![]()

See this visualization first on the Voronoi app.

Use This Visualization

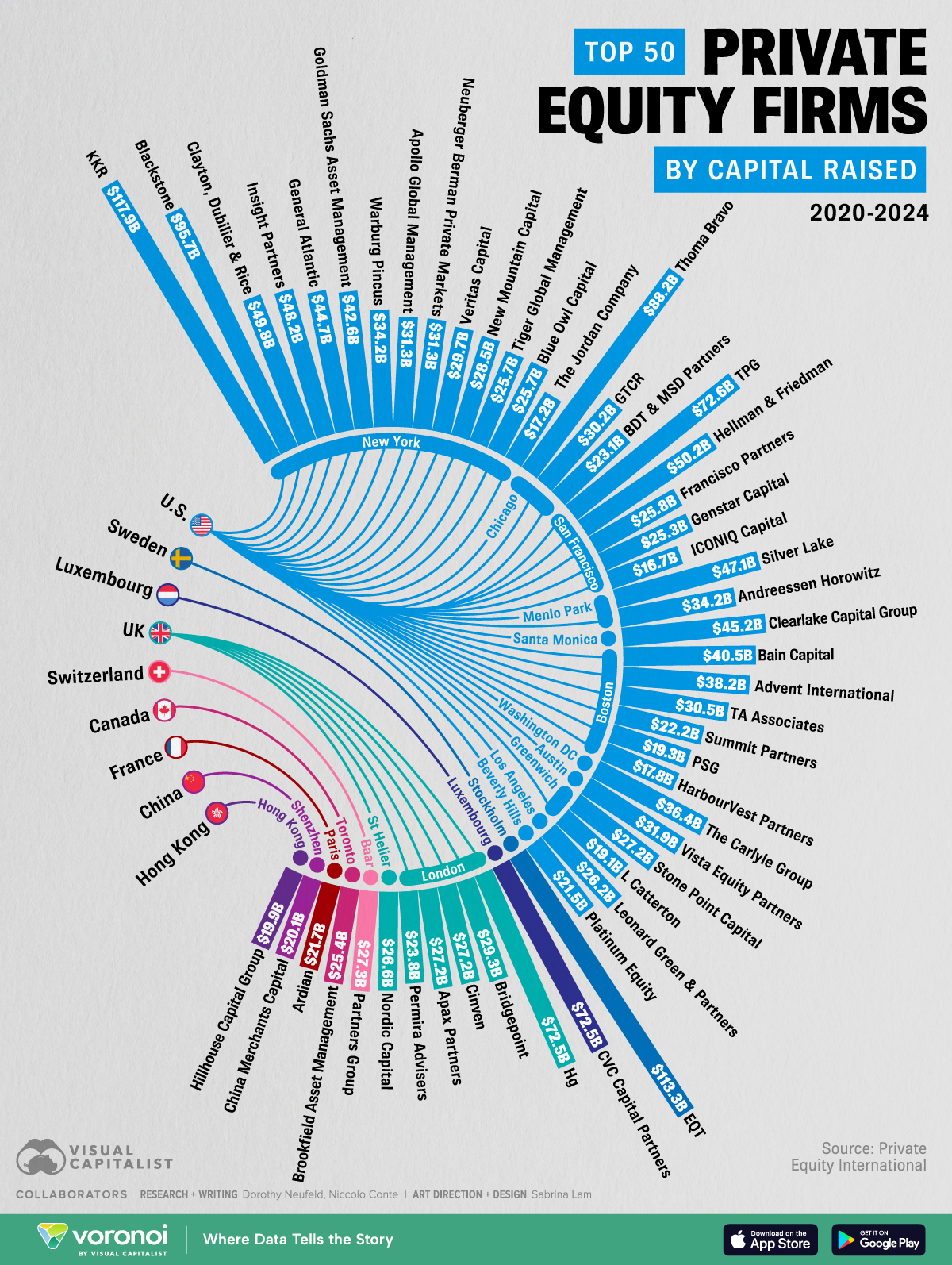

Visualizing the World’s Top 50 Private Equity Firms in 2025

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

Key Takeaways

- New York-based KKR takes top spot in the PEI 300 rankings by Private Equity International, raising $117.9 billion over the past five years.

- Following next in line is mega-fund EQT, the largest private equity (PE) firm in Europe.

- Falling to third place is Blackstone, which recently invested $300 million into AI platform DDN, whose customers include Elon Musk’s xAI.

In the last five years, the top 300 private equity (PE) firms raised $3.3 trillion—up just 0.4% from last year’s total.

Overall, PE fundraising has slumped in recent years, with many expecting the trend to continue in 2025. At the same time, the industry is getting increasingly divided—with the six largest players raising 60% of total funds in the first nine months of 2024.

This graphic shows the top 50 PE firms globally, based on data from Private Equity International.

Ranked: The Global Leaders in Private Equity

Below, we show the biggest PE firms by capital raised between 2020 and 2024:

| Ranking | Name | City | Capital Raised 2020-2024 (B) |

|---|---|---|---|

| 1 | KKR | New York | $117.9 |

| 2 | EQT | Stockholm | $113.3 |

| 3 | Blackstone | New York | $95.7 |

| 4 | Thoma Bravo | Chicago | $88.2 |

| 5 | TPG | San Francisco | $72.6 |

| 6 | CVC Capital Partners | Luxembourg | $72.5 |

| 7 | Hg | London | $72.5 |

| 8 | Hellman & Friedman | San Francisco | $50.2 |

| 9 | Clayton, Dubilier & Rice | New York | $49.8 |

| 10 | Insight Partners | New York | $48.2 |

| 11 | Silver Lake | Menlo Park | $47.1 |

| 12 | Clearlake Capital Group | Santa Monica | $45.2 |

| 13 | General Atlantic | New York | $44.7 |

| 14 | Goldman Sachs Asset Management | New York | $42.6 |

| 15 | Bain Capital | Boston | $40.5 |

| 16 | Advent International | Boston | $38.2 |

| 17 | The Carlyle Group | Washington DC | $36.4 |

| 18 | Warburg Pincus | New York | $34.2 |

| 19 | Andreessen Horowitz | Menlo Park | $34.2 |

| 20 | Vista Equity Partners | Austin | $31.9 |

| 21 | Apollo Global Management | New York | $31.3 |

| 22 | Neuberger Berman Private Markets | New York | $31.3 |

| 23 | TA Associates | Boston | $30.5 |

| 24 | GTCR | Chicago | $30.2 |

| 25 | Veritas Capital | New York | $29.7 |

| 26 | Bridgepoint | London | $29.3 |

| 27 | New Mountain Capital | New York | $28.5 |

| 28 | Partners Group | Baar | $27.3 |

| 29 | Cinven | London | $27.2 |

| 30 | Apax Partners | London | $27.2 |

| 31 | Stone Point Capital | Greenwich | $27.2 |

| 32 | Nordic Capital | St Helier | $26.6 |

| 33 | Leonard Green & Partners | Los Angeles | $26.2 |

| 34 | Francisco Partners | San Francisco | $25.8 |

| 35 | Tiger Global Management | New York | $25.7 |

| 36 | Blue Owl Capital | New York | $25.7 |

| 37 | Brookfield Asset Management | Toronto | $25.4 |

| 38 | Genstar Capital | San Francisco | $25.3 |

| 39 | Permira Advisers | London | $23.8 |

| 40 | BDT & MSD Partners | Chicago | $23.1 |

| 41 | Summit Partners | Boston | $22.2 |

| 42 | Ardian | Paris | $21.7 |

| 43 | Platinum Equity | Beverly Hills | $21.5 |

| 44 | China Merchants Capital | Shenzhen | $20.1 |

| 45 | Hillhouse Capital Group | Hong Kong | $19.9 |

| 46 | PSG | Boston | $19.3 |

| 47 | L Catterton | Greenwich | $19.1 |

| 48 | HarbourVest Partners | Boston | $17.8 |

| 49 | The Jordan Company | New York | $17.2 |

| 50 | ICONIQ Capital | San Francisco | $16.7 |

With $117.9 billion raised, PE giant KKR leads the rankings, driven by its focus on opportunities in North America and Asia.

Most recently, the firm acquired a 12% stake in medical supply company Henry Schein, while working with the company to consider an employee-ownership model. With 284 portfolio companies, KKR manages $620 billion in assets overall.

Ranking in second is Swedish buyout firm EQT, raising $113.3 billion in the past five years. In 2024, fund exits surged by 72% in a record-breaking year. With IPOs covering skincare firm Golderma to exits for data center provider EdgeConneX, EQT saw the highest fund exits globally.

Meanwhile, Blackstone, one of the largest owners of commercial property worldwide, fell from first to third place with $95.7 billion in capital raised.

Learn More on the Voronoi App ![]()

To learn more about this topic from a geographical perspective, check out this graphic on the top PE firms by country.