![]()

See this visualization first on the Voronoi app.

Where Does Palantir’s Revenue Come From?

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data‑driven charts from a variety of trusted sources.

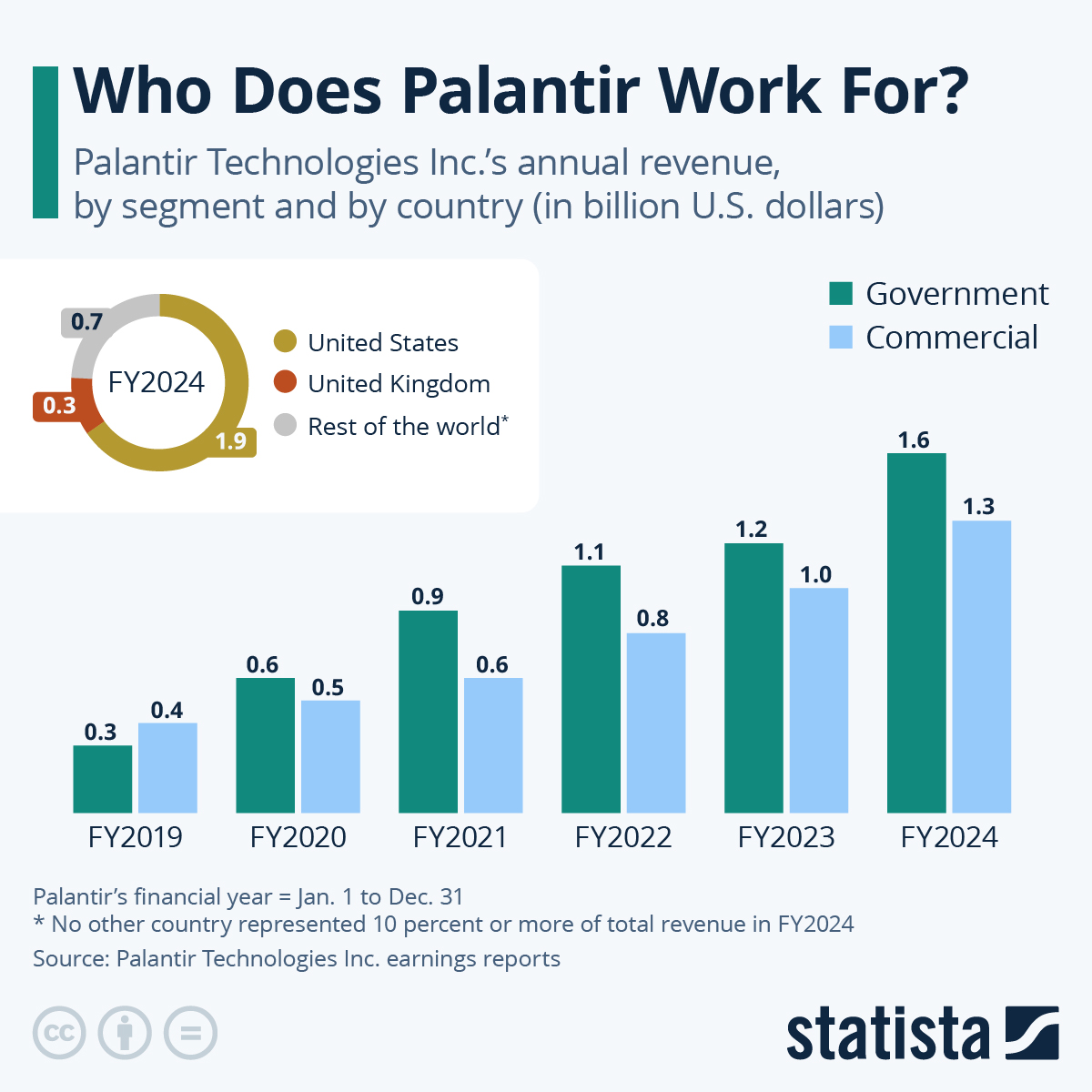

- 55% of FY 2024 revenue came from government clients, underscoring Palantir’s deep ties to defense, intelligence, and law‑enforcement agencies.

- Combined revenue jumped from $0.7B in FY 2019 to $2.9B in FY 2024, riding the wave of AI‑powered data analytics adoption.

- U.S. heavy: Two‑thirds of sales came from American clients, with just $1.0B spread across the rest of the world.

Palantir Technologies began as a clandestine data‑crunching outfit for U.S. intelligence agencies. Two decades later it is a publicly traded enterprise positioning its Gotham and Foundry platforms as mission‑critical operating systems for both armies and asset managers alike. The chart above, created by Statista, shows where the money is coming from.

Palantir annual revenue by customer segment, FY 2019‑24

| Financial Year | Government Revenue (Billion USD) | Commercial Revenue (Billion USD) |

|---|---|---|

| FY2019 | 0.3 | 0.4 |

| FY2020 | 0.6 | 0.5 |

| FY2021 | 0.9 | 0.6 |

| FY2022 | 1.1 | 0.8 |

| FY2023 | 1.2 | 1.0 |

| FY2024 | 1.6 | 1.3 |

Despite rapid commercial uptake, the most obvious takeaway is that government dollars remain Palantir’s lifeblood—and that those dollars are overwhelmingly American.

From Skunk‑Works Project to Wall Street Fixture

Palantir’s top line has expanded every single year since its FY 2019 public filing.

AI tailwinds, a swelling backlog of defense work, and rising enterprise demand for predictive analytics pushed revenue past the $2 billion mark in 2023 and to $2.9 billion last year. That’s a compound annual growth rate north of 30%, helping the company’s share price outpace the broader market in 2025 so far.

The Government Footprint Keeps Expanding

Military and law enforcement agencies continue to bankroll Palantir’s ambitions. Gotham—the platform custom‑built for operations ranging from battlefield logistics to border security—has become embedded in the U.S. defense ecosystem. It’s little surprise Palantir rubs shoulders with America’s largest defense contractors.

Critics, however, question the opacity of such projects and the ethical implications of using big‑data surveillance in conflict zones.

Commercial Wins Gather Steam

Foundry, Apollo, and the freshly launched Artificial Intelligence Platform (AIP) are gaining traction in healthcare, manufacturing, and finance.

Commercial revenue climbed to $1.3 billion in FY 2024—up 65% since 2021—as blue‑chip customers look to streamline supply chains and wring insights from sprawling data sets. Still, governments wrote the bigger check, underscoring the durability of Palantir’s public‑sector moat.

U.S.–Centric, but Globalizing

A glance at FY 2024 geography shows $1.9 billion in revenue originating in the United States, versus $0.3 billion from the UK and $0.7 billion from the rest of the world. International expansion remains a priority, yet local regulatory hurdles and entrenched competitors mean growth abroad may come in fits and starts.

Learn More on the Voronoi App

Explore how Palantir’s surging top line is translating into market performance in “Palantir Stock Price Nearly Doubles in First Half of 2025.”