Published

3 seconds ago

on

November 13, 2023

| 32 views

-->

By

Dorothy Neufeld

Graphics & Design

- Athul Alexander

The following content is sponsored by Citizens Commercial Banking

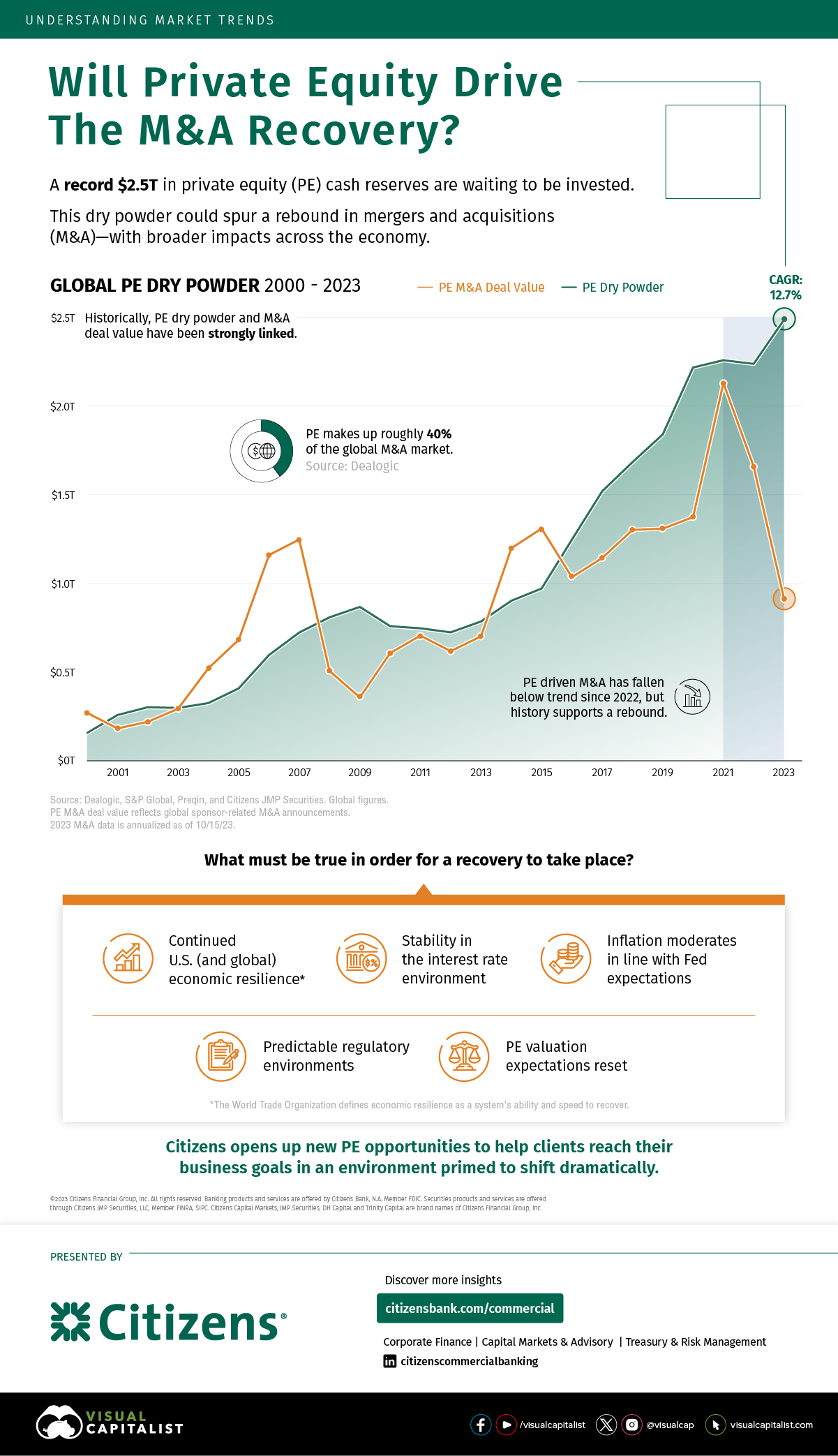

Visualizing $2.5 Trillion in Private Equity Cash Reserves

Private equity (PE) firms, which invest in companies that are not publicly-listed, are sitting on a record $2.5 trillion in cash reserves.

PE firms deploy this cash to acquire private companies ripe for growth, with the goal of driving higher valuations. Historically, a higher store of cash has been strongly linked to greater PE deal activity.

Despite this stockpile, activity remains muted. As interest rates sit at multi-decade highs in an uncertain market environment, mergers and acquisitions (M&A) have fallen to 10-year lows.

This graphic, sponsored by Citizens, shows the historic rise in cash reserves, and why this may spur a recovery in M&A deal activity.

Is Private Equity Primed for a Rebound?

Since 2000, global PE cash reserves—also known as dry powder—have grown at a 12.7% compound annual growth rate.

This capital has been a key source of growth and funding for companies, with PE making up roughly 40% of the global M&A market. The table below shows global PE dry powder and M&A deal value in 2023:

| Year | Global Dry Powder | Global M&A Deal Value |

|---|---|---|

| 2023 | $2,485B | $776B* |

| 2022 | $2,237B | $1,403B |

| 2021 | $2,258B | $2,130B |

| 2020 | $2,217B | $1,162B |

| 2019 | $1,840B | $1,107B |

| 2018 | $1,683B | $1,101B |

| 2017 | $1,520B | $967B |

| 2016 | $1,246B | $876B |

| 2015 | $971B | $1,108B |

| 2014 | $902B | $1,014B |

| 2013 | $786B | $594B |

| 2012 | $724B | $523B |

| 2011 | $747B | $597B |

| 2010 | $759B | $514B |

| 2009 | $868B | $302B |

| 2008 | $809B | $429B |

| 2007 | $723B | $1,056B |

| 2006 | $596B | $982B |

| 2005 | $408B | $577B |

| 2004 | $326B | $441B |

| 2003 | $298B | $249B |

| 2002 | $302B | $186B |

| 2001 | $258B | $155B |

| 2000 | $158BB | $229B |

*2023 M&A deal value annualized as of 10/15/2023. Source: Dealogic, S&P Global, Preqin, and Citizens JMP Securities. PE M&A deal value reflects sponsor-related M&A announcements.

As we can see in the table above, 2023 has been an aberration for global M&A deal activity. Since last year, M&A deal value has declined 75% to $776 billion.

Today, high interest rates are putting pressure on borrowing costs, with many PE firms waiting in the wings for conditions to improve. The majority of deals are happening among smaller companies, while PE firms hold out on mega-deals.

Nevertheless, this vast amount of dry powder could help fuel an eventual recovery.

Key Factors for a Recovery

Looking ahead, the following market conditions will be important for a revival in PE deal activity:

- Continued U.S. (and global) economic resilience

- Stability in the interest rate environment

- Inflation moderates in line with Fed expectations

- Predictable regulatory environments

- PE valuation expectations reset

With PE firms holding significant cash piles, key opportunities could open up if conditions improve. As a result, the PE market could be well-positioned for growth in an environment primed for a rebound—with impacts across the wider economy.

Explore more insights with Citizens.

Please enable JavaScript in your browser to complete this form.Enjoying the data visualization above? *Subscribe

Related Topics: #inflation #m&a #interest rates #private equity #economic recovery #citizens #Citizens Bank

Click for Comments

var disqus_shortname = "visualcapitalist.disqus.com";

var disqus_title = "Visualizing $2.5 Trillion in Private Equity Cash Reserves";

var disqus_url = "https://www.visualcapitalist.com/sp/2-5-trillion-private-equity-cash-reserves/";

var disqus_identifier = "visualcapitalist.disqus.com-162151";

You may also like

-

Investor Education6 days ago

The 20 Most Common Investing Mistakes, in One Chart

Here are the most common investing mistakes to avoid, from emotionally-driven investing to paying too much in fees.

-

Markets1 week ago

Charted: U.S. Retail Investor Inflows (2014–2023)

Considered a side show in the stock market for much of the last decade, U.S. retail investors are now breaking records.

-

Real Estate3 weeks ago

Ranked: The Cities With the Most Bubble Risk in Their Property Markets

Despite higher mortgages and sharply correcting prices, some cities’ property markets are still in bubble-risk territory.

-

Stocks3 weeks ago

Charted: The Key Investment Theme of Each Decade (1950-Today)

Here are the investment themes that have defined each decade from the ‘Nifty Fifty’ to the tech giants of the 2010s.

-

Markets3 weeks ago

Ranked: The Fastest Growing Economies In 2024

This graphic uses the latest IMF projections to rank the world’s top 20 fastest growing economies for 2024.

-

Economy3 weeks ago

Charted: Comparing the GDP of BRICS and the G7 Countries

As BRICS is set to add six new countries, how does the bloc and its new members’ GDP compare with that of the G7?

Subscribe

Please enable JavaScript in your browser to complete this form.Join the 375,000+ subscribers who receive our daily email *Sign Up

The post Visualizing $2.5 Trillion in Private Equity Cash Reserves appeared first on Visual Capitalist.