Interest Rate Projections for Advanced Economies

While U.S. inflation cooled in the second half of last year, price pressures returned in 2024, leading investors to rethink how soon central bankers will cut rates.

Despite the recent increase, the interest rate forecast for many economies looks optimistic, thanks to subdued energy price shocks and abating supply chain disruptions. Still, short-term risks remain, including persistently high services inflation clouding the outlook.

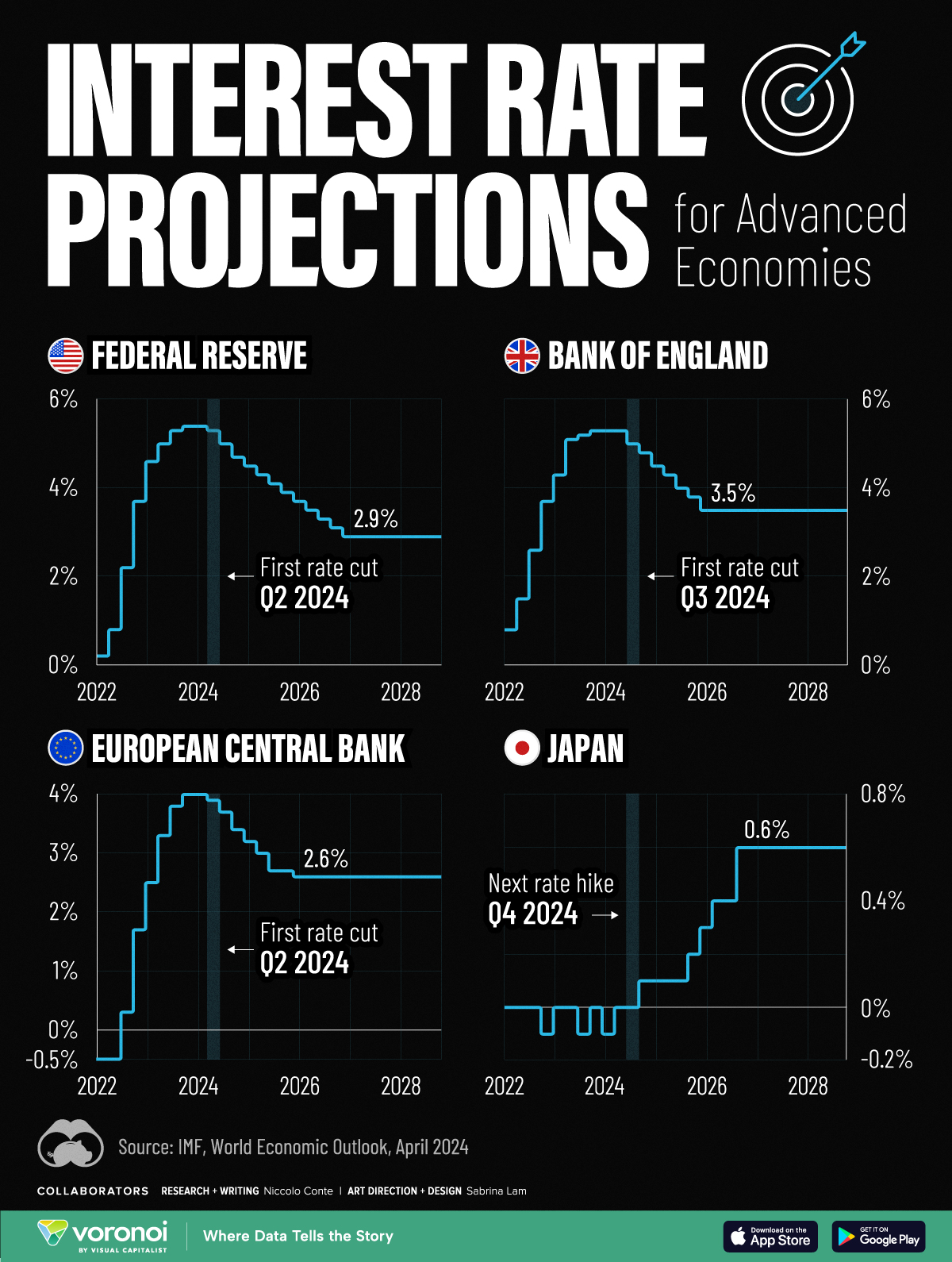

This graphic shows the interest rate forecast for advanced economies, based on the International Monetary Fund’s (IMF) 2024 World Economic Outlook.

Get the Key Insights of the IMF’s World Economic Outlook

Want a visual breakdown of the insights from the IMF’s 2024 World Economic Outlook report?

This visual is part of a special dispatch of the key takeaways exclusively for VC+ members.

Get the full dispatch of charts by signing up to VC+.

A Closer Look at the IMF Interest Rate Forecast

Below, we show the projected path of interest rates based on the IMF’s latest data:

| Federal Reserve | Bank of England | ECB | Bank of Japan | |

|---|---|---|---|---|

| Q1 2024 | 5.4% | 4.0% | -0.1% | 5.3% |

| Q2 2024 | 5.3% | 3.9% | 0.0% | 5.3% |

| Q3 2024 | 5.0% | 3.7% | 0.0% | 5.0% |

| Q4 2024 | 4.7% | 3.4% | 0.1% | 4.8% |

| Q1 2025 | 4.5% | 3.2% | 0.1% | 4.5% |

| Q2 2025 | 4.3% | 3.0% | 0.1% | 4.3% |

| Q3 2025 | 4.1% | 2.7% | 0.1% | 4.0% |

| Q4 2025 | 3.9% | 2.7% | 0.2% | 3.8% |

| Q1 2026 | 3.7% | 2.6% | 0.3% | 3.5% |

| Q2 2026 | 3.5% | 2.6% | 0.4% | 3.5% |

| Q3 2026 | 3.3% | 2.6% | 0.4% | 3.5% |

| Q4 2026 | 3.1% | 2.6% | 0.6% | 3.5% |

| Q1 2027 | 2.9% | 2.6% | 0.6% | 3.5% |

| Q2 2027 | 2.9% | 2.6% | 0.6% | 3.5% |

| Q3 2027 | 2.9% | 2.6% | 0.6% | 3.5% |

| Q4 2027 | 2.9% | 2.6% | 0.6% | 3.5% |

| Q1 2028 | 2.9% | 2.6% | 0.6% | 3.5% |

| Q2 2028 | 2.9% | 2.6% | 0.6% | 3.5% |

| Q3 2028 | 2.9% | 2.6% | 0.6% | 3.5% |

| Q4 2028 | 2.9% | 2.6% | 0.6% | 3.5% |

As we can see, the U.S. is forecast to see its first rate cut in the second quarter of 2024.

Broadly speaking, rates will be cut very gradually, with two additional rate cuts anticipated for this year. By 2027, interest rates are projected to fall to 2.9% after a series of moderate rate cuts as inflation dissipates.

Like the U.S., the European Central Bank is forecast to cut rates in the second quarter of 2024, with rates set to fall to 2.6% by 2026. While inflation has cooled at a faster rate across Europe compared to the U.S., GDP growth is also projected to be more muted. This year, the IMF projects that GDP across the euro area will increase just 0.8% versus 2.7% for the U.S. economy.

In the UK, monetary easing is projected to move more gradually, with the first cut projected for the third quarter of this year. Growth across the UK economy is projected to be tepid for 2024, weighed down by the impact of higher rates, lower productivity, and sluggish investment growth.

Rates Rising Slowly in Japan

After years of enduring negative interest rates, Japan raised its short-term policy rate to 0.0-0.1% in March 2024.

This was due in part to a promising inflation outlook over the coming years. The IMF projects that the next rate hike will take place in the fourth quarter of 2024, as it moves away from a multi-decade battle with deflation.

Get the Full Analysis of the IMF’s Outlook on VC+

This visual is part of an exclusive special dispatch for VC+ members which breaks down the key takeaways from the IMF’s 2024 World Economic Outlook.

For the full set of charts and analysis, sign up for VC+.

The post Visualized: Interest Rate Forecasts for Advanced Economies appeared first on Visual Capitalist.