With a new administration coming into office in 2017, it might be useful to examine what potential policies will be enacted that may have an impact on housing. The market responded to the election results as if it were a Black Swan event. Most of the comments preceding the election almost assumed it was a foregone conclusion that Hillary Clinton was going to be the next President. Clearly that was not the case. The bond markets had an immediate sizable reaction. We still don’t have the full details on how things will change but there are some changes planned that may have an impact on housing. It is hard to see how rental Armageddon changes because of this. The overall challenges for housing will continue to persist and the Taco Tuesday crowd will continue to imagine that any move is good for housing. So what does a Trump administration mean for housing?

The impact on deductions

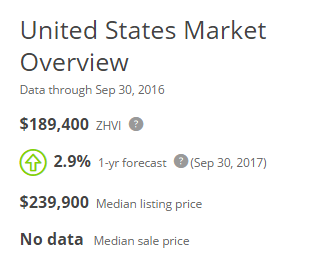

One major benefits of buying a home that is championed by the entire house humping crowd is in regards to the deduction you can take. In particular, the focus is usually around the mortgage interest deduction. While this does help, it is usually oversold since the standard deduction is already $12,600 for married couples. The typical US home is valued at around $189,400:

So assume someone bought the typical home with a 20 percent down payment. That means they can write off roughly $5,732 in mortgage interest for the first year (well below the standard deduction). This benefit dwindles as each year passes as more money goes to pay off principal. The mortgage interest deduction rarely helps the middle class but definitely helps wealthier buyers. However, the Trump tax plan will cut into this benefit:

[image]https://www.doctorhousingbubble.com/wp-content/uploads/2016/11/standard-deduction.png[/image]

The tax proposal seeks to raise the standard deduction for married couples up to $30,000 and $15,000 for singles. Many that are buying in more expensive areas are couples, at least based on sales data. Even if you buy a $700,000 crap shack with 20 percent down, the annual mortgage interest comes nowhere close to the new standard deduction whereas today, it does make an impact.

If the tax plan takes effect, this will largely negate the mortgage interest benefit in many overpriced metro areas that is usually pitched by housing cheer leaders. As we noted, the typical US home costs around $200,000 so what you have currently is lower priced states basically subsidizing the mortgage interest deduction for wealthier coastal regions. That may change.

Mortgage rates

Mortgages rates are reacting to the big change in the bond market recently:

“(WSJ) The ultimate problem is the impact of rising rates on home values,” said Stu Feldstein, president at SMR Research Corp., a mortgage-research firm. “We’re back into a bubble condition in part because of low rates that have enabled people to buy houses much more expensive than their incomes could afford.”

He said his firm expects that by the end of 2017 rising rates will have contributed to home values declining in about one-third of the U.S.”

[image]https://www.doctorhousingbubble.com/wp-content/uploads/2016/11/10-year.png[/image]

The market reacted quickly here pushing mortgage interest rates up. This reaction comes from the expectation of inflation (not necessarily in housing) but also the new administration’s view of the Fed:

September 26, 2016

“(WSJ) Mr. Trump has taken aim at the Fed on several occasions recently, accusing Ms. Yellen of creating a “false economy” by keeping interest rates low to help President Barack Obama.

He also has praised Ms. Yellen, saying just four months ago that he had “great respect” for her and he warned that raising rates “would be a disaster.”

So we’re in a bubble because of low interest rates and raising rates would be a disaster. A Catch 22. The markets are reacting assuming that rates are going to rise one way or another.

“(Forbes) More than $1 trillion was wiped off the value of bonds around the world this week as U.S. President-elect Donald Trump’s policies are seen boosting spending and quickening inflation.

“We do view the election of Donald Trump as a game changer,” said Adam Donaldson, head of debt research at Sydney-based Commonwealth Bank of Australia. “The strong bias toward fiscal expansion and inflationary policy represents a stark change to the malaise of recent years. This opens the door for the Fed to hike in December, but also more quickly in 2017 and 2018 than previously expected.”

Much of this reaction is based on big spending plans on infrastructure and tax breaks. While this can be viewed as good for the overall economy, this actually stops the fuel going into the current housing run, that of low interest rates and a Fed that won’t “rock the boat” – if this election taught us anything is that things are going to get shaken up.

Many comments before the election assumed Clinton was going to win and were saying that nothing would change since the policies would simply be an extension of the Obama administration. And this was spun as good for inflated housing values. Yet now, they are spinning higher inflation as good for housing assuming the new incoming administration is highly focused on keeping crap shack values inflated.

What is clear is that you should gear up to expect the unexpected. And most people expect housing values will only continue to go up.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.