Published

8 seconds ago

on

August 20, 2024

| 13 views

-->

By

Jenna Ross

The following content is sponsored by Morningstar

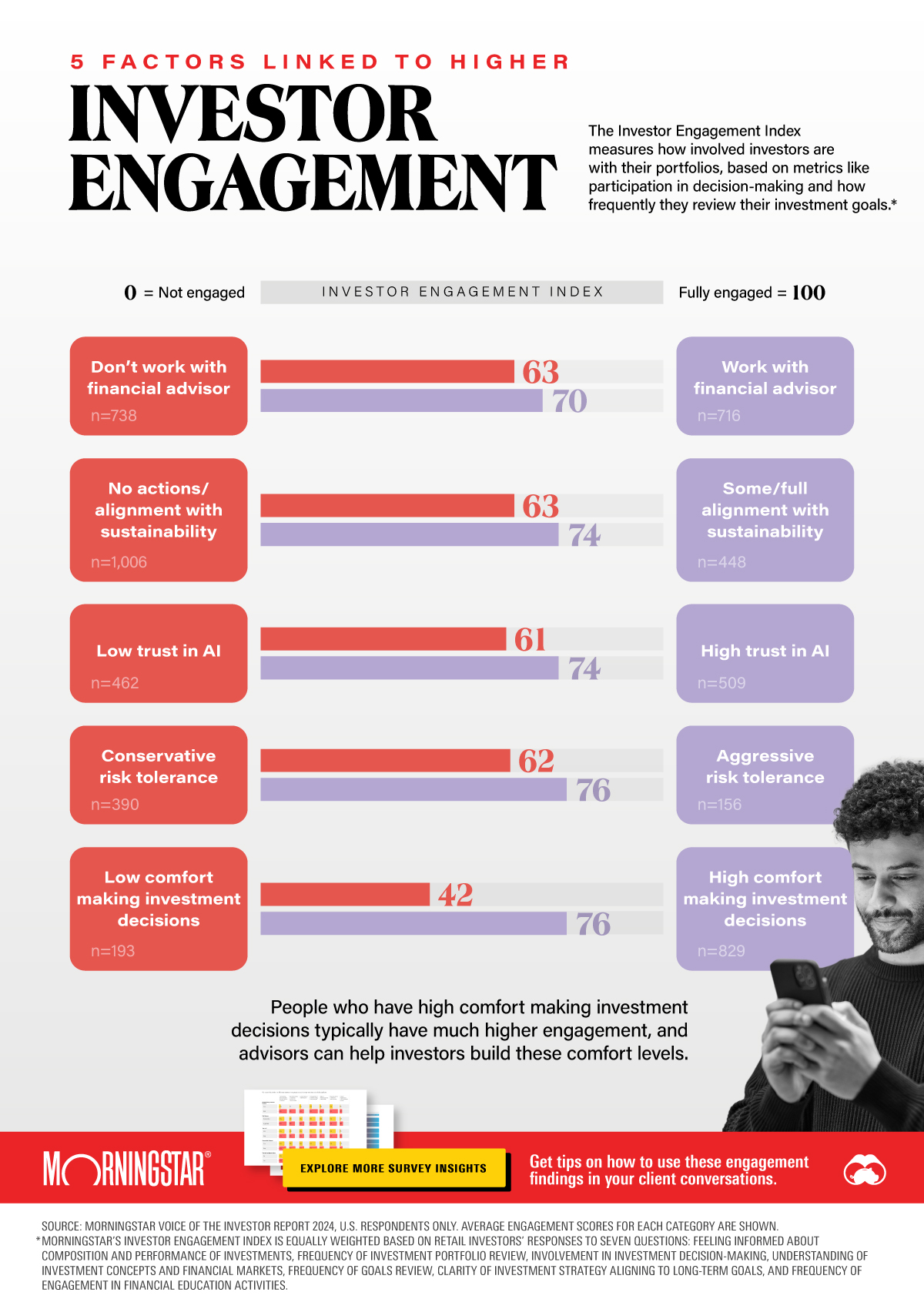

5 Factors Linked to Higher Investor Engagement

Imagine two investors. One investor reviews their investment goals every quarter and actively makes decisions. The second investor hasn’t reviewed their goals in over a year and doesn’t take part in any investment decisions. Are there traits that the first, more involved investor would be more likely to have?

In this graphic from Morningstar, we explore five factors that are associated with high investor engagement.

Influences on Investor Engagement

Morningstar scores their Investor Engagement Index from a low of zero to a high of 100, which indicates full engagement. In their survey, they discovered five traits that are tied to higher average engagement levels among investors.

| Factor | Investor Engagement Index Score (Max = 100) |

|---|---|

| Financial advisor relationship | Don’t work with financial advisor: 63 |

| Work with financial advisor: 70 | |

| Sustainability alignment | No actions/alignment: 63 |

| Some/full alignment: 74 | |

| Trust in AI | Low trust: 61 |

| High trust: 74 | |

| Risk tolerance | Conservative: 62 |

| Aggressive: 76 | |

| Comfort making investment decisions | Low comfort: 42 |

| High comfort: 76 |

Morningstar’s Investor Engagement Index is equally weighted based on retail investors’ responses to seven questions: feeling informed about composition and performance of investments, frequency of investment portfolio review, involvement in investment decision-making, understanding of investment concepts and financial markets, frequency of goals review, clarity of investment strategy aligning to long-term goals, and frequency of engagement in financial education activities.

On average, people who work with financial advisors, have sustainability alignment, trust AI, and have a high risk tolerance are more engaged.

The starkest contrast was that people with high comfort making investment decisions have engagement levels that are nearly two times higher than those with low comfort. In fact, people with a high comfort level were significantly more likely to say they were knowledgeable about the composition and performance of their investments (84%) vs. those with low comfort (18%).

Personalizing Experiences Based on Engagement

Advisors can consider adjusting their approach depending on an investor’s engagement level. For example, if a client has an aggressive risk tolerance this may indicate the client is more engaged. Based on this, the advisor could check if the client would prefer more frequent portfolio reviews.

On the other hand, soft skills can play a key role for those who are less engaged. People with low comfort making investment decisions indicated that the top ways their financial advisor provides value is through optimizing for growth and risk management (62%), making them feel more secure about their financial future (38%), and offering peace of mind and relief from the stress of money management (30%).

Explore more survey insights for tips on how to use these engagement findings in client conversations.

Please enable JavaScript in your browser to complete this form.Enjoying the data visualization above? *Subscribe

Related Topics: #sustainability #ai #financial advisor #Morningstar #investor engagement #risk tolerance

Click for Comments

var disqus_shortname = "visualcapitalist.disqus.com";

var disqus_title = "5 Factors Linked to Higher Investor Engagement";

var disqus_url = "https://www.visualcapitalist.com/sp/5-factors-linked-to-higher-investor-engagement/";

var disqus_identifier = "visualcapitalist.disqus.com-169394";

You may also like

-

Personal Finance19 hours ago

Access to Paid Time Off by Wage Group in America

The U.S. is the only nation in the OECD without a federal paid time off mandate. We show how access to paid leave varies by income…

-

Markets2 weeks ago

Charted: American Stock Ownership Back at All-Time Highs

Today, the share of Americans’ financial assets that are invested in public stocks is near all-time highs.

-

Personal Finance2 weeks ago

Charted: Growth in U.S. Real Wages, by Income Group (1979-2023)

Since 2019, low-paid workers’ real income spiked more than the last 40 years combined. Here are real wages over time, by income group.

-

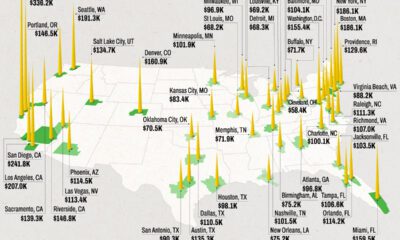

Personal Finance4 weeks ago

Mapped: The Salary Needed to Buy a Home in 50 U.S. Cities in 2024

As the cost of home ownership nears record levels, we show the household income required to buy a median-priced home in 50 U.S. metro areas.

-

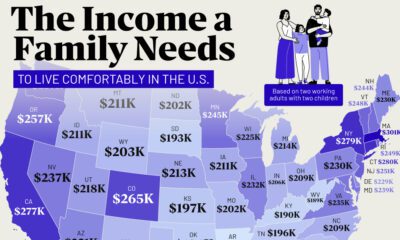

Personal Finance3 months ago

Mapped: The Income a Family Needs to Live Comfortably in Every U.S. State

Families in expensive states require over $270,000 annually to live comfortably.

-

Money3 months ago

Visualizing the Tax Burden of Every U.S. State

Tax burden measures the percent of an individual’s income that is paid towards taxes. See where it’s the highest by state in this graphic.

Subscribe

Please enable JavaScript in your browser to complete this form.Join the 375,000+ subscribers who receive our daily email *Sign Up

The post 5 Factors Linked to Higher Investor Engagement appeared first on Visual Capitalist.