during retirement, with 16% saying they want to move to a less expensive state.

On top of cost of living, the other main factors people consider are the climate and being close to loved ones. Not surprisingly, people say they would most like to retire near the beach (32%) and in the mountains or countryside (22%). The most popular states for retirement are Florida, New York, and California.

Making a plan

No matter where you plan to retire, the first step is developing a plan to save enough for your ideal retirement.

Looking for more insights into retirement savings tips and the week’s financial headlines?

Check out Empower’s newsletter The Currency for the latest money news.

Methodology: Average retirement savings are based on anonymous, aggregate data of linked accounts and self-declared values are excluded. User count varies by state but was at least 2,000 people in all cases. Excludes spouse accounts, any account value greater than $100M or less than -$100M (negative $100M), and users without relevant accounts. Retirement accounts include: 401(a), 401(a) former employer, 401(k), 401(k) former employer, 403(b), 403(b) former employer, 457, 457 former employer, IRA, Rollover IRA, non-taxable IRA, Roth IRA, traditional IRA, Roth 401(k), Roth 401(k) former employer, Roth SEP IRA, SEP IRA, SEP former employer, simple IRA, general retirement account, non-taxable, inherited Roth IRA, inherited traditional IRA, pension plan, pension plan non-taxable, rollover Roth, Roth conversion.

Please enable JavaScript in your browser to complete this form.Enjoying the data visualization above? *Subscribe

Related Topics: #ira #retirement #pension #401k #empower #retirement savings

Click for Comments

var disqus_shortname = "visualcapitalist.disqus.com";

var disqus_title = "Ranked: The Top 10 States by Average Retirement Savings";

var disqus_url = "https://www.visualcapitalist.com/sp/emp01-ranked-the-top-10-states-by-average-retirement-savings/";

var disqus_identifier = "visualcapitalist.disqus.com-169704";

You may also like

-

Personal Finance2 weeks ago

Charted: The Most Popular Investing Strategies, by Generation

Buy and hold remains the most popular investing strategy across generations, with Baby Boomers relying on this strategy the most.

-

Demographics3 weeks ago

Visualized: Global Spending Power by Generation

Gen Z is expected to add almost $9 trillion in spending globally in the next 10 years, more than any other generation.

-

Wealth1 month ago

Charted: Maxed-Out Credit Cards by Generation

Younger credit card users tend to max out their credit cards more often than older generations, with 15% of Gen Z maxing out their cards.

-

Money2 months ago

Ranked: The 10 Best U.S. States to Retire In

The best U.S. states to retire in are those that are affordable and warm. But #1 is from the mid-Atlantic region.

-

United States2 months ago

Access to Paid Time Off by Wage Group in America

The U.S. is the only nation in the OECD without a federal paid time off mandate. We show how access to paid leave varies by income…

-

Personal Finance2 months ago

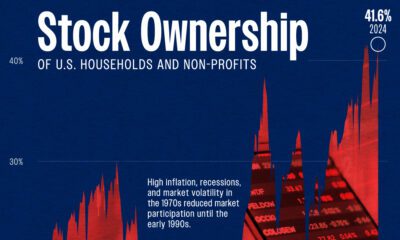

Charted: American Stock Ownership Back at All-Time Highs

Today, the share of Americans’ financial assets that are invested in public stocks is near all-time highs.

Subscribe

Please enable JavaScript in your browser to complete this form.Join the 375,000+ subscribers who receive our daily email *Sign Up

The post Ranked: The Top 10 States by Average Retirement Savings appeared first on Visual Capitalist.