Authored by David Stockman via Contra Corner blog,

The Senate Finance Committee tax bill is not supply side and it's not even a tax cut; it's a gimmick-ridden policy mongrel that smells to high heaven of political desperation and cynicism.

Contrary to the Donald's delusional promise that the American people will get some tax cut sugar plums for Christmas, we are reasonably confident that this misbegotten exercise in reverse-robin hood economics won't reach his desk. But whether it passes in some diluted form or not, we are entirely sure that what the American people are actually getting is a giant lump of fiscal coal----courtesy of the craven capitulation of McConnell & Co to the K-Street lobbies and Wall Street.

And we do mean craven in the very fullest sense of beltway mendacity. Come to think of it, we have witnessed few exercises in raw partisan brinksmanship that were as meretricious and fiscally irresponsible as the current GOP campaign to pass a tax bill---any tax bill--- merely for the sake of posting a legislative victory.

And that assessment comes after scrolling all the way back to 1970, when your editor got a $50 loan from his mother in order to buy an airline ticket from Boston (where we were hiding out from the Vietnam War at Harvard Divinity School) to Washington DC (to interview for a job on Capitol Hill). As it happened, we got the job, paid back the loan and have since then witnessed 47 years of Warfare State and Welfare State aggrandizement up close and personal.

But what is now happening in the Imperial City is a true turning point for the worst. The last vestige of fiscal rectitude is now being deep-sixed by the GOP's vestigial budget hawks in the name of pure partisan advantage.

To be sure, the partisan juggernaut that resulted in Obamacare in 2010 was every bit as craven and fiscally deleterious. It accommodated every element of the nation's bloated health care cartels---hospitals, doctors, pharma, HMOs and insurance companies----with sweetheart reimbursement schemes in return for their acquiescence to the bill's passage and the fulfillment of what had been a 60-year Dem quest for quasi-socialized health care.

Yet at least the Democrats did attempt to finance the trillions in new tax credits and Medicaid costs generated by ObamaCare with some revenue raisers such as the medical device and insurance company taxes and the added levies on upper income earners and investment returns.

Back in the day, in fact, this kind of "tax and spend" welfare statism is exactly what the Democrats stood for. And it was also the party's political Achilles Heel because it enabled the GOP to periodically arouse the electorate on the dangers of "big government" and thereby obtain a resurgence in Washington's corridors of political power.

But after the break from the old-time fiscal religion of balanced budgets during the so-called Reagan Revolution in 1981, the GOP has slowly morphed into the "borrow and spend" party.

Indeed, as the historically ordained party of fiscal rectitude, the GOP's apostasy has enabled two-party complicity in a mindless regime of fiscal kick-the-can since the turn of the century. That lapse, in turn, acutely aggravated an already perilous fiscal equation owing to the baby boom retirement wave and the Fed induced slowdown in the trend rate of economic growth (see below).

In this context, it should be noted that the Senate bill is a farce insofar as it claims to be a middle class tax cut and growth stimulant---since it actually accomplishes neither.

On a honestly reckoned basis (counting debt service and eliminating budget gimmicks), however, it would add $2.2 trillion of new debt over the next decade on top of the $12 trillion already built-in under current policy. Accordingly, the Senate version of Trumpite "tax reform" would accelerate the public debt toward $35 trillion by 2027 or 140% of GDP.

Yet all of this added red ink would be "wasted" on cuts for 150 million individual taxpayers that are written in disappearing ink (i.e. they lapse after 2025) and on misbegotten corporate rate cuts that will do virtually nothing for economic growth. Indeed, contrary to the old Washington saw about "wasting a good crisis" the Senate bill involves something more like creating a good crisis and wasting it, too.

In the first place, you don't really even need a tax table to see that the overwhelming share of individual taxpayers get shafted----aside from 4.2 million very wealthy filers who would benefit from the alternative minimum tax repeal and a few ten thousand high income business owners who will get a 17% deduction for eligible business income ( a version of the House's pass-thru rate of 25%).

By 2025 the combined cut from these two provisions amounts to $155 billion per year; and despite sun-setting the following year in keeping with the general fiscal scam of the Senate bill, it's unequivocally big bucks of tax relief for households at the tippy-top of the economic ladder while it lasts.

By contrast, there are no net goodies at all even while the provisions do last for the remaining 145 million individual filers. (All individual tax provisions expire at the end of 2025 in order to propagate the myth that the bill does not add to the long-term deficit and thereby complies with the so-called Byrd Rule for reconciliation and the 51-vote majority).

In fact, the overall deal is a crap shoot. According to the Joint Committee on Taxation, when fully effective in 2025, the Senate bill will lower rates in the seven brackets by $165 billion per year and provide further relief of $102 billion owing to doubling the standard deduction (to $25,000 for joint returns) and $78 billion for doubling the child credit to $2,000 per eligible dependent. So that's $345 billion per year of "cuts".

At the same time, repeal of the existing $4,050 personal exemption, complete repeal of the SALT deduction and other loophole closers would raise tax collections by $355 billion in 2025. In a word, aggregate households other than business owners and alternative minimum tax payers, come out $10 billion in the hole---and that's in the best year (2025) before it all expires!

Surely, this is the farce of the century; after the estimated 350 amendments slated for consideration on the Senate floor, it will undoubtedly be subject to the full measure of the ridicule and legislative scorn and redo it deserves.

By the same token, the $1.4 trillion ten-year cost of cutting the corporate rate to 20% and eliminating the corporate minimum tax is permanent. That is the source of all the Wall Street excitement about the bill, but also the reason why the GOP claims that it will stimulate a tsunami of economic growth are so completely groundless.

In a word, the corporate tax is paid by shareholders, not workers; America's big businesses have located production and jobs off-shore (as opposed to merely their tax books and small HQ operations) to access cheaper labor costs and to be nearer to supply chains and end markets, not due to the 35% statutory rate (which few US-based internationals pay); and owing to decades of central bank financial repression and the falsification of financial asset prices, debt and equity capital has never been cheaper.

Accordingly, the $1.4 trillion corporate rate cut will not go into more jobs, more domestic investment or higher wages; it will overwhelmingly be returned to shareholders in the form of stock buybacks, higher dividends and leveraged recaps. That is, it will go to the 1% and the 10% who own most of the publicly traded equities in the US.

We will examine the GOP's phony "growth" and "dynamic scoring" story in greater depth in part 2. But the larger point here is straight forward: Why try to fool the middle class with a temporary tax cut?

That is, an unsustainable budgetary maneuver that is hostage to a growing fiscal crisis. Yet the GOP is wholly unwilling to confront the latter by reeling in a runaway Warfare State and $3 trillion per year of entitlements and other mandatory spending programs.

Worse still, why aggravate the central bank driven financial engineering spree in the C-suites via a deficit-financed increase in after-tax corporate cash flows that will yield little return in extra growth and revenue?

Neither of these actions would be justifiable under even ordinary circumstances. But in light of the double whammy of the aging baby boom and faltering economic growth induced by monetary central planning, these measures are especially egregious.

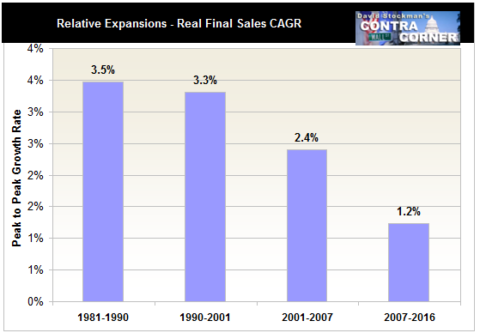

As we frequently point out, real final sales are a far better measure of economic growth than GDP because this metric excludes inventory fluctuations, which can distort the data at key turning points in the business cycle.

Moreover, it is self-evident that the business cycle has not been abolished by the Fed or anyone else. What counts, therefore, is the sustained growth rate over longer time frames during which the business cycle boom and bust periods are averaged together.

On that basis, the U.S. economy has hit the skids very badly---with the trend growth of final sales now at just one-third of its historic average.

Here's a news flash for the GOP. The above 36-year trend of stark deterioration in U.S. economic growth didn't happen because Federal taxes were rising relative to their historic moorings. As a matter of fact, Ronald Reagan inherited a budget with taxes at about 20% of GDP and under current law for FY 2018, the Federal tax take will amount to just 17.7%.

In Part 2 we will discuss the actual anti-growth skunk in the woodpile---which is the Bubble Finance policies of the Fed and the manner in which they have turned the C-suites of corporate American into anti-growth financial engineering operations. But for the moment the idea that the 1.2% real growth trend, which has been in place over the past decade, can somehow be tripled as claimed by White House needs to be recognized for what it is: pie-in-the-sky arm-waving that can't possibly result from the above described Senate tax bill.

Indeed, what the GOP is failing to reckon with in its misplaced confidence that the U.S. growth machine can be revved up at the wave of a tax plan is a hard stop economic reality lurking just around the corner. Namely, that we are now in a late stage business cycle expansion that is due for a recession.

Thus, when the Donald recently enthused that "I happen to be one that thinks we can go much higher than three percent. There's no reason why we shouldn’t. (Applause.)", we are quite sure that no one has ever shown him the chart below.

To wit, to have even a prayer of 3.0% real GDP growth over the next decade---to say nothing of "much higher" levels---the U.S. economy would have to go 207 months without a cyclical downturn. That's never happened in recorded history; it's 2X the longest expansion on record and nearly 3X the average expansion since 1950.

[image]https://davidstockmanscontracorner.com/wp-content/uploads/2017/04/Capture-48-480x292.png[/image]

The best way to visualize that crucial point about the cyclically adjusted long-term growth rate---that is, averaging the boom and bust years together---is via the contrafactual. The blue line in the graph below projects nominal GDP through 2027 based on the actual growth rate over 2006-2016---a period which averages in a full cycle of boom, bust and recovery.

By the terminal year for current budgeting purposes (2027), nominal GDP---which is what actually drives the Federal revenues and the deficit---would clock in at about $25.7 trillion. That compares to $19 trillion at present and amounts to a cut-and-paste replication of the last decade.

By contrast, if you were to overlay upon this actual 10-year trend a real GDP growth rate of 3.0% , which the White House and many Capitol Hill Republicans suggest is a "no sweat" proposition, you get the gray line. That's the annual sum of the 2% inflation rate, which the Fed is bound and determine to achieve one way or another, and the 3.0% real growth predicate.

The bottom line is $30 trillion of extra GDP over the coming decade or nearly 23% more than would be generated by the actual growth rate (blue line) during the last decade.

[image]https://davidstockmanscontracorner.com/wp-content/uploads/2017/06/Capture-35-480x453.png[/image]

(Note: the data in the box is unfortunately upside down. The 2006-2016 actual trend should be on the top line and the Trump forecast on the bottom).

Needless to say, there is no set of imaginable tax policies that can generate $30 trillion more of cumulative GDP over the next decade than would occur based on the actual expansion of the last decade. Moreover, that is especially not going to happen in the face of monetary policy normalization at the Fed and other central banks around the world, and even more especially not after the house of cards in the Red Ponzi eventually barfs all over the world economy.

As we have frequently argued, the actual problem is much more the composition of taxes in the U.S., not the absolute level. While lower taxes and smaller government are always preferable, the lesson of the last 35 years is that cutting nominal tax rates but not spending levels only results in an explosion of public debt. It also means, implicitly, that future and unborn taxpayers will bear the burden eventually.

In that context, we must insist once again that what is hammering jobs and take home pay in Flyover America is high and rising payroll taxes, not the corporate income tax. The fact is, very few U.S. corporations pay the statutory 35% rate, and the ones which do are essentially domestic operations like retailers, restaurant chains, wholesale distribution and warehousing operations etc. that have no jobs to bring back home anyway.

In fact, the effective corporate tax rate in the U.S. is about 20%, not 35% and has been declining for decades.

In part 2, we will demonstrate why any corporate rate reduction that is actually legislated---and we continue to doubt any tax bill at all can be enacted---will have virtually no impact on jobs. Under current Fed policy and the financial engineering it induces in the corporate C-suites, virtually all the tax savings will be flushed back into the casino as stock buybacks, LBOs and increased dividend payouts.