Published

1 hour ago

on

August 31, 2023

| 51 views

-->

By

Rida Khan

Graphics & Design

- Zack Aboulazm

The following content is sponsored by Roundhill Investments

The Video Game Industry: Insights for Investors

Newzoo indicates that 79% of the total online population engages with video games. However, even those who don’t play can benefit from investment opportunities in this thriving industry.

This infographic, sponsored by Roundhill Investments, delves into the growth of the gaming industry and related financial opportunities.

Video Gamers, by Region

Video gaming platforms were home to 3.2 billion gamers around the world in 2022, and the number is projected to reach 3.5 billion by 2025, according to Newzoo.

However, this growth varies across regions.

| Region | Number of gamers (2022) | Year-on-year growth (2021-2022) |

|---|---|---|

| Asia-Pacific | 1746M | 4.2% |

| Middle East & Africa | 488M | 8.2% |

| Europe | 430M | 3.4% |

| Latin America | 315M | 4.8% |

| North America | 219M | 2.6% |

Also, due to ease of access and low barriers to entry, mobile gaming is the most popular segment, generating almost three-quarters of the revenue.

Video Gaming Industry, by Revenue

The inherent resilience of the gaming industry was evident during the COVID-19 recession.

During that period, the launch of many eagerly awaited games experienced delays, and many of those are now being released in 2023 and 2024.

Consequently, these years are poised to be the industry’s best yet. According to PwC, it is projected to generate $257B in 2023, and at a CAGR of 8.4%, it will cross $320B by 2026.

Exploring Investment Opportunities

In the video gaming industry’s dynamic landscape, investors can gain from investing in the industry’s major players. Here are some prominent ones to be aware of across certain gaming sectors.

- Gaming software companies: Electronic Arts, Ubisoft, and Take-Two Interactive.

- Integrated gaming hardware & software companies: Nintendo and CD Projekt.

- Mobile gaming companies: Kakao Games, NetMarble, and Rovio.

- Gaming infrastructure & platform companies: Unity, Roblox, and AppLovin.

Roundhill Investment’s video gaming ETF makes it easy for investors to get exposure to many leading video game companies and AAA game publishers worldwide, including the ones listed above.

Overall, given the expansive and varied demographic, coupled with minimal entry barriers and swift innovation, the video games market is considered hold a lot of potential for investors over the coming years.

Invest in the video games ETF: $NERD today.

Please enable JavaScript in your browser to complete this form.Enjoying the data visualization above? *Subscribe

Related Topics: #top video games #video gaming #Roundhill #Roundhill Investments #gamers #etf #Gaming Companies #investors #video games #global markets

Click for Comments

var disqus_shortname = "visualcapitalist.disqus.com";

var disqus_title = "The Video Game Industry: Insights for Investors";

var disqus_url = "https://www.visualcapitalist.com/sp/video-games-industry-for-investors/";

var disqus_identifier = "visualcapitalist.disqus.com-160687";

You may also like

-

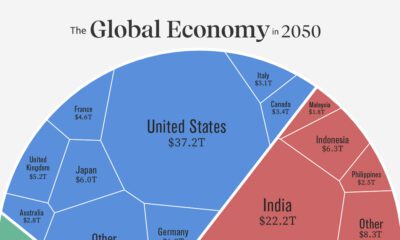

Economy1 week ago

Visualizing the Future Global Economy by GDP in 2050

Asia is expected to represent the world’s largest share of real GDP in 2050. See how this all breaks down in one chart.

-

Markets1 week ago

Visualized: U.S. Corporate Bankruptcies On the Rise

In 2023, over 400 companies have folded. This graphic shows how corporate bankruptcies are growing at the second-fastest rate since 2010.

-

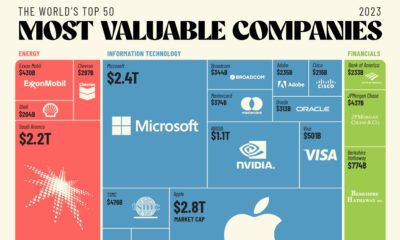

Markets2 weeks ago

The 50 Most Valuable Companies in the World in 2023

The world’s 50 most valuable companies represent over $25 trillion in market cap. We break this massive figure down by company and sector.

-

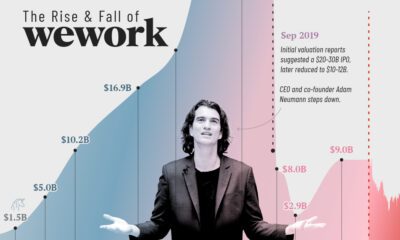

Stocks2 weeks ago

Charted: The Rise and Fall of WeWork

At the height of its success, WeWork was valued at $47 billion. Four years later, WeWork is worth a fraction of the total. What happened?

-

shipping2 weeks ago

Visualized: Which Airports Move the Most Cargo?

Cargo that moves through airports represents the value of around 35% of world trade. These hubs move the most cargo globally.

-

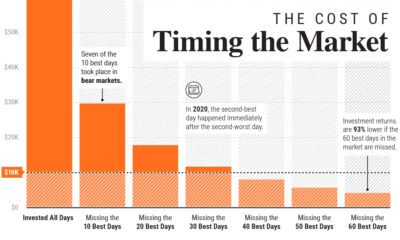

Markets2 weeks ago

Timing the Market: Why It’s So Hard, in One Chart

In this graphic, we show why timing the market is extremely difficult, and how it can meaningfully dent portfolio returns.

Subscribe

Please enable JavaScript in your browser to complete this form.Join the 375,000+ subscribers who receive our daily email *Sign Up

The post The Video Game Industry: Insights for Investors appeared first on Visual Capitalist.