![]()

See this visualization first on the Voronoi app.

Visualizing the Green Investments of Sovereign Wealth Funds

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

With $11.2 trillion in assets, sovereign wealth funds are increasingly looking to sustainable investments as the energy transition gains greater traction.

Sovereign wealth funds are government-run pools of capital typically derived from surplus reserves or revenues from commodity exports. While investment in green assets have risen significantly in recent years, they still make up a small share of overall fund assets, covering less than 1% of the total.

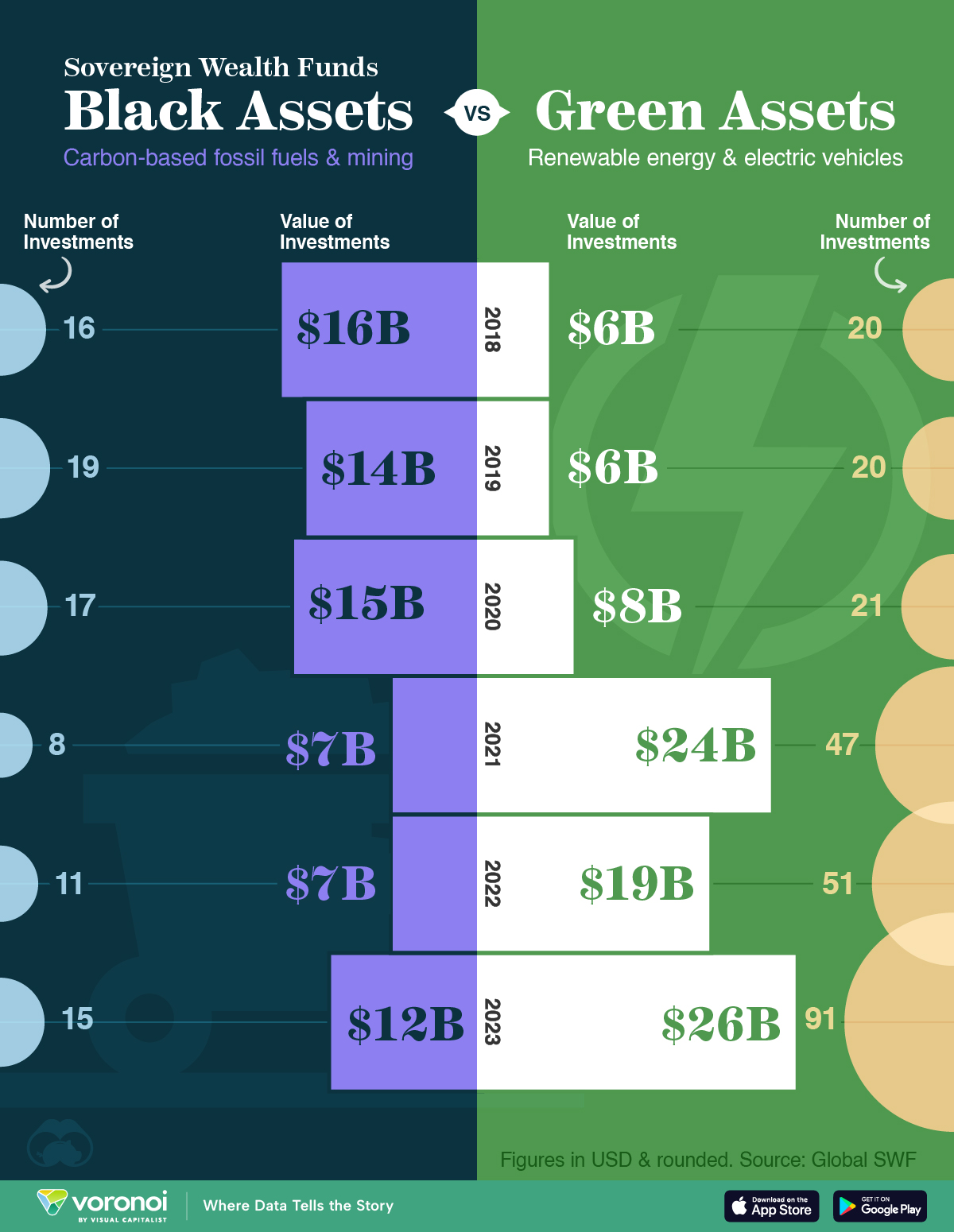

This graphic compares the investment in green and black assets across sovereign wealth funds, based on data from Global SWF.

Green Assets Outpace Black Assets

In 2023, sovereign wealth funds held $26 billion in green investments—surpassing black investments by more than double.

While green assets include investments in renewable energy and electric vehicles, black assets are seen across fossil fuels and finite resources. Below, we show the growth in green investments in these funds since 2018:

| Year | Black AssetsValue of Investments | Black Assets# of Investments | Green AssetsValue of Investments | Green Assets# of Investments |

|---|---|---|---|---|

| 2023 | $12B | 15 | $26B | 91 |

| 2022 | $7B | 11 | $19B | 51 |

| 2021 | $7B | 8 | $24B | 47 |

| 2020 | $15B | 17 | $8B | 21 |

| 2019 | $14B | 19 | $6B | 20 |

| 2018 | $16B | 16 | $6B | 20 |

Nearly half of green assets were held by Gulf funds who are channeling energy revenues into sustainable investments.

For instance, a major UAE fund has stakes in India-based Tata Power Renewables, an offshore wind company based in Germany, and a U.S residential solar firm. Meanwhile, Saudi Arabia’s fund has a 44% stake in the utility firm ACWA Power which is working to increase its hydrogen capacity.

Along with this, Singapore’s fund is making key investments in sustainable assets. In 2022, it created a $5 billion investment arm focused on decarbonizing the global economy.

The government of New Zealand, which runs another leading fund investing in renewables, partnered with BlackRock in 2023 to launch a $1.2 billion fund focused on climate infrastructure. The fund is intended to accelerate the country’s decarbonization efforts as it aims to become among the first countries to have renewables powering 100% of its electricity system.

The post Visualizing the Green Investments of Sovereign Wealth Funds appeared first on Visual Capitalist.