Submitted by Gail Tverberg via Our Finite World blog,

Back in 1776, Adam Smith talked about the “invisible hand” of the economy. Investopedia explains how the invisible hand works as, “In a free market economy, self-interested individuals operate through a system of mutual interdependence to promote the general benefit of society at large.”

We talk and act today as if governments and economic policy are what make the economy behave as it does. Unfortunately, Adam Smith was right; there is an invisible hand guiding the economy. Today we know that there is a physics reason for why the economy acts as it does: the economy is a dissipative structure–something we will talk more about later. First, let’s talk about how the economy really operates.

Our Economy Is Like a Self-Driving Car: Wages of Non-Elite Workers Are the Engine

Workers make goods and provide services. Non-elite workers–that is, workers without advanced education or supervisory responsibilities–play a special role, because there are so many of them. The economy can grow (just like a self-driving car can move forward) (1) if workers can make an increasing quantity of goods and services each year, and (2) if non-elite workers can afford to buy the goods that are being produced. If these workers find fewer jobs available, or if they don’t pay sufficiently well, it is as if the engine of the self-driving car is no longer working. The car could just as well fall apart into 1,000 pieces in the driveway.

If the wages of non-elite workers are too low, they cannot afford to pay very much in taxes, so governments are adversely affected. They also cannot afford to buy capital goods such as vehicles and homes. Thus, depressed wages of non-elite workers adversely affect both businesses and governments. If these non-elite workers are getting paid well, the “make/buy loop” is closed: the people whose labor creates fairly ordinary goods and services can also afford to buy those goods and services.

Recurring Needs of Car/Economy

The economy, like a car, has recurring needs, analogous to monthly lease payments, insurance payments, and maintenance costs. These would include payments for a variety of support services, including the following:

- Government programs, including payments to the elderly and unemployed

- Higher education programs

- Healthcare

Needless to say, the above services tend to keep rising in cost, whether or not the wages of non-elite workers keep rising to keep up with these costs.

The economy also needs to purchase a portfolio of goods on a very regular basis (weekly or monthly), or it cannot operate. These include:

- Fresh water

- Food of many different types, including vegetables, fruits, and grains

- Energy products of many types, such as oil, coal, natural gas, and uranium. These needs include many subtypes suited to particular refineries or electric power plants.

- Minerals of many types, including copper, iron, lithium, and many others

Some of these goods are needed directly by the workers in the economy. Other goods are needed to make and operate the “tools” used by the workers. It is the growing use of tools that allows workers to keep becoming more productive–produce the rising quantity of goods and services that is needed to keep the economy growing. These tools are only possible through the use of energy products and other minerals of many kinds.

I have likened the necessary portfolio of goods the economy needs to ingredients in a recipe, or to chemicals needed for a particular experiment. If one of the “ingredients” is not available–probably because of prices that are too high for consumers or too low for producers–the economy needs to “make a smaller batch.” We saw this happen in the Great Recession of 2007 to 2009. Figure 1 shows that the use of several types of energy products, plus raw steel, shrank back at exactly the same time. In fact, the recent trend in coal and raw steel suggests another contraction may be ahead.

Figure 1. World Product Consumption, indexed to the year 2000, for selected products. Raw Steel based on World USGS data; other amounts based of BP Statistical Review of World Energy 2016 data.

The Economy Re-Optimizes When Things Go Wrong

If you have a Global Positioning System (GPS) in your car to give you driving directions, you know that whenever you make a wrong turn, it recalculates and gives you new directions to get you back on course. The economy works in much the same way. Let’s look at an example:

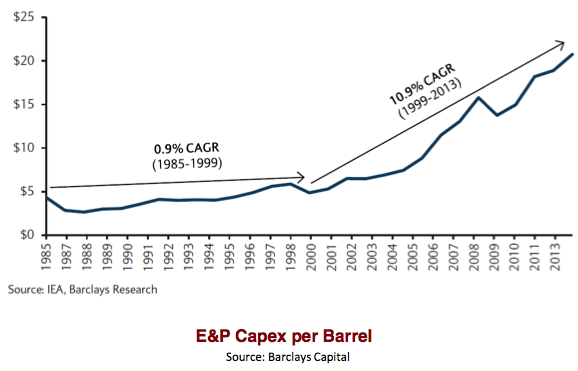

Back in early 2014, I showed this graph from a presentation given by Steve Kopits. It shows that the cost of oil and gas extraction suddenly started on an upward trend, about the year 1999. Instead of costs rising at 0.9% per year, costs suddenly started to rise by an average of 10.9% per year.

Figure 2. Figure by Steve Kopits of Westwood Douglas showing trends in world oil exploration and production costs per barrel. CAGR is “Compound Annual Growth Rate.”

When costs were rising by only 0.9% per year, it was relatively easy for oil producers to offset the cost increases by efficiency gains. Once costs started rising much more quickly, it was a sign that we had in some sense “run out” of new fields of easy-to-extract oil and gas. Instead, oil companies were forced to start accessing fields with much more expensive-to-produce oil and gas, if they wanted to replace depleting fields with new fields. There would soon be a mismatch between wages (which generally don’t rise very much) and the cost of goods made with oil, such as food grown using oil products.

Did the invisible hand sit idly by and let business as usual continue, despite this big rise in the cost of extraction of oil from new fields? I would argue that it did not. It was clear to business people around the world that there was a large amount of coal in China and India that had been bypassed because these countries had not yet become industrialized. This coal would provide a much cheaper source of energy than the oil, especially if the cost of oil appeared likely to rise. Furthermore, wages in these countries were lower as well.

The economy took the opportunity to re-optimize. Part of this re-optimization can be seen in Figure 1, shown earlier in this post. It shows that world coal supply has grown rapidly since 2000, while oil supply has grown quite slowly.

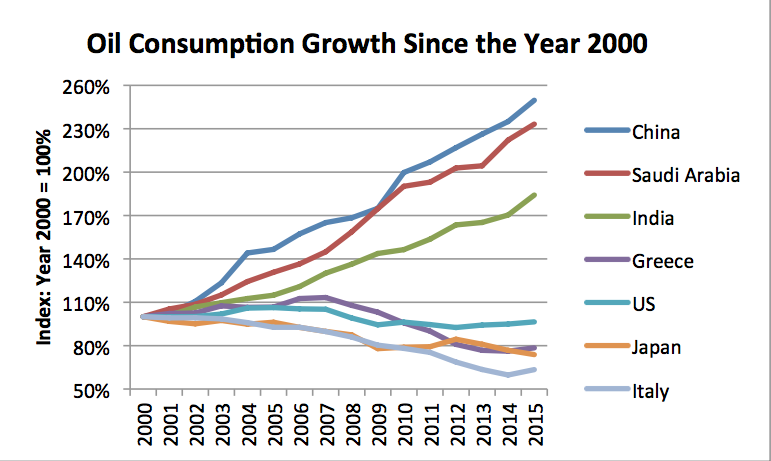

Figure 3, below, shows a different kind of shift: a shift in the way oil supplies were distributed, after 2000. We see that China, Saudi Arabia, and India are all examples of countries with big increases in oil consumption. At the same time, many of the developed countries found their oil consumption shrinking, rather than growing.

Figure 3. Figure showing oil consumption growth since 2000 for selected countries, based on data from BP Statistical Review of World Energy 2016.

A person might wonder why Saudi Arabia’s use of oil would grow rapidly after the year 2000. The answer is simple: Saudi Arabia’s oil costs are its costs as a producer. Saudi Arabia has a lot of very old wells from which oil extraction is inexpensive–perhaps $15 per barrel. When oil prices are high and the cost of production is low, the government of an oil-exporting nation collects a huge amount of taxes. Saudi Arabia was in such a situation. As a result, it could afford to use oil for many purposes, including electricity production and increased building of highways. It was not an oil importer, so the high world oil prices did not affect the country negatively.

China’s rapid rise in oil production could take place because, even with added oil consumption, its overall cost of producing goods would remain low because of the large share of coal in its energy mix and its low wages. The huge share of coal in China’s energy mix can be seen in Figure 4, below. Figure 4 also shows the extremely rapid growth in China’s energy consumption that took place once China joined the World Trade Organization in late 2001.

Figure 4. China energy consumption by fuel based on BP 2016 Statistical Review of World Energy.

India was in a similar situation to China, because it could also build its economy on cheap coal and cheap labor.

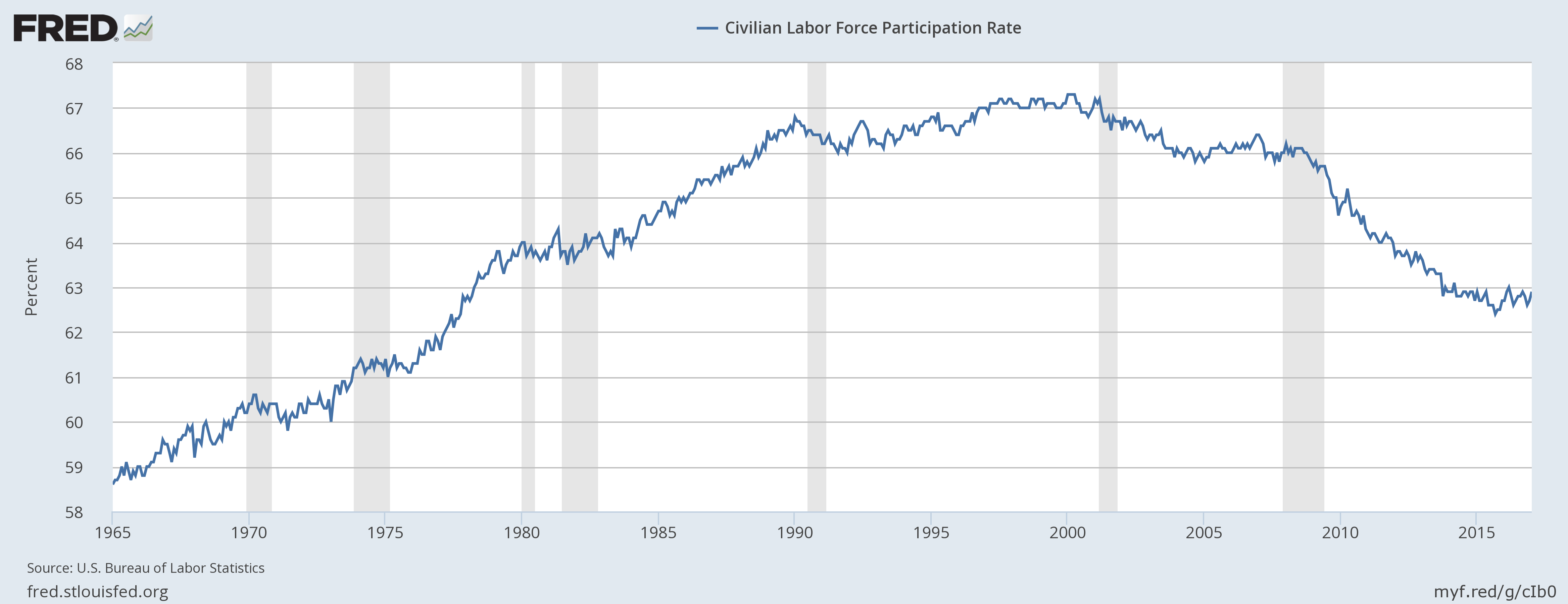

When the economy re-optimizes itself, job patterns are affected as well. Figure 5 shows the trend in labor force participation rate in the US:

Figure 5. US Civilian labor force participation rate, based on US Bureau of Labor Statistics data, as graphed by fred.stlouisfed.org.

Was it simply a coincidence that the US labor force participation rate started falling about the year 2000? I don’t think so. The shift in energy consumption to countries such as China and India, as oil costs rose, could be expected to reduce job availability in the US. I know several people who were laid off from the company I worked for, as their jobs (in computer technical support) were shifted overseas. These folks were not alone in seeing their jobs shipped overseas.

The World Economy is Like a Car that Cannot Make Sharp Turns

The world economy cannot make very sharp turns, because there is a very long lead-time in making any change. New factories need to be built. For these factories to be used sufficiently to make economic sense, they need to be used over a long period.

At the same time, the products we desire to make more energy efficient, for example, automobiles, homes, and electricity generating plants, aren’t replaced very often. Because of the short life-time of incandescent light bulbs, it is possible to force a fairly rapid shift to more efficient types. But it is much more difficult to encourage a rapid change in high-cost items, which are typically used for many years. If a car owner has a big loan outstanding, the owner doesn’t want to hear that his car no longer has any value. How could he afford a new car, or pay back his loan?

A major limit on making any change is the amount of resources of a given type, available in a given year. These amounts tend to change relatively slowly, from year to year. (See Figure 1.) If more lithium, copper, oil, or any other type of resource is needed, new mines are needed. There needs to be an indication to producers that the price of these commodities will stay high enough, for a long enough period, to make this investment worthwhile. Low prices are a problem for many commodities today. In fact, production of many commodities may very well fall in the near future, because of continued low prices. This would collapse the economy.

The World Economy Can’t Go Very Far Backward, Without Collapsing

The 2007-2009 recession is an example of an attempt of the economy to shrink backward. (See Figure 1.) It didn’t go very far backward, and even the small amount of shrinkage that did occur was a huge problem. Many people lost their jobs, or were forced to take pay cuts. One of the big problems in going backward is the large amount of debt outstanding. This debt becomes impossible to repay, when the economy tries to shrink. Asset prices tend to fall as well.

Furthermore, while previous approaches, such as using horses instead of cars, may be appealing, they are extremely difficult to implement in practice. There are far fewer horses now, and there would not be places to “park” the horses in cities. Cleaning up after horses would be a problem, without businesses specializing in handling this problem.

What World Leaders Can Do to (Sort of) Fix the Economy

There are basically two things that governments can do, to try to make the economy (or car) go faster:

- They can encourage more debt. This is done in many ways, including lowering interest rates, reducing bank regulation, encouraging lower underwriting standards or longer term loans, taking out greater debt themselves, guaranteeing debt of non-creditworthy entities, and finding new markets for “recycled debt.”

- They can increase complexity levels. This means increasing output of goods and services through the use of more and better machines and through more training and specialization of workers. More complex businesses are likely to lead to more international businesses and longer supply chains.

Both of these actions work like turbocharging a car. They have the possibility of making the economy run faster, but they have the downside of extra cost. In the case of debt, the cost is the interest that needs to be paid; also the risk of “blow-up” if the economy slows. There is a limit on how low interest rates can go, as well. Ultimately, part of the output of the economy must go to debt holders, leaving less for workers.

In the case of complexity, the problem is that there gets to be increasing wage disparity, when some employees have wages based on special training, while others do not. Also, with capital goods, some individuals are owners of capital goods, while others are not. The arrangement creates wealth disparity, besides wage disparity.

In theory, both debt and increased complexity can help the economy grow faster. However, as I noted at the beginning, it is the wages of the non-elite workers that are especially important in allowing the economy to continue to move forward. The greater the proportion of the revenue that goes to high paid employees and to bond holders, the less that is available to non-elite workers. Also, there are diminishing returns to adding debt and complexity. At some point, the cost of each of these types of turbo-charging exceeds the benefit of the process.

Why the Economy Works Like a Self-Driving Car

The reason why the economy acts like a self-driving car is because the economy is, in physics terms, a dissipative structure. It grows and changes “on its own,” using energy sources available to it. The result is exactly the same effect that Adam Smith was observing. What makes the economy behave in this way is the fact that flows of energy are available to the economy. This happens because an economy is an open system, meaning its borders are permeable to energy flows.

When there is an abundance of energy available for use (from the sun, or from burning fossil fuels, or even from food), a variety of dissipative structures self-organize. One example is hurricanes, which self-organize over warm oceans. Another example is plants and animals, which self-organize and grow from small beginnings, if they have adequate food energy, plus other necessities of life. Another example is ecosystems, consisting of a number of different kinds of plants and animals, which interact together for the common good. Even stars, including our sun, are dissipative structures.

The economy is yet another type of a dissipative structure. This is why Adam Smith noticed the effect of the invisible hand of the economy. The energy that sustains the economy comes from a variety of sources. Humans have been able to obtain energy by burning biomass for over one million years. Other long-term energy sources include solar energy that provides heat and light for gardens, and wind energy that powers sail boats. More recently, other types of energy have been added, including fossil fuels energy.

When energy supplies are very cheap and easy to obtain, it is easy to ramp up their use. With growing supplies of energy, it is possible to keep adding more and better tools for people to work with. I use the term “tools” broadly. Besides machines to enable greater production, I include things like roads and advanced education, which also are helpful in making workers more effective. The use of growing energy supplies allows growing use of tools, and this growing use of tools increasingly leverages human labor. This is why we see growing productivity; we can expect to see falling human productivity if energy supplies should start to decline. Falling productivity will tend to push the economy toward collapse.

One problem for economies is diminishing returns of resource extraction. Diminishing returns cause the economy to become less and less efficient. Once energy extraction starts to have a significant problem with diminishing returns (such as in Figure 2), it is like losing energy resources into a sinkhole. More work is necessary, without greater output in terms of goods and services. Indirectly, economic growth must suffer. This seems to be the problem that the economy has been encountering in recent years. From the invisible hand’s point of view, $100 per barrel oil is very different from $20 per barrel oil.

One characteristic of dissipative structures is that they keep re-optimizing for the overall benefit of the dissipative structure. We saw in Figures 3 and 4 how fuel use and jobs rebalance around the world. Another example of rebalancing is the way the economy uses every part of a barrel of oil. If, for example, our only goal were to maximize the number of miles driven for automobiles, it would make sense to operate cars using diesel fuel, rather than gasoline. In fact, the energy mix available to the economy includes quite a bit of gasoline and natural gas liquids. If we need to use what is available, it makes sense to use gasoline in private passenger cars, and save diesel for commercial use.

Another characteristic of dissipative structures is that they are not permanent. They grow for a while, and then collapse. Later, new similar dissipative structures may develop and indirectly replace the ones that have collapsed. In this way, the overall system is able to evolve in a way that adapts to changing conditions.

What Are the Likely Events that Would Cause the Economy to Collapse?

I modeled the system as being like a self-driving car. The thing that keeps the system operating is the continued growth of inflation-adjusted wages of non-elite workers. This analogy was chosen because in ecosystems in general, the energy return on the labor of an animal is very important. The collapse of a population of fish, or of some other animal, tends to happen when the return on the labor of that animal falls too low.

In the case of the fish, the return on the labor of the fish falls too low when nearby supplies of food disappear, and the fish must swim too far to obtain new supplies of food. The return on human labor would seem to be the inflation-adjusted wages of non-elite workers. We know that wages for many workers have been falling in recent years, because of competition from globalization, and because of replacement of human labor by advanced machines, such as computers and robots.

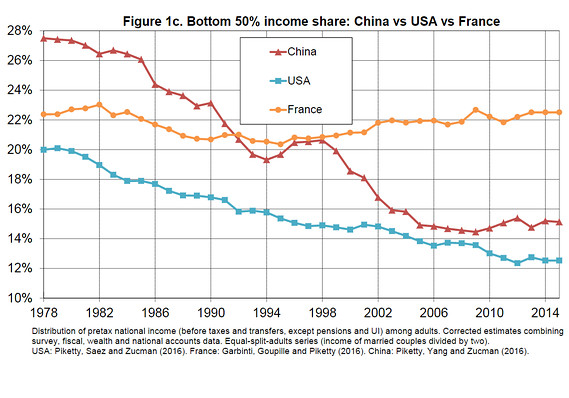

Figure 6. Bottom 50% income share, from recent Piketty analysis.

Besides the problem of falling wages of non-elite workers, earlier in this post I mentioned a number of other issues that make the wages of these workers go less far. These include growing government spending, and the growing costs of education and healthcare. I also mentioned the problem of rising debt, and the increased concentration of wealth, as we try to add complexity to solve problems. All of these issues make it hard for “demand”–which might also be called “affordability”–to be sufficiently great to allow commodity prices to rise to the level producers need for profitability.

Prices Play a Very Important Role in the Economy

The pricing system is the communication system of the economy, as a dissipative structure. One use of energy is to create “information.” Prices are a high level form of information.

One big area where prices come up is with respect to the whole portfolio of products needed on a regular basis, which I mentioned earlier (water, food, energy products, and mineral products). In order for the system to continue working, the prices need to be both:

- Affordable by consumers

- High enough for producers to cover their costs, including a margin for taxes and reinvestment

Now, in 2017, prices are “sort of” affordable for consumers, but they are not high enough for producers. Oil companies will go out of business if these low prices persist.

Back in 2007 and 2008, we had the reverse problem. Prices were high enough for producers, but too high for consumers (especially non-elite workers). This is a big part of what pushed the economy into recession.

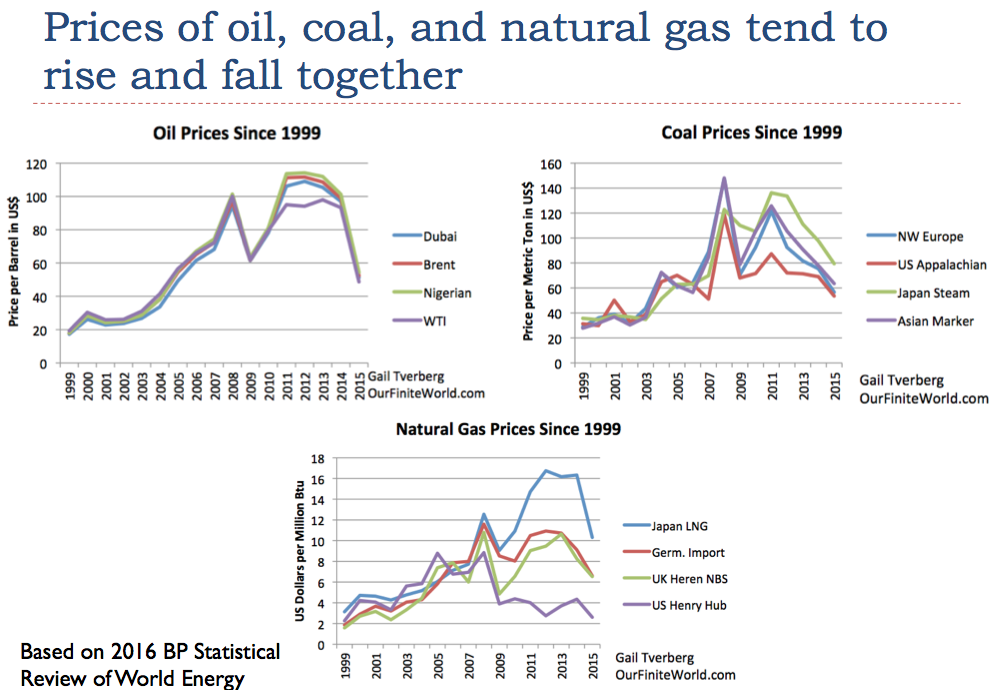

We noticed back in Figure 1 that quantities of energy products/goods tend to move up and down together. A similar phenomenon holds true for prices: commodity prices tend to rise and fall together (Figure 7). The reason this happens is because when the world economy is moving swiftly forward (higher wages, more building activity, more debt), demand tends to be high for many different types of materials at the same time. When the economy slows, prices of all of these commodities tend to fall at the same time. Inflation tends to fall as well.

Figure 7. Prices of oil, call and natural gas tend to rise and fall together. Prices based on 2016 Statistical Review of World Energy data.

If prices cannot rise high enough for producers, it is likely a sign that wages of non-elite workers are already too low. The affordability loop mentioned earlier is not being closed, so prices cannot stay up at a high enough level to maintain production.

Most Modelers Overlook the Fact that the Economy Is an Open System

Most energy models are based on one of two views of the world: (1) fossil fuel energy supply will eventually run short, so we must use it as sparingly as possible; or (2) we want to reduce the use of fossil fuels as quickly as possible, because of climate change. Because of these issues, we want to leverage the fossil fuel energy we have, to as great an extent as possible, with energy that we can somehow capture from renewable sources, such as the solar energy or wind. With this view of the situation, our major objective is to create “renewables” that use fossil fuel energy as efficiently as possible. The hope is that these renewables, together with the actions of governments, will allow the economy to gradually shrink back to a level that is somehow more sustainable.

Implicit is this model is the view that the economy, and the world in general, is a closed system. Our current government and business leaders are in charge; they can make the changes they would prefer, without the invisible hand causing an unforeseen problem. Very few have realized that the economy cannot really shrink back very much; past history, as well as the nature of dissipative structures, shows that economies tend to collapse. The only economies that have at least temporarily avoided that fate have shifted toward less complexity–for example, eliminating huge government programs, such as armies–rather than yielding to the temptation to add ever more complexity, such as wind turbines and solar panels.

The real situation is that we have a here-and-now problem of too low wages for non-elite workers. Commodity prices are also too low. Intermittent renewables such as wind and solar are thought to be solutions, but it is well-known that intermittent renewables cause too-low prices for other types of electricity generation, when added to the electric grid. Thus, they are likely part of the low-price problem, not part of the solution. Temporary solutions, if there are any, are likely in the direction of cutting back on government expenditures and reducing regulation of banks. In fact, with the election of Trump and the passage of Brevity, the economy seems to again be re-optimizing.

We also know that dissipative structures do not shrink back well, at all. They tend to collapse, instead. For example, you, as a human being, are a dissipative structure. If your food intake were cut back to, say, 500 calories per day, how well would you do? If you could not get along on a very low calorie diet, how would you expect the economy to shrink back to a renewables-only level? Renewables that can be used in a shrunken economy are scarce; we don’t have a huge number of trees to cut down. We cannot maintain the electric grid without fossil fuels.

The assumption that the economy is a closed system is pretty much standard when modeling our current energy situation. This occurs because, until recently, we did not understand that the self-organizing properties of inanimate systems were as important as they are. Also, modeling of the economy as a closed system, rather than an open system, makes modeling much easier. The problem is that closed system modeling doesn’t really tell the right story. For a discussion of some of the issues associated with this mis-modeling, see the recent academic paper, Is the increased use of biofuels the road to sustainability? Consequences of the methodological approach.