By Chris at www.CapitalistExploits.at

I was recently sent a research piece by one of my LPs.

The piece was from the principal of a well known hedge fund and this particular manager has grave concerns for the US stock market. In the article to clients he laid out all the reasons why fundamentally none of it makes much sense. I can't and won't disagree with the primary analysis.

He's not the only one.

Many of my friends and colleagues in this industry are saying similar things. In fact, quite a few of my friends and LP's have asked, "Why are you not short?"

A very good question I'll try explain by way of "Bucket Economics" (trademarked). Distinctly different to "Fu**it Economics", which is what you get when you get it all wrong.

Reasons to Be Bearish the US Equity Market

https://twitter.com/jtepper2/status/828599652694032385

Geez...

And this from John Hussman at Hussman Funds:

https://twitter.com/hussmanjp/status/825752513508958208

These are all sharp smart investors and I've taken just two as a sampling, and they're clearly bearish.

While this is taking place in the land of apple pie across the pond we have...

A Spanner in the Works

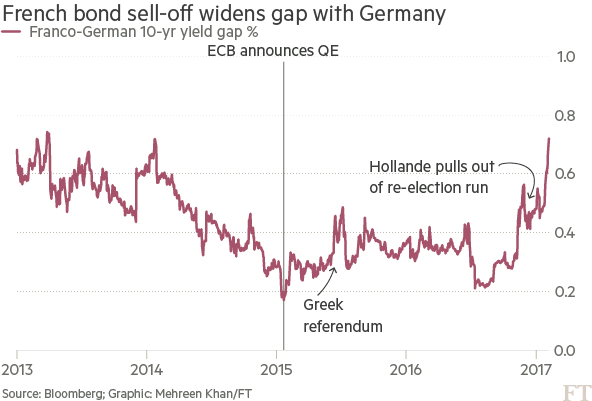

Here we see France's risk premium rising. Franco-German bond spreads blow out as the market attempts to come to terms when Le Pen unveiled her party's manifesto (see my article earlier this week on this very topic).

I've written about the problems in Europe till my fingers bleed so I'll not be revisiting it now. Curious or forgetful readers can simply scour the site.

Europe has some serious issues in front of them, not least of which is how the euro breaks up and the multiple ramifications both socially and economically. Not to mention how the bureaucrats in Brussels are going to deal with member states refusing to pay debts.

In a nutshell, Europe looks a lot worse than the US right now. A LOT worse.

Ok, so now let me throw out why I'm unprepared to short the US stock market.

Here's how I think about it.

Capital typically has 3 places to live.

Think of these as investment buckets, where you will keep your investments in the most favourable bucket or buckets at any one time.

In a stable goldilocks economy where inflation is neither to high nor too low, where debt is low and manageable, and where faith in currency is not in question we could argue that investors would be OK with the above setup (not trying to be too fancy - bear with me).

What about when inflation is rising sharply? How do investors re-allocate?

Simplistically, like this:

How about a strong deflationary environment?

Simplistically like this:

Now, let me ask you to consider that as investors we have the entire world in front of us into which we can allocate our investment capital.

One thing I've learned over the last 20 odd years in finance is that capital flows are extremely important and have become increasingly important as globalisation has taken hold. As such, it's not just equities but equities in what country. Ditto bonds and currencies.

The ease and speed with which we can allocate capital not only into multiple sectors, but into multiple currencies and indeed countries means that not only do the above buckets apply to the 3 categories listed but they apply to countries and currencies of countries. So cash, for example, can be USD, JPY, EUR, RUB, CNY, and a whole range of others, or a basket of them.

So I want to ask you a question:

When allocating capital, imagine for a minute you're managing a few billion dollars (as I know some of you are). Now let me ask you where you're going to allocate looking out over the next couple of years?

- Europe? Looks to be on the precipice and uncertainty is rising, not falling

- Emerging markets? Lost $60 billion in December and are typically considered more of a "risk on" trade

- The US?

A blow up in Europe, which looks more and more inevitable with each passing day, will see capital flee to the land of warm apple pie.

This will have to go somewhere, and so much of it will go into treasuries causing the dollar to strengthen and stoke inflationary fears.

Much will head into equities too.

This too will stoke fears of inflation and the clowns Fed who are way behind the curve already will scurry to catch up, raising rates. Ironically, raising rates will further exacerbate the spreads between US and non-US paper causing more capital to head to the US, creating a self perpetuating cycle.

This will actually be highly contractionary for the global economy as it will cause further dollar funding shortages (read my piece on the eurodollar market for more on this topic).

As the rest of the world contracts, the US will seemingly appear to be the only safe place to park capital. More self perpetuating capital influx.

Note that this capital flowing into the US will have nothing to do with US corporate profits and none of this will really have anything to do with policies enacted by the Trump administration (though you can bet your bottom dollar Trump will be sure to take credit for it, misunderstanding what is actually taking place and why).

Aaaand so....

Is the US equity market overvalued? Yes!

Do I want to be short the US equity market? No!

There are many pieces to this puzzle and I don't pretend to know them all or how they will interact with one another.

What I do know is that global capital flows often overwhelm any "fundamental valuations" (I never used to think like this as for years I was firmly in the fundamental value camp).

I also know is that globally we've never before been so inter-connected than we are today.

Furthermore, I do believe that we're rapidly running out of road down which the can will been kicked. Europe first and the consequences of that favour Trumplandia.

- Chris

"There is only one difference between a bad economist and a good one: the bad economist confines himself to the visible effect; the good economist takes into account both the effect that can be seen and those effects that must be foreseen." — Frederic Bastiat

--------------------------------------

Liked this article? Don't miss our future missives and podcasts, and

get access to free subscriber-only content here.

--------------------------------------