By EconMatters

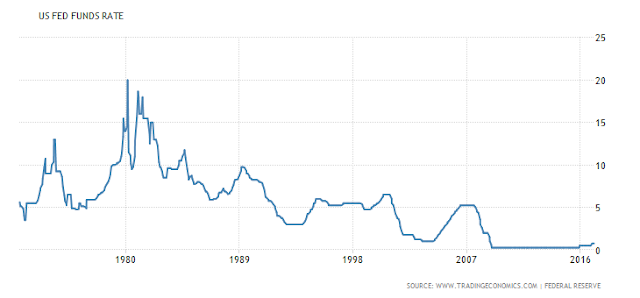

It appears the Federal Reserve took notice of the overheated stock market and realized they really must be behind the inflation curve. You don`t reach year end targets in the stock market already at all-time highs and haven`t even gotten out of February, and not wake up and realize that you are way behind the asset bubble inflation rate hiking curve.

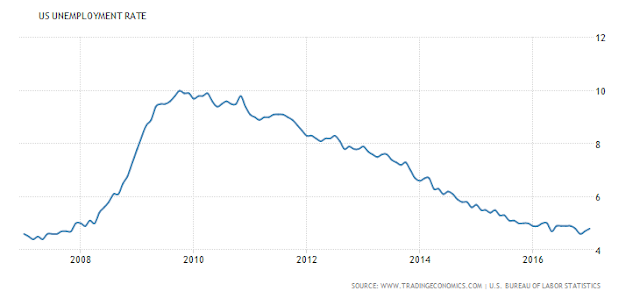

The Neutral Fed Funds Rate should be at 2.5 to 3% given the same historical comparisons in the employment data, inflation data, retail sales, consumer sentiment, PMI`s, auto sales, etc. and most importantly you don`t have the elephant in the room of a stock market bubble staring you squarely in the face. The Fed needs consecutive 25 basis point rate hikes at each of the next 3-4 FOMC Meetings. This waiting six months between live meetings is not going to cut it anymore, the stock market bubble is out of control!

https://www.youtube.com/watch?v=27DRYKaC8nc

© EconMatters All Rights Reserved | Facebook | Twitter | YouTube | Email Digest | Kindle