Written By Aran Ali

Graphics & Design

- Athul Alexander

Published March 28, 2023

•

Updated March 28, 2023

•

The following content is sponsored by Guinness Atkinson Funds

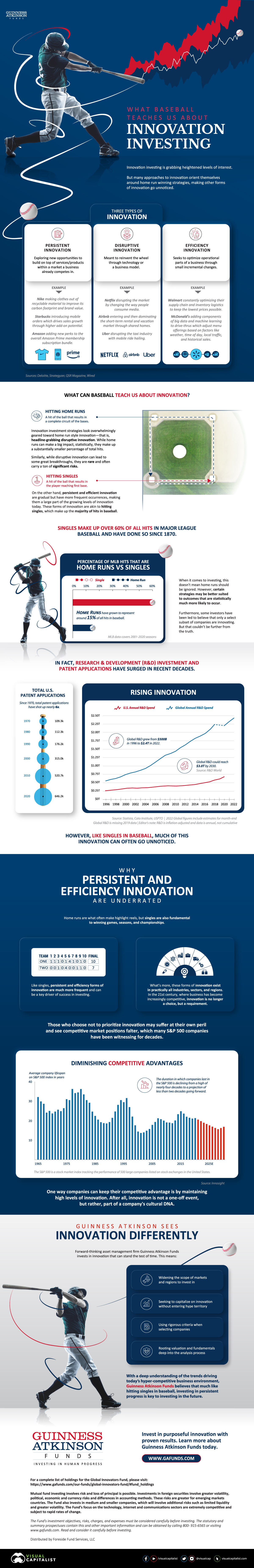

What Baseball Teaches Us About Innovation Investing

Innovation investing is a popular investment theme due to its return potential.

However, not all innovation investing is the same, and too many approaches today focus on home-run-style disruptive innovation, Llaving the other forms relatively unnoticed and underrated.

In this sponsored post by Guinness Atkinson Funds, we explore innovation investing through the lens of baseball by comparing types of hits at base to forms of innovation.

Types of Innovation

There are three common types of innovation that various business strategies fall under.

| Persistent Innovation | Disruptive Innovation | Efficiency Innovation |

|---|---|---|

| Exploring new opportunities to build on top of services/products within a market a business already competes in. | Meant to reinvent the wheel through technology or a business model. | Seeks to optimize operational parts of a business through small incremental changes. |

| Nike making clothes out of recyclable material to improve carbon footprint and brand value.

Starbucks introducing mobile orders while driving sales growth through higher add on. Amazon adding new perks to the overall Amazon Prime membership subscription bundle. |

Netflix disrupting the market by changing the way people consume media.

Airbnb entering and then dominating the short term rental and vacation market through shared homes. Uber disrupting the taxi industry with mobile ride hailing. |

Walmart constantly optimizing their supply chain and investor logistics to keep the lowest price possible.

McDonald’s adding components of big data and machine learning to drive-thrus which adjust menu offerings based on factors like weather, time of day, local traffic, and historical sales. |

Home runs are most often noticed in the sport of baseball and tend to make up the bulk of highlight reels and headlines. And while home runs can have a big impact, did you know that they statistically make up a small portion of total hits in the game?

Similarly, disruptive innovation tends to grab the most media attention due to the impact it can have. But like home runs, they make up a small chunk of the overall innovation universe, while also tending to be riskier bets.

On the other hand, persistent and efficiency forms of innovation are gradual in their impacts, but are much more frequent in occurrences, making them a much larger part of the growing levels of innovation today. These forms of innovation are akin to hitting singles (going to first base), which make up the majority of hits in baseball.

The Data Behind Singles and Home Runs

Singles make up over 60% of all hits in Major League Baseball (MLB). What’s more, they’ve had a track record of doing so for 150 years, going back to 1870. Home runs on the other hand represent around 15% of all hits.

When it comes to investing, this doesn’t mean home runs should be ignored. Rather, certain strategies may be better suited to outcomes that are statistically much more likely to occur.

Furthermore, some investors may have been led to believe that only a select subset of companies are innovating. But that couldn’t be further from the truth.

An Innovative World

Research and Development (R&D) and patent applications are rising and have been for decades. In fact, in the U.S., total patent applications have shot up nearly six times.

| Decade | Total U.S. Patent Applications |

|---|---|

| 1970 | 109,300 |

| 1980 | 112,300 |

| 1990 | 176,200 |

| 2000 | 315,000 |

| 2010 | 520,700 |

| 2020 | 646,200 |

On the R&D side, total global spending grew from $500 billion in 1996 to $2.2 trillion in 2018. In addition, estimates say global R&D can pass $3 trillion in the 2020s.

Trillions of dollars being spent in R&D and hundreds of thousands of patent applications every year suggest innovation is becoming more and more of a priority. However, like singles in baseball, much of this innovation can go unnoticed.

Why Persistent and Efficiency Innovation are Underrated

Representing almost two-thirds of all hits, it’s clear that singles are fundamental to successful games, seasons, and championships.

Like singles, persistent and efficiency forms of innovation are much more frequent and can be a key driver of success in investing. Furthermore, these forms of innovation exist in practically all industries, sectors, and regions. In the 21st century, where business has become increasingly competitive, innovation is no longer a choice, but a requirement.

Those who choose not to prioritize innovation may suffer at their own peril by seeing competitive market positions falter, just as many S&P 500 companies have been witnessing for decades. From 1965 to 2020, the average lifespan of a company in the index has trimmed from a high of over 35 years to around 20 years today.

One possible way companies can keep their competitive advantage is by maintaining high levels of innovation. and incorporating it into the company’s cultural DNA.

Guinness Atkinson Sees Innovation Differently

Forward-thinking asset management firm Guinness Atkinson Funds invests in innovation with the firm belief that it can stand the test of time. This means:

- Widening the scope of markets and regions to invest in.

- Seeking to capitalize on innovation without entering hype territory.

- Using rigorous criteria when selecting companies.

- Rooting valuation and fundamentals deep into the analysis process.

With a deep understanding of the trends driving today’s hyper-competitive business environment, Guinness Atkinson Funds believes that much like hitting singles in baseball, investing in persistent progress is key to investing in the future.

>>>Invest in purposeful innovation with proven results. Visit gafunds.com to learn more now.

Please enable JavaScript in your browser to complete this form.Subscribe to our free newsletter and get your mind blown on a daily basis: *Sign up

Related Topics: #Guinness Atkinson #Guinness Atkinson Funds #investing #home run #innovation #home run investing #wealth management #persistent innovation #investment funds #MLB #GA Funds #efficiency innovation #disruptive innovation

Click for Comments

var disqus_shortname = "visualcapitalist.disqus.com";

var disqus_title = "What Baseball Can Teach Us About Investing in Innovation";

var disqus_url = "https://www.visualcapitalist.com/sp/what-baseball-can-teach-us-about-investing-in-innovation/";

var disqus_identifier = "visualcapitalist.disqus.com-156517";

You may also like

-

Politics1 day ago

Timeline: Cannabis Legislation in the U.S.

At the federal level, cannabis is illegal, but state laws differ. This graphic looks at the timelines of cannabis legislation in the U.S.

-

Markets4 days ago

Which Countries Hold the Most U.S. Debt?

Foreign investors hold $7.3 trillion of the national U.S. debt. These holdings declined 6% in 2022 amid a strong U.S. dollar and rising rates.

-

Investor Education6 days ago

Visualizing 90 Years of Stock and Bond Portfolio Performance

How have investment returns for different portfolio allocations of stocks and bonds compared over the last 90 years?

-

Economy6 days ago

Visualizing the Link Between Unemployment and Recessions

This infographic examines 50 years of data to highlight a clear visual trend: recessions are preceded by a cyclical low in unemployment.

-

Demographics1 week ago

Mapped: The World’s Happiest Countries in 2023

Where do the happiest people on earth live? This map is a snapshot of the world’s most (and least) happy countries in 2023.

-

Money2 weeks ago

The Richest People in the World in 2023

The world’s five richest people are worth a combined $729 billion. From luxury moguls to Asia’s rising titans, we show the richest in 2023.

Subscribe

Please enable JavaScript in your browser to complete this form.Join the 380,000+ subscribers who receive our daily email *Sign Up

The post What Baseball Can Teach Us About Investing in Innovation appeared first on Visual Capitalist.