Visualizing Investments of the Ultra-Wealthy

How do the world’s richest people invest their money?

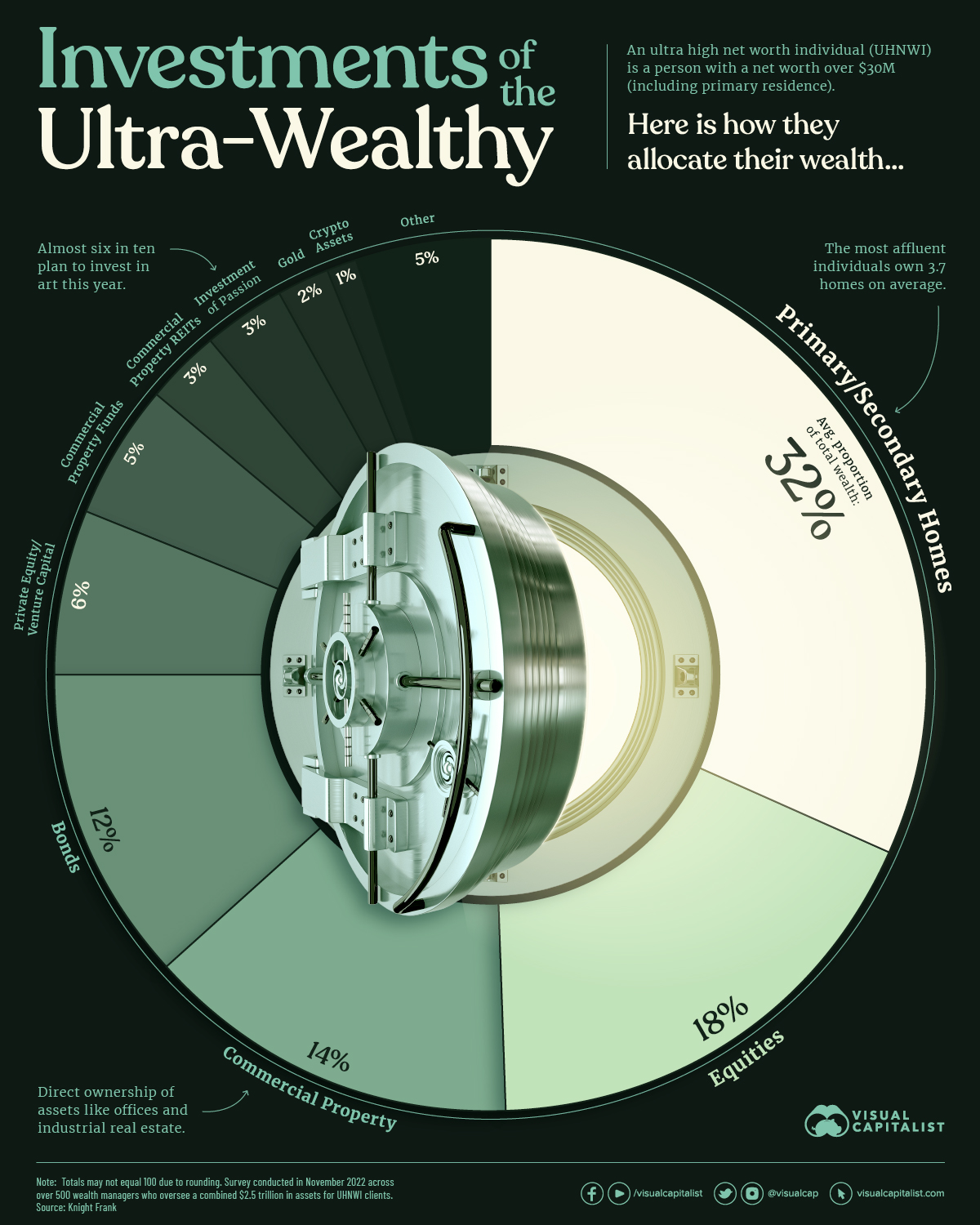

This graphic shows how ultra high net worth individuals (UHNWIs)—people with a net worth of $30 million or more including their primary residence—allocate their wealth based on data from Knight Frank’s 2023 Wealth Report.

How the Ultra-Wealthy Invest

Below, we show where UHNWIs invest their fortunes, based on a global survey of over 500 wealth managers, family offices, and private bankers that oversee a combined $2.5 trillion in assets:

| Rank | Asset | Average Proportion of Total Wealth |

|---|---|---|

| 1 | Primary and Secondary Homes | 32% |

| 2 | Equities | 18% |

| 3 | Commercial Property | 14% |

| 4 | Bonds | 12% |

| 5 | Private Equity / Venture Capital | 6% |

| 6 | Commercial Property Funds | 5% |

| 7 | Commercial Property REITs | 3% |

| 8 | Investment of Passion (e.g. art, cars, wine) | 3% |

| 9 | Gold | 2% |

| 10 | Crypto Assets | 1% |

| 11 | Other | 5% |

Numbers may not total 100 due to rounding.

As the table above shows, primary and secondary homes make up 32% of total wealth, the largest share across assets. The average UHNWI owns 3.7 homes.

Investments in stocks comprised almost 20% of UHNWI wealth, with those in the Americas having the highest share of wealth in equities (33%) followed by Europe (28%) and Asia (26%).

Private equity and venture capital investments, which include investments in startup companies that have not yet gone public, accounted for 6% of total wealth on average. A separate report shows that the average investment in a private equity company ranges between $1.8 million and $6.9 million for UHNWI investors.

Luxury Investments of the Ultra-Rich

Investments of passion, which include a range of luxury items from art to classic cars, make up an average 3% of the total wealth of the ultra-rich.

In 2023, nearly six in 10 UHNWIs said they plan to purchase art.

| Likely to Purchase in 2023 | Global Average |

|---|---|

| Art | 59% |

| Watches | 46% |

| Wine | 39% |

| Classic Cars | 34% |

| Jewelry | 33% |

| Luxury Handbags | 20% |

| Rare Whiskey Bottles | 18% |

| Furniture | 14% |

| Colored Diamonds | 9% |

| Coins | 8% |

Many of these items retain their value over time. In fact, all 10 of these items increased in value over 2022 despite a challenging economic environment which saw the S&P 500 fall over 19%.

The art market saw prices increase 29% last year, the highest across luxury items. Luxury cars (25%) and watches (18%) also saw some of the highest price increases.

The Growth of the Uber-Affluent

In 2022, there were roughly 579,000 people globally with wealth that exceeded $30 million. New York, Tokyo, and San Francisco are home to the most ultra-rich individuals worldwide. Over the next five years, this number is projected to reach 744,000—a 29% increase.

As these numbers continue to climb, demand for luxury real estate, equity investments, and luxury items will likely grow given the investment patterns of the ultra-wealthy illustrated today.

The post Visualizing the Investments of the Ultra-Wealthy appeared first on Visual Capitalist.