Published

46 mins ago

on

July 7, 2025

| 8 views

-->

By

Jenna Ross

Graphics & Design

- Jennifer West

The following content is sponsored by Plasma

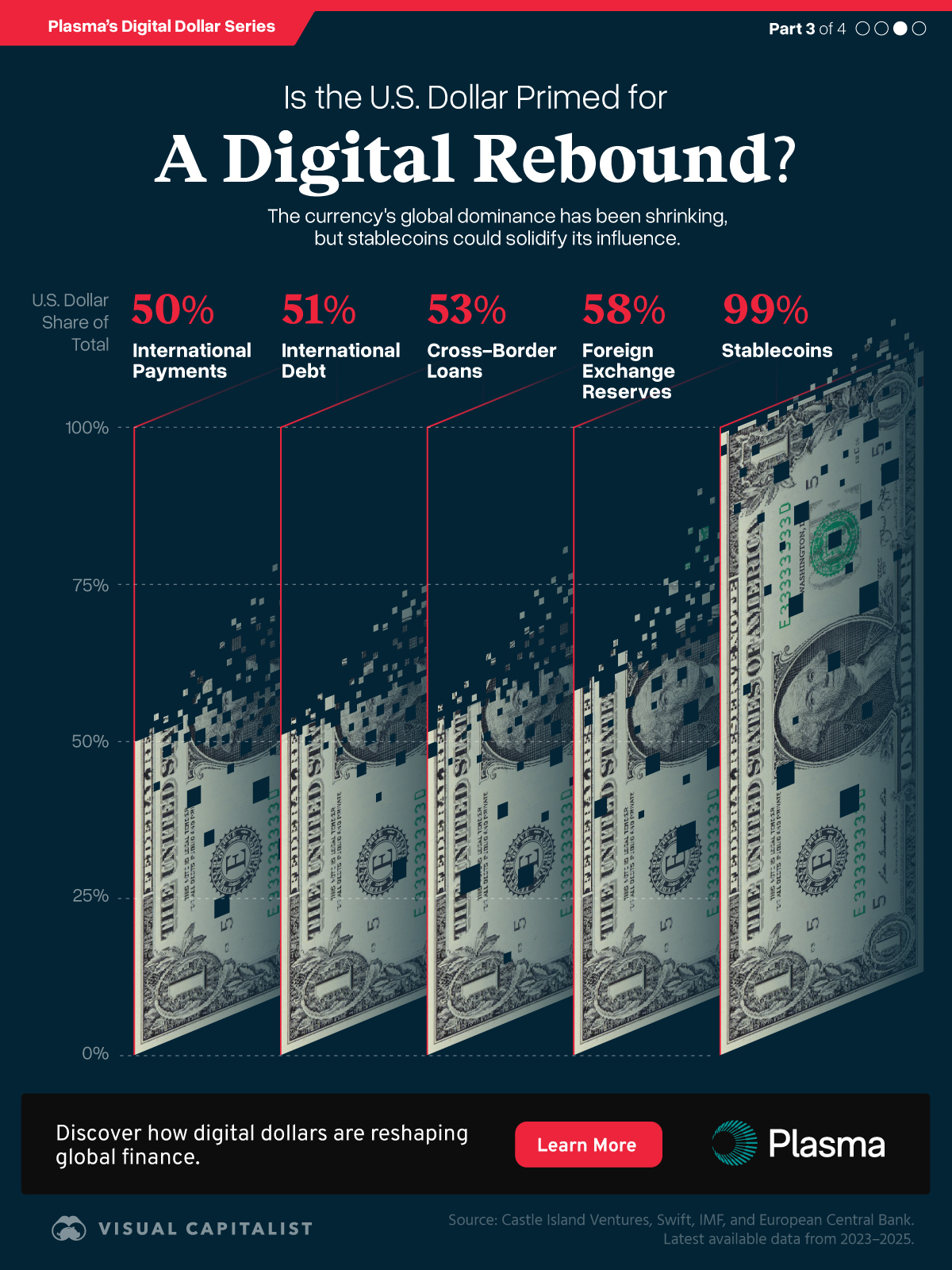

Is the U.S. Dollar Primed for a Digital Rebound?

Key Takeaways

- The dominance of the U.S. dollar has shrunk over time, with the currency making up 58% of foreign exchange reserves.

- However, 99% of stablecoins are pegged to the U.S. dollar.

After decades as the world’s unrivaled reserve currency, the U.S. dollar’s dominance is eroding in traditional financial systems. The U.S. dollar now accounts for 58% of foreign exchange reserves—its lowest share in decades.

Yet in the rapidly evolving digital economy, the dollar is staging a powerful resurgence. In this infographic, part three of the Digital Dollar Series created in partnership with Plasma, we explore how digital finance may be bolstering the greenback’s influence.

The U.S. Dollar on a Global Scale

As a share of global totals, the U.S. dollar’s prominence across five major financial indicators varies.

| Metric | U.S. Dollar Share of Global Total |

|---|---|

| International Payments | 50% |

| International Debt | 51% |

| Cross-Border Loans | 53% |

| Foreign Exchange Reserves | 58% |

| Stablecoins | 99% |

Source: Castle Island Ventures, Swift, IMF, and European Central Bank. Latest available data from 2022–2024.

In more traditional financial indicators, the greenback’s proportion is between 50% and 60% globally.

For instance, as a share of reserves, the dollar reached as high as 73% in 2001 before declining to the current 58%. According to the IMF, the dollar’s decline has been offset by increases in the shares of nontraditional reserve currencies. For instance, shares of the Australian dollar, Canadian dollar, and Chinese renminbi have increased. These currencies help reserve managers diversify and offer relatively attractive yields.

The Chinese renminbi has been climbing as the country moves away from American currency in cross-border payments and pilots its own central bank digital currency.

Digital Finance: The Dollar’s Next Chapter

Despite some signs of de-dollarization in traditional finance, the digital realm tells a different story. A striking 99% of all stablecoins are pegged to the U.S. dollar, underscoring its pivotal role in crypto-based finance.

As stablecoin supply surges, issuers need to back up their coins by buying Treasuries or other liquid assets. This drives significant demand for the dollar. Notably, stablecoin issuers collectively rank among the top 20 holders of U.S. government debt.

With financial systems evolving, stablecoins are positioned to reinforce the dollar’s global dominance.

Discover how Plasma is building the future of stablecoin transactions—making them cheaper and faster than ever before.

More from Plasma

-

Money1 week ago

Ranked: The Biggest Currency Drops So Far in 2025

In the first half of 2025, one currency dropped over 50% against the U.S. dollar. What led to the decline?

-

Technology1 month ago

Ranked: Countries With the Highest Remittance Costs

To send money across borders, workers can be charged high remittance fees—over 50% of the amount transferred in some cases.

Subscribe

Please enable JavaScript in your browser to complete this form.Join the 375,000+ subscribers who receive our daily email *Sign Up