Authored by Wolf Richter via WolfStreet.com,

No one knows the full magnitude, but it’s huge.

How big is margin debt really, and how much of a threat is it to the stock market and to “financial stability,” as central banks like to call their concerns about crashes? Turns out, no one really knows.

What we do know: Margin debt, as reported monthly by the New York Stock Exchange, spiked to another record high of $528 billion. But it’s only part of the total outstanding margin debt – which is when investors borrow money from their broker, pledging their portfolio as collateral.

An example of unreported margin debt: Robo-advisory Wealthfront, a so-called fintech startup overseeing nearly $6 billion, announced that it would offer its clients loans against their portfolios.

“The dream house. The dream wedding. The dream kitchen. The dream vacation.” That’s how it introduced it in a blog post this week. “We want you to have your cake and eat it too,” it said.

Instant debt “without the hassle of paperwork,” it said. “We want our clients to be able to borrow what they need, when they need it, directly from their smartphones.” Secured by “your own investments.”

It’s a great deal as long as stocks are soaring. Clients with at least $100,000 in their account can borrow up to 30% of the account value. It’s seductive: No required monthly payments and no payoff date, though interest accrues and is added to the monthly balance. The rate is as low as 3.25%. “How’s that for flexibility?” it says.

That’s how margin debt is being pushed at the end of the cycle.

This borrowed money can be drawn out of the account to fund vacations or a down-payment of a house. But when stocks spiral down, as they’re known to do in highly leveraged markets, and fall below the margin requirement, clients get a margin call. They either have to put cash into the account to make up for the losses or they have to start liquidating their portfolio at the worst possible time.

This forced selling occurs across the spectrum during a sharp market downturn and drives prices down further and begets more forced selling. Margin debt is the great accelerator on the way up, and it’s the great accelerator on the way down. Crashes feed on margin debt.

So how much margin debt is out there? We know only the $528 billion reported by NYSE. Then there are companies like Wealthfront. But it’s just small fry. Big players have been doing this for a long time. These securities-based loans (SBLs) are called “shadow margin,” and no one knows how much of it is out there. But it’s a lot.

The New York Post took a look at it:

Finra, the brokerage regulator, doesn’t track it, nor does the Securities and Exchange Commission — even though both have warned investors about the risks.

However, several advisers surveyed by The Post estimated there is between $100 billion and $250 billion in outstanding SBLs among all brokerages.

Morgan Stanley is one of the few firms that says how much in SBLs it’s sold – $36 billion, as of Dec. 31, a 26-percent increase from the year before.

Other major sellers of the loans are UBS, Bank of America, Wells Fargo, Raymond James, and Stifel Nicolaus, sources said.

If this “shadow margin” is $250 billion, it would bring total margin debt to $778 billion. That would make for a lot of forced selling.

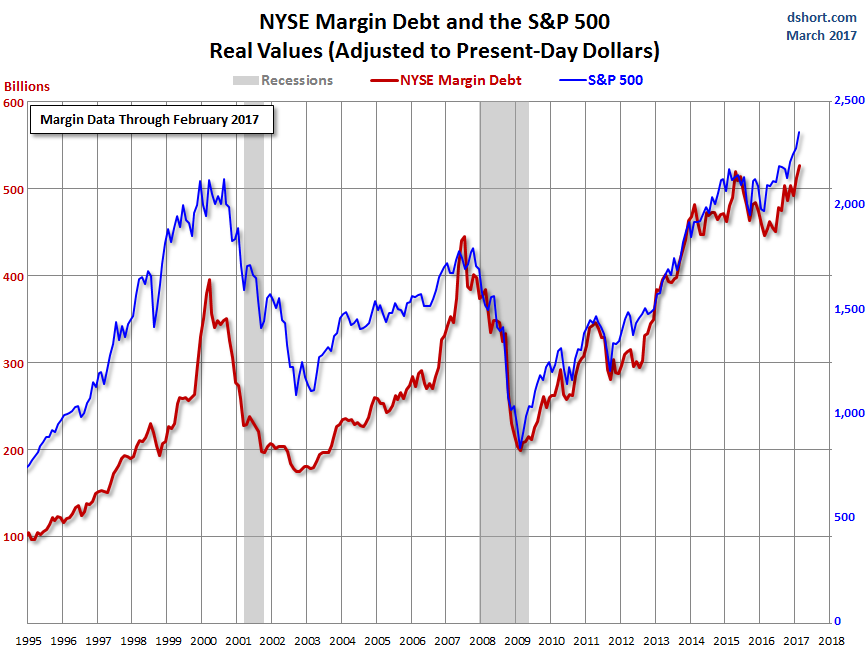

Margin debt is in an uncanny relationship with the stock market. It soars when stocks soar, and it crashes when stocks crash. They feed on each other.

This chart by Doug Short at Advisor Perspectives overlays margin debt as reported by the NYSE (red line, left scale) and the S&P 500 (blue line), both adjusted for inflation, with margin debt expressed in current dollars. In February, the latest reporting month, margin debt surged 2.9% to a new high of $528 billion:

And the chart below shows growth in percentage terms of the S&P 500 (blue line) and margin debt (red line), adjusted for inflation, since 1995. Two things become brutally clear: Just how leveraged the stock market has become, and how peaks of leverage are unwound by crashes (via Doug Short at Advisor Perspectives):

[image]https://wolfstreet.com/wp-content/uploads/2017/04/US-margin-debt-NYSE-2017-02-percentage-change.png[/image]

But the charts only depict the $528 billion in margin debt reported by the NYSE. Now add the current spike in “shadow margin” of perhaps $250 billion in SBLs. This “shadow margin” might raise current leverage by nearly 50%!

Leverage speaks of investor confidence. A lot of leverage signifies exuberance. Borrowing money to buy stocks creates demand and drives up prices. Higher prices encourage players to borrow even more. And when prices rise for long enough, the notion that they could actually return to some prior levels disappears. That’s the beauty of leverage. It’s free money. Nothing can ever go wrong.

But margin debt, as the charts show, has the unnerving habit of peaking right around the time the bubble turns into a sell-off. While it’s a terrible predictor of a crash – no one knows if February was the peak or just another stage on the way to an even more dazzling peak – it is associated with enormous risks. And the fact that much of it occurs in the shadows, and that the total leverage of the stock market remains unknown, makes this a powerful time bomb that stock markets are sitting on in blithe spirits.

This is what companies in the S&P 500 index have become really good at: Railroads slash capital spending, but plow more money into buying back their own shares, after two years of Freight Recession. Read… This Vicious Cycle is What Bedevils the US Economy