We end the year with a dump bump and the best analogy for US equity markets we could find all year... (Forward to 2:00)

https://www.youtube.com/watch?v=BB5LXF0c__g

Never Gets Old, sorry.

* * *

WORST SINCE 2008...

2015 ended with The S&P 500 (oops!), The Dow Industrials (weak), Dow Transports (monkey-hammered), and Small Caps (slammed) in the red, But Nasdaq well in the green...

Thanks to FANGs...

And not thanks to Energy stocks...

As Breadth collapsed...

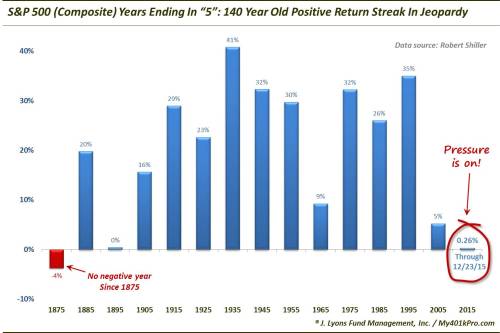

The 140 year streak is over - a year ending with "5" closed red for the S&P 500!!...

A year of living cognitively dissonant...

Gold, Oil, and The Dow all lower on the year for the first time since 1984...

1985 saw WTI rally 29%, Gold rally 14%, and Dow surge 30%

This was Apple's worst year since 2008 - down 4% (while Netflix gained 140%). This means the "no brainer" trade has made no money for investors since October 27th 2014...

Shares have shed about a fifth of their value since touching a high of $134.54 on April 28, and are down 17.5 percent since the inclusion of the stock in the Dow Jones industrial average in March. During its six-year run of gains, the stock has risen by at least 25 percent in five of those years.

Crude was the worst in 2015. The Dollar Index rose 9.2% and PMs dropped 10-11%. Bonds broadly speaking lost 4.3% as The Dow dropped around 2%...

Crude had its worst 2-year drop on record...

Leveraged Loans tumbled almost 3% YoY - the biggest drop since the financial crisis (and 2nd biggest drop on record). Lev100 is now at its lowest since August 2013...

* * *

Q4 was a big quarter for stocks... (except Trannies)

As they outperformed bonds (-2.5%), HY (+1.3%), and PMs (-5%)

* * *

On the day every effort was made to get The S&P 500 above 2058.90 and ensure a green close for the year...

But despite the best effort for a post-EU-close ramp, it failed...

As USDJPY was ramped (fail)

Crude was epically ramped (fail)

and VIX was crushed the moment Europe closed.. but it did not last and towards the end of the day VIX went bananas...

Shorts were instantly squeezed as soon as Europe closed... but that effort stalled once the S&P broke above breakeven for the year... and it was dumped into the close...

* * *

On the week, stocks were red as Santa's rally faded... with a very ugly close...

Futures show the peak right at the cash close on Tuesday...

Since The FOMC, everything is down...

Treasury yields rose on the week but rallied into the close today...

The Dollar Index ended the week around 1% higher driven by weakness in EUR and Swissy...

Commodities mostly dropped this week (though copper clung to short-squeeze gains)...

Charts: Bloomberg

Bonus Chart: Because Fun-Durr-Mentals...

Bonus Bonus Chart: Bad Breadth Breaking Bad-der...